5080, Sales, Use and Withholding Taxes MonthlyQuarterly Return 2025

What is the 5080, Sales, Use And Withholding Taxes MonthlyQuarterly Return

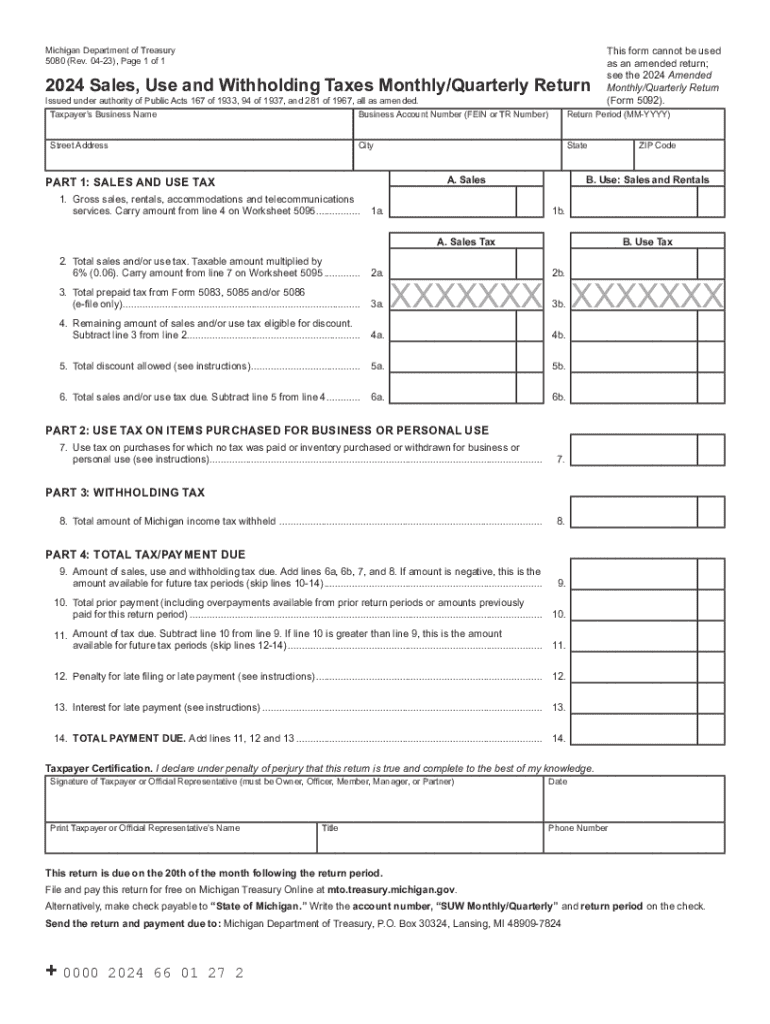

The 5080 form is a tax return used by businesses in the United States to report sales, use, and withholding taxes on a monthly or quarterly basis. This form is essential for ensuring compliance with state tax regulations. Businesses must accurately report the taxes they have collected from customers and any taxes they owe to the state. The 5080 form helps streamline the tax reporting process and provides a clear record for both the business and tax authorities.

How to use the 5080, Sales, Use And Withholding Taxes MonthlyQuarterly Return

To effectively use the 5080 form, businesses should first gather all necessary financial records, including sales receipts and tax collected. Once the data is compiled, the business can fill out the form by entering the total sales, the amount of tax collected, and any applicable deductions. It is important to follow the specific instructions provided with the form to ensure accurate completion. After filling out the form, businesses must submit it to the appropriate state tax agency by the designated deadline.

Steps to complete the 5080, Sales, Use And Withholding Taxes MonthlyQuarterly Return

Completing the 5080 form involves several key steps:

- Gather all relevant sales and tax records for the reporting period.

- Calculate the total sales and the corresponding sales tax collected.

- Fill out the form with accurate figures, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Submit the completed form to the appropriate state tax authority.

Filing Deadlines / Important Dates

Filing deadlines for the 5080 form vary depending on whether a business reports monthly or quarterly. Monthly filers typically must submit their forms by the last day of the month following the reporting period. Quarterly filers generally have until the last day of the month following the end of the quarter. It is crucial for businesses to be aware of these deadlines to avoid penalties and ensure compliance with state tax laws.

Penalties for Non-Compliance

Failure to file the 5080 form on time or inaccuracies in reporting can result in significant penalties. States may impose fines based on the amount of tax owed or a flat fee for late submissions. Additionally, businesses may face interest charges on any unpaid taxes. To avoid these penalties, it is important to file the form accurately and on time, ensuring all tax obligations are met.

Who Issues the Form

The 5080 form is issued by the state tax authority in the jurisdiction where the business operates. Each state may have its own version of the form, tailored to its specific tax regulations and requirements. Businesses should ensure they are using the correct form for their state to comply with local tax laws.

Create this form in 5 minutes or less

Find and fill out the correct 5080 sales use and withholding taxes monthlyquarterly return

Create this form in 5 minutes!

How to create an eSignature for the 5080 sales use and withholding taxes monthlyquarterly return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 5080, Sales, Use And Withholding Taxes MonthlyQuarterly Return?

The 5080, Sales, Use And Withholding Taxes MonthlyQuarterly Return is a tax form used by businesses to report sales, use, and withholding taxes to the state. It is essential for compliance and helps ensure that your business meets its tax obligations accurately and on time.

-

How can airSlate SignNow help with the 5080, Sales, Use And Withholding Taxes MonthlyQuarterly Return?

airSlate SignNow streamlines the process of preparing and submitting the 5080, Sales, Use And Withholding Taxes MonthlyQuarterly Return by allowing you to eSign and send documents securely. This reduces the time spent on paperwork and enhances compliance with tax regulations.

-

What are the pricing options for using airSlate SignNow for tax returns?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose a plan that fits your needs, whether you require basic features for occasional use or advanced functionalities for frequent submissions of the 5080, Sales, Use And Withholding Taxes MonthlyQuarterly Return.

-

Are there any integrations available with airSlate SignNow for tax management?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your 5080, Sales, Use And Withholding Taxes MonthlyQuarterly Return. These integrations help streamline your workflow and ensure accurate data transfer between platforms.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, which are essential for managing your 5080, Sales, Use And Withholding Taxes MonthlyQuarterly Return. These tools enhance efficiency and ensure that your documents are handled securely.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow employs advanced encryption and security protocols to protect your documents, including the 5080, Sales, Use And Withholding Taxes MonthlyQuarterly Return. This ensures that your sensitive information remains confidential and secure throughout the signing process.

-

Can I access airSlate SignNow on mobile devices?

Yes, airSlate SignNow is accessible on mobile devices, allowing you to manage your 5080, Sales, Use And Withholding Taxes MonthlyQuarterly Return on the go. This flexibility ensures that you can handle your tax documents anytime, anywhere.

Get more for 5080, Sales, Use And Withholding Taxes MonthlyQuarterly Return

- Dfw airport identificationaccess badge application to be form

- Canada nova scotia community college form

- Healthusnewscomdoctorsmarwan shaykh 205168dr marwan m shaykh mdjacksonville flobstetrician form

- Liability waiver or release form what is itliability waiver or release form what is itrelease of liability formfree waiver

- Immunization form student health centers mercer university

- Consent form for research us legal forms

- Approved student pick up form 21 22

- Wwwcourseherocomfilep78bof3onamestudent id last first phys 121 version a midterm form

Find out other 5080, Sales, Use And Withholding Taxes MonthlyQuarterly Return

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form