FundsAtWork Preservation Funds Withdrawal Form 2013

What is the FundsAtWork Preservation Funds Withdrawal Form

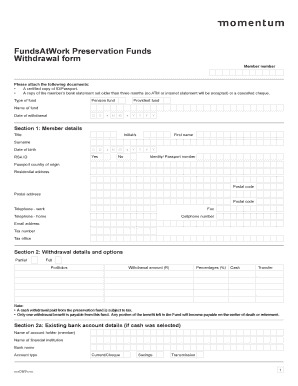

The FundsAtWork Preservation Funds Withdrawal Form is a document used by individuals to initiate the withdrawal of funds from their preservation accounts. These accounts are typically set up to safeguard retirement savings when changing jobs or retiring. This form ensures that the withdrawal process is compliant with applicable regulations and that the account holder's intentions are clearly documented.

How to use the FundsAtWork Preservation Funds Withdrawal Form

Using the FundsAtWork Preservation Funds Withdrawal Form involves several straightforward steps. First, obtain the form from the appropriate source, such as your financial institution or employer. Next, fill out the required fields, including personal identification details, account information, and the amount you wish to withdraw. After completing the form, review it for accuracy before submitting it to ensure a smooth processing experience.

Steps to complete the FundsAtWork Preservation Funds Withdrawal Form

Completing the FundsAtWork Preservation Funds Withdrawal Form requires careful attention to detail. Follow these steps:

- Gather necessary personal information, including your Social Security number and account number.

- Clearly indicate the amount you wish to withdraw and the reason for the withdrawal.

- Provide any additional documentation that may be required, such as identification or proof of eligibility.

- Review the completed form for any errors or omissions.

- Submit the form according to the instructions provided, whether online, by mail, or in person.

Required Documents

To successfully complete the FundsAtWork Preservation Funds Withdrawal Form, you may need to provide several supporting documents. These typically include:

- A copy of your identification, such as a driver's license or passport.

- Proof of your current address, like a utility bill or bank statement.

- Any relevant tax documents that may support your withdrawal request.

Having these documents ready can help expedite the processing of your withdrawal.

Form Submission Methods

The FundsAtWork Preservation Funds Withdrawal Form can be submitted through various methods, depending on the preferences of the financial institution. Common submission methods include:

- Online submission via the institution's secure portal.

- Mailing the completed form to the designated address.

- Delivering the form in person at a local branch office.

Be sure to check the specific submission guidelines provided by your financial institution to ensure compliance.

Eligibility Criteria

To be eligible to use the FundsