Pass through Entity & Fiduciary Income Tax Updates 2023

Understanding Pass Through Entities and Fiduciary Income Tax Updates

Pass through entities are business structures where income is not taxed at the corporate level. Instead, income "passes through" to the owners or shareholders, who report it on their personal tax returns. Common types of pass through entities include partnerships, S corporations, and limited liability companies (LLCs). Fiduciary income tax updates pertain to the taxation of estates and trusts, which also function as pass through entities. These updates can impact how income is reported and taxed at both the entity and individual levels.

Steps to Complete Pass Through Entity and Fiduciary Income Tax Updates

Completing the Pass Through Entity and Fiduciary Income Tax Updates involves several key steps:

- Gather necessary documentation, including income statements and previous tax returns.

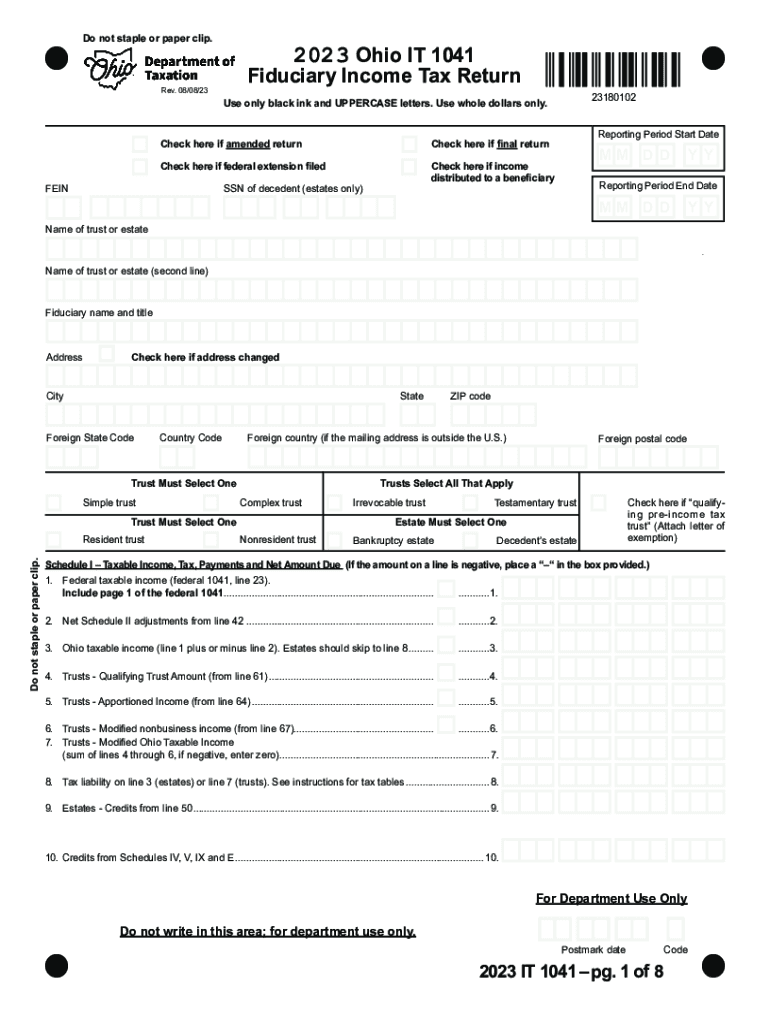

- Identify the specific tax forms required for your entity type, such as Form 1065 for partnerships or Form 1041 for estates and trusts.

- Review the latest IRS guidelines and updates to ensure compliance with current tax laws.

- Complete the relevant forms accurately, ensuring all income and deductions are reported correctly.

- Submit the completed forms by the designated filing deadlines to avoid penalties.

Legal Use of Pass Through Entity and Fiduciary Income Tax Updates

Understanding the legal framework surrounding pass through entities and fiduciary income tax is crucial for compliance. These entities must adhere to specific IRS regulations, including proper reporting of income and deductions. Failure to comply with these regulations can result in penalties and legal issues. It is important to consult with a tax professional to navigate the complexities of tax laws related to these entities.

