Sales & Use Tax Forms 2025-2026

What are Sales & Use Tax Forms?

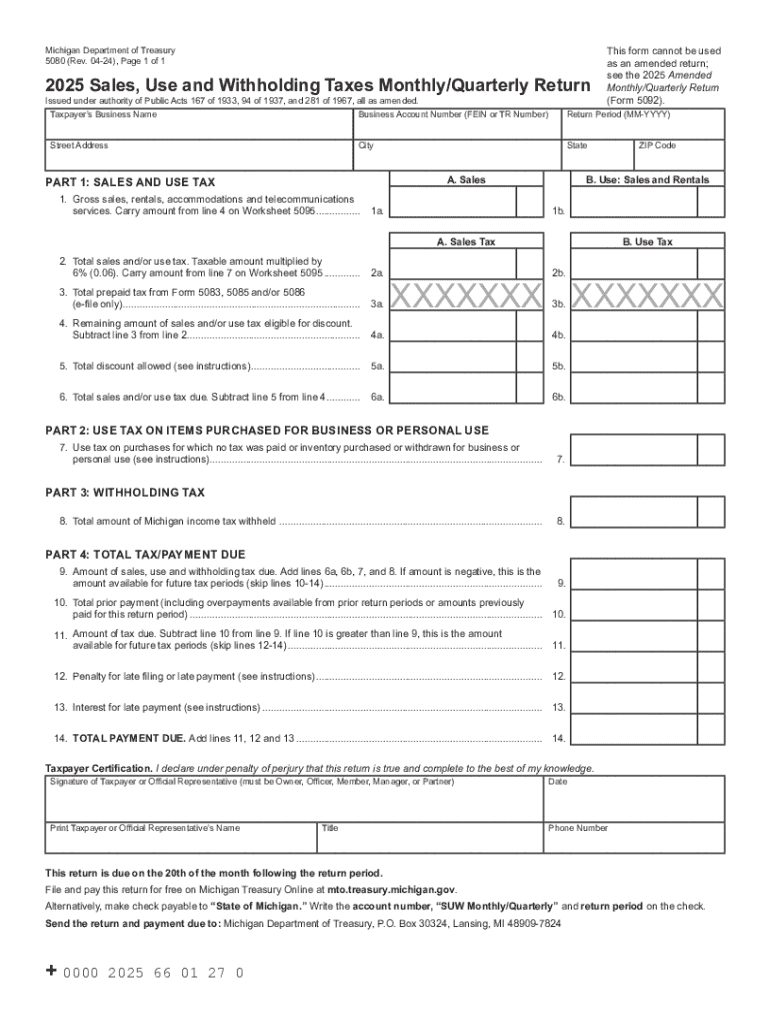

Sales & Use Tax Forms are essential documents used by businesses and individuals to report and remit sales tax collected on goods and services sold. These forms help ensure compliance with state tax laws and allow for the proper calculation of taxes owed. The forms vary by state, reflecting local tax rates and regulations. Understanding these forms is crucial for accurate tax reporting and avoiding penalties.

How to Use Sales & Use Tax Forms

Using Sales & Use Tax Forms involves several steps. First, determine the appropriate form for your state, as each state may have different requirements. Next, gather the necessary information, including sales figures and tax rates. Complete the form by accurately entering all required data. Finally, submit the form according to your state’s guidelines, either online or by mail, to ensure timely processing.

Steps to Complete Sales & Use Tax Forms

Completing Sales & Use Tax Forms can be straightforward if you follow these steps:

- Identify the correct form based on your state’s requirements.

- Collect sales records and receipts to determine the total sales amount.

- Calculate the total sales tax due based on applicable rates.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors before submission.

- Submit the form by the state’s deadline, either electronically or via mail.

State-Specific Rules for Sales & Use Tax Forms

Each state has its own rules regarding Sales & Use Tax Forms, including deadlines, rates, and specific requirements for completion. It is important to familiarize yourself with your state’s regulations to ensure compliance. Some states may have additional forms or documentation requirements, while others may offer streamlined processes for filing. Always check with your state’s tax authority for the most current information.

Filing Deadlines / Important Dates

Filing deadlines for Sales & Use Tax Forms vary by state and can depend on the frequency of filing, such as monthly, quarterly, or annually. Missing these deadlines can result in penalties and interest on unpaid taxes. It is essential to keep track of these dates and plan ahead to ensure timely submissions. Many states provide a calendar of important dates on their tax authority websites.

Penalties for Non-Compliance

Failure to file Sales & Use Tax Forms on time or inaccuracies in reporting can lead to significant penalties. Common consequences include late fees, interest on unpaid taxes, and potential legal action from state tax authorities. Businesses and individuals should take compliance seriously to avoid these repercussions. Regular audits and reviews of tax records can help maintain compliance and reduce the risk of penalties.

Create this form in 5 minutes or less

Find and fill out the correct sales amp use tax forms

Create this form in 5 minutes!

How to create an eSignature for the sales amp use tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Sales & Use Tax Forms?

Sales & Use Tax Forms are official documents used to report and pay sales tax to the appropriate tax authorities. These forms help businesses comply with tax regulations and ensure accurate reporting of sales transactions. Using airSlate SignNow, you can easily create, send, and eSign these forms to streamline your tax processes.

-

How can airSlate SignNow help with Sales & Use Tax Forms?

airSlate SignNow provides a user-friendly platform for creating and managing Sales & Use Tax Forms. With features like eSignature and document tracking, you can ensure that your forms are completed accurately and submitted on time. This not only saves you time but also reduces the risk of errors in your tax filings.

-

What is the pricing structure for using airSlate SignNow for Sales & Use Tax Forms?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose from various subscription options based on your needs, ensuring you only pay for the features you use. This cost-effective solution makes it easy to manage your Sales & Use Tax Forms without breaking the bank.

-

Are there any integrations available for Sales & Use Tax Forms?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your Sales & Use Tax Forms. These integrations allow for automatic data transfer, reducing manual entry and minimizing errors. This ensures that your tax documents are always up-to-date and accurate.

-

Can I customize my Sales & Use Tax Forms in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your Sales & Use Tax Forms to meet your specific business needs. You can add your branding, adjust fields, and include any necessary information to ensure compliance with local tax regulations. This flexibility helps you create professional and compliant tax documents.

-

Is airSlate SignNow secure for handling Sales & Use Tax Forms?

Yes, airSlate SignNow prioritizes security and compliance when handling Sales & Use Tax Forms. The platform uses advanced encryption and secure storage to protect your sensitive information. You can confidently manage your tax documents knowing that they are safe and secure.

-

How does eSigning work for Sales & Use Tax Forms in airSlate SignNow?

eSigning in airSlate SignNow is simple and efficient for Sales & Use Tax Forms. You can send documents for signature via email, and recipients can sign them electronically from any device. This process speeds up the completion of your tax forms and ensures that all signatures are legally binding.

Get more for Sales & Use Tax Forms

Find out other Sales & Use Tax Forms

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors