Wisconsin Dept of Revenue Notice Amountn Due Form

What is the Wisconsin Dept Of Revenue Notice Amount Due Form

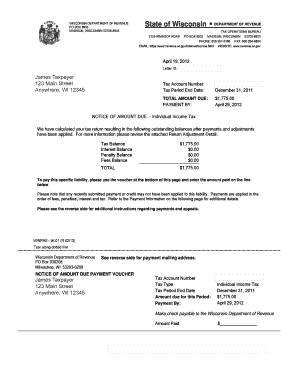

The Wisconsin Dept Of Revenue Notice Amount Due Form is an official document issued by the state’s Department of Revenue to inform taxpayers of outstanding tax liabilities. This form serves as a notification that a taxpayer owes a specific amount to the state, detailing the nature of the debt, including taxes owed, penalties, and interest. Understanding this form is crucial for taxpayers to manage their obligations and avoid further penalties.

How to use the Wisconsin Dept Of Revenue Notice Amount Due Form

Using the Wisconsin Dept Of Revenue Notice Amount Due Form involves several steps. First, review the information provided on the form, which includes the total amount due and any relevant deadlines. Next, determine the payment options available, which may include online payments, mailing a check, or visiting a local office. If you believe the amount due is incorrect, you can use the contact information provided to discuss the matter with a representative.

Steps to complete the Wisconsin Dept Of Revenue Notice Amount Due Form

Completing the Wisconsin Dept Of Revenue Notice Amount Due Form requires careful attention to detail. Follow these steps:

- Read the form thoroughly to understand the amounts listed.

- Gather any necessary documentation that supports your case or payment.

- Fill out any required sections on the form, ensuring accuracy.

- Decide on your payment method and prepare the necessary payment details.

- Submit the form and payment by the specified deadline to avoid penalties.

Key elements of the Wisconsin Dept Of Revenue Notice Amount Due Form

The key elements of the Wisconsin Dept Of Revenue Notice Amount Due Form include:

- Taxpayer Information: Name, address, and identification number.

- Amount Due: Total tax liability, including any penalties and interest.

- Payment Instructions: Detailed guidance on how to remit payment.

- Contact Information: Details for reaching the Department of Revenue for questions.

Form Submission Methods

Taxpayers can submit the Wisconsin Dept Of Revenue Notice Amount Due Form through various methods:

- Online: Payments can often be made through the Wisconsin Department of Revenue website.

- Mail: Send the completed form and payment to the address specified on the notice.

- In-Person: Visit a local Department of Revenue office to submit the form and payment directly.

Penalties for Non-Compliance

Failing to respond to the Wisconsin Dept Of Revenue Notice Amount Due Form can result in significant penalties. These may include:

- Additional interest on the unpaid amount.

- Late fees that accumulate over time.

- Potential legal action for collection of the debt.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wisconsin dept of revenue notice amountn due form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Wisconsin Dept Of Revenue Notice Amount Due Form?

The Wisconsin Dept Of Revenue Notice Amount Due Form is a document issued by the state to inform taxpayers of outstanding amounts owed. It is crucial for individuals and businesses to address this notice promptly to avoid penalties. Understanding this form can help you manage your tax obligations effectively.

-

How can airSlate SignNow help with the Wisconsin Dept Of Revenue Notice Amount Due Form?

airSlate SignNow provides a seamless platform for electronically signing and sending the Wisconsin Dept Of Revenue Notice Amount Due Form. Our solution simplifies the process, ensuring that you can quickly respond to the notice without the hassle of printing and mailing documents. This efficiency can save you time and reduce stress.

-

Is there a cost associated with using airSlate SignNow for the Wisconsin Dept Of Revenue Notice Amount Due Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solution allows you to manage documents like the Wisconsin Dept Of Revenue Notice Amount Due Form without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Wisconsin Dept Of Revenue Notice Amount Due Form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools make it easy to manage the Wisconsin Dept Of Revenue Notice Amount Due Form efficiently. You can streamline your workflow and ensure that all necessary documents are handled promptly.

-

Can I integrate airSlate SignNow with other software for handling the Wisconsin Dept Of Revenue Notice Amount Due Form?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your ability to manage the Wisconsin Dept Of Revenue Notice Amount Due Form. Whether you use CRM systems or accounting software, our platform can seamlessly connect to improve your document management process.

-

What are the benefits of using airSlate SignNow for the Wisconsin Dept Of Revenue Notice Amount Due Form?

Using airSlate SignNow for the Wisconsin Dept Of Revenue Notice Amount Due Form provides numerous benefits, including increased efficiency and reduced turnaround time. Our platform ensures that you can respond to tax notices quickly, helping you avoid late fees. Additionally, the secure eSigning feature protects your sensitive information.

-

How secure is airSlate SignNow when handling the Wisconsin Dept Of Revenue Notice Amount Due Form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your documents, including the Wisconsin Dept Of Revenue Notice Amount Due Form. You can trust that your sensitive information is safe while using our platform.

Get more for Wisconsin Dept Of Revenue Notice Amountn Due Form

Find out other Wisconsin Dept Of Revenue Notice Amountn Due Form

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template