Do Not Staple or Paper Clip Ohio it 1041 Fid 2024-2026

Understanding the Do Not Staple Or Paper Clip Ohio IT 1041 Fid

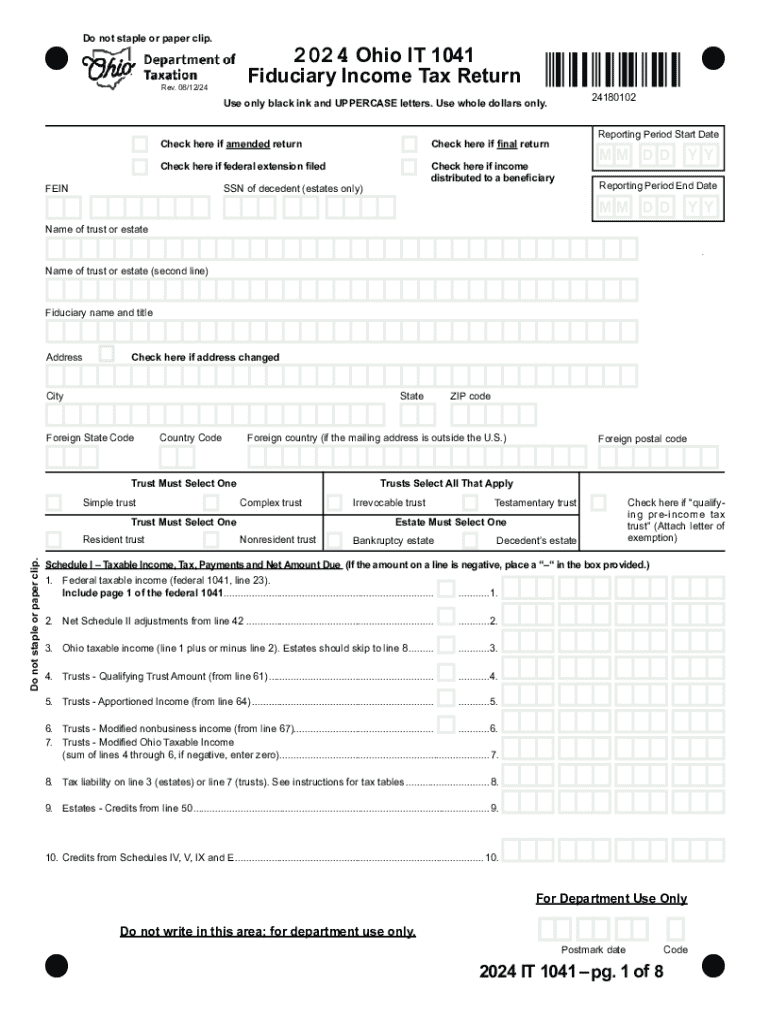

The Do Not Staple Or Paper Clip Ohio IT 1041 Fid is a specific form used in Ohio for filing fiduciary income tax returns. This form is essential for estates and trusts that earn income during the tax year. It allows fiduciaries to report income, deductions, and credits related to the estate or trust. Proper completion of this form ensures compliance with state tax regulations and accurate reporting of financial activities.

Steps to Complete the Do Not Staple Or Paper Clip Ohio IT 1041 Fid

Completing the Ohio IT 1041 Fid involves several key steps. First, gather all necessary financial documents related to the estate or trust, including income statements and deduction records. Next, accurately fill out the form, ensuring all required fields are completed. It is important to follow the specific instructions provided with the form, particularly regarding the prohibition against using staples or paper clips, as this can affect processing.

Legal Use of the Do Not Staple Or Paper Clip Ohio IT 1041 Fid

The legal use of the Ohio IT 1041 Fid is crucial for maintaining compliance with Ohio tax laws. This form must be filed by fiduciaries who manage estates or trusts and is subject to specific regulations. Failure to file correctly or on time can result in penalties or interest charges. Understanding the legal implications of this form helps ensure that fiduciaries fulfill their responsibilities effectively.