Filing Deadlines and Important Dates

Filing deadlines for pass through entities and fiduciary income tax updates vary based on the entity type. Generally, partnerships and S corporations must file their returns by March 15, while estates and trusts typically have a filing deadline of April 15. It is essential to stay informed about these dates to ensure timely submissions and avoid potential penalties.

Required Documents for Pass Through Entity and Fiduciary Income Tax Updates

To successfully complete the Pass Through Entity and Fiduciary Income Tax Updates, several documents are typically required:

- Income statements, including K-1 forms for partnerships and S corporations.

- Previous tax returns for reference and accuracy.

- Documentation of any deductions or credits applicable to the entity.

- Records of distributions made to beneficiaries for fiduciary entities.

IRS Guidelines for Pass Through Entities and Fiduciary Income Tax Updates

The IRS provides comprehensive guidelines for pass through entities and fiduciary income tax updates. These guidelines outline the requirements for reporting income, allowable deductions, and the responsibilities of the entity's owners or beneficiaries. Staying updated with IRS publications and bulletins is crucial for ensuring compliance and making informed tax decisions.

Create this form in 5 minutes or less

Find and fill out the correct pass through entity amp fiduciary income tax updates

Create this form in 5 minutes!

How to create an eSignature for the pass through entity amp fiduciary income tax updates

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Pass Through Entity & Fiduciary Income Tax Updates?

Pass Through Entity & Fiduciary Income Tax Updates refer to the latest changes in tax regulations affecting entities like partnerships and estates. These updates are crucial for ensuring compliance and optimizing tax strategies. Staying informed about these updates can help businesses minimize their tax liabilities and avoid penalties.

-

How can airSlate SignNow assist with Pass Through Entity & Fiduciary Income Tax Updates?

airSlate SignNow provides a streamlined platform for managing documents related to Pass Through Entity & Fiduciary Income Tax Updates. With our eSigning capabilities, you can quickly sign and send tax-related documents, ensuring timely compliance. This efficiency helps businesses focus on their core operations while staying updated on tax obligations.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features like customizable templates, secure eSigning, and document tracking, all essential for managing Pass Through Entity & Fiduciary Income Tax Updates. These tools simplify the document workflow, making it easier to handle tax forms and agreements. Additionally, our platform ensures that all documents are stored securely and are easily accessible.

-

Is airSlate SignNow cost-effective for small businesses dealing with tax updates?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses managing Pass Through Entity & Fiduciary Income Tax Updates. Our pricing plans are flexible and cater to various needs, ensuring that you only pay for what you use. This affordability allows small businesses to access essential document management tools without breaking the bank.

-

Can airSlate SignNow integrate with accounting software for tax updates?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, making it easier to manage Pass Through Entity & Fiduciary Income Tax Updates. This integration allows for automatic syncing of documents and data, reducing manual entry errors and saving time. By connecting your tools, you can streamline your tax processes and enhance overall efficiency.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents offers numerous benefits, including enhanced security, improved efficiency, and better compliance with Pass Through Entity & Fiduciary Income Tax Updates. Our platform ensures that your documents are encrypted and securely stored, while the eSigning feature speeds up the approval process. This combination helps businesses stay organized and compliant with tax regulations.

-

How does airSlate SignNow ensure the security of tax documents?

airSlate SignNow prioritizes the security of your documents, especially those related to Pass Through Entity & Fiduciary Income Tax Updates. We utilize advanced encryption methods and secure cloud storage to protect sensitive information. Additionally, our platform complies with industry standards and regulations, ensuring that your tax documents are safe from unauthorized access.

Get more for Pass Through Entity & Fiduciary Income Tax Updates

- Ss4046ada ttc student services admissions application update form

- Proquest ftpcs submission publishing agreement form

- Ehs incident investigation blank form

- Rescloudinarycom form

- Bachelor of science speech language siue form

- 2020 21 verification worksheet independent form

- Atsu verification request form

- St cloud state cheer competition form

Find out other Pass Through Entity & Fiduciary Income Tax Updates

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure

- Electronic signature California Sublease Agreement Template Myself