Establishing secure connection…Loading editor…Preparing document…

We are not affiliated with any brand or entity on this form.

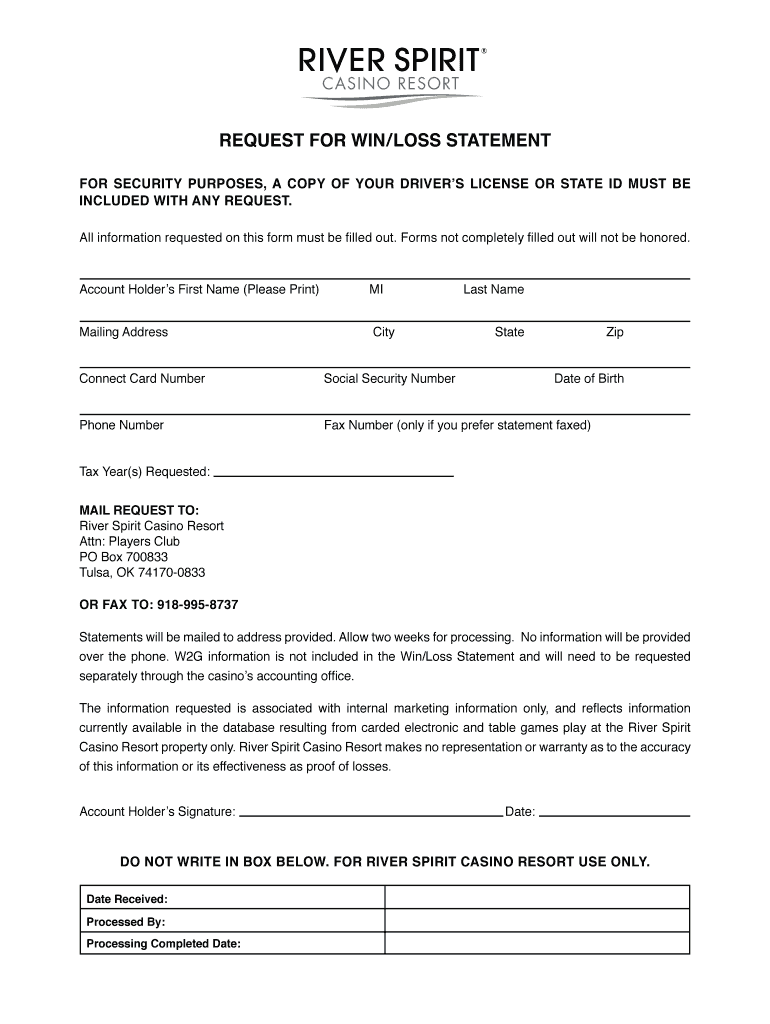

REQUEST for WINLOSS STATEMENT 2016-2026

be ready to get more

Create this form in 5 minutes or less

Find and fill out the correct request for winloss statement

Versions

Form popularity

Fillable & printable

4.7 Satisfied (36 Votes)

4.8 Satisfied (2180 Votes)

Create this form in 5 minutes!

How to create an eSignature for the request for winloss statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a REQUEST FOR WINLOSS STATEMENT?

A REQUEST FOR WINLOSS STATEMENT is a formal request to obtain a detailed report of wins and losses in business transactions. This statement helps businesses analyze their performance and make informed decisions. Utilizing airSlate SignNow, you can easily create and send this request for efficient processing.

-

How can airSlate SignNow help with my REQUEST FOR WINLOSS STATEMENT?

airSlate SignNow streamlines the process of sending and eSigning your REQUEST FOR WINLOSS STATEMENT. Our platform allows you to create customizable templates, ensuring that your requests are professional and compliant. This saves time and enhances the accuracy of your documentation.

-

Is there a cost associated with sending a REQUEST FOR WINLOSS STATEMENT using airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Our pricing plans are flexible, allowing you to choose the best option based on your needs. The investment in our service can lead to signNow time savings and improved document management.

-

What features does airSlate SignNow offer for managing REQUEST FOR WINLOSS STATEMENTS?

airSlate SignNow offers a variety of features for managing REQUEST FOR WINLOSS STATEMENTS, including customizable templates, real-time tracking, and secure eSigning. These features ensure that your requests are processed quickly and efficiently. Additionally, our platform provides audit trails for compliance and record-keeping.

-

Can I integrate airSlate SignNow with other software for my REQUEST FOR WINLOSS STATEMENT?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for REQUEST FOR WINLOSS STATEMENTS. Whether you use CRM systems, cloud storage, or other business tools, our integrations ensure that your document management process is smooth and efficient.

-

What are the benefits of using airSlate SignNow for my REQUEST FOR WINLOSS STATEMENT?

Using airSlate SignNow for your REQUEST FOR WINLOSS STATEMENT offers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. Our platform simplifies the document signing process, allowing you to focus on your core business activities. Additionally, the ability to track requests in real-time improves accountability.

-

How secure is my data when sending a REQUEST FOR WINLOSS STATEMENT through airSlate SignNow?

Your data security is our top priority at airSlate SignNow. When you send a REQUEST FOR WINLOSS STATEMENT, we utilize advanced encryption and security protocols to protect your information. Our platform is compliant with industry standards, ensuring that your sensitive data remains safe throughout the signing process.

Get more for REQUEST FOR WINLOSS STATEMENT

Find out other REQUEST FOR WINLOSS STATEMENT

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

be ready to get more

Get this form now!

If you believe that this page should be taken down, please follow our DMCA take down process here.