Required Documents for the Do Not Staple Or Paper Clip Ohio IT 1041 Fid

When preparing to file the Ohio IT 1041 Fid, certain documents are required. These typically include the estate or trust's financial statements, prior year tax returns, and any supporting documentation for deductions or credits claimed. Having these documents ready will facilitate accurate completion of the form and help avoid delays in processing.

Filing Deadlines for the Do Not Staple Or Paper Clip Ohio IT 1041 Fid

Filing deadlines for the Ohio IT 1041 Fid are critical to avoid penalties. Generally, the form must be filed by the fifteenth day of the fourth month following the close of the tax year. For estates and trusts that operate on a calendar year, this means the due date is typically April 15. It is essential to mark these dates on your calendar to ensure timely submission.

Form Submission Methods for the Do Not Staple Or Paper Clip Ohio IT 1041 Fid

The Ohio IT 1041 Fid can be submitted through various methods. It can be filed electronically using approved software, which is often the most efficient option. Alternatively, the form can be mailed to the appropriate Ohio tax authority. When submitting by mail, ensure the form is printed on plain paper without staples or paper clips, as required by the state.

Create this form in 5 minutes or less

Find and fill out the correct do not staple or paper clip ohio it 1041 fid

Create this form in 5 minutes!

How to create an eSignature for the do not staple or paper clip ohio it 1041 fid

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the importance of the 'Do Not Staple Or Paper Clip Ohio IT 1041 Fid.' instruction?

The 'Do Not Staple Or Paper Clip Ohio IT 1041 Fid.' instruction is crucial for ensuring that your tax documents are processed correctly. Staples and paper clips can interfere with scanning and processing, potentially delaying your filing. By following this guideline, you help streamline the review process for your submissions.

-

How does airSlate SignNow help with the 'Do Not Staple Or Paper Clip Ohio IT 1041 Fid.' requirement?

airSlate SignNow provides a digital solution that eliminates the need for physical staples or paper clips. By allowing you to eSign and send documents electronically, you can ensure compliance with the 'Do Not Staple Or Paper Clip Ohio IT 1041 Fid.' requirement effortlessly. This not only saves time but also reduces the risk of errors.

-

What features does airSlate SignNow offer for managing Ohio IT 1041 Fid documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically designed for managing Ohio IT 1041 Fid documents. These features ensure that you can easily create, send, and manage your documents while adhering to the 'Do Not Staple Or Paper Clip Ohio IT 1041 Fid.' guidelines. This makes the process efficient and user-friendly.

-

Is there a cost associated with using airSlate SignNow for Ohio IT 1041 Fid documents?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. The cost is competitive and reflects the value of a streamlined process for handling documents like the Ohio IT 1041 Fid. Investing in this solution can save you time and reduce the hassle associated with traditional paper filing.

-

Can I integrate airSlate SignNow with other software for Ohio IT 1041 Fid management?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for Ohio IT 1041 Fid management. This integration allows you to automate processes and maintain compliance with the 'Do Not Staple Or Paper Clip Ohio IT 1041 Fid.' requirement, making your document management more efficient.

-

What are the benefits of using airSlate SignNow for my Ohio IT 1041 Fid submissions?

Using airSlate SignNow for your Ohio IT 1041 Fid submissions offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. By adhering to the 'Do Not Staple Or Paper Clip Ohio IT 1041 Fid.' guideline, you ensure that your documents are processed smoothly. Additionally, the platform's user-friendly interface makes it easy for anyone to navigate.

-

How secure is airSlate SignNow for handling sensitive Ohio IT 1041 Fid documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your sensitive Ohio IT 1041 Fid documents. By using this platform, you can confidently manage your documents while adhering to the 'Do Not Staple Or Paper Clip Ohio IT 1041 Fid.' requirement. Your data's safety is our top priority.

Get more for Do Not Staple Or Paper Clip Ohio IT 1041 Fid

Find out other Do Not Staple Or Paper Clip Ohio IT 1041 Fid

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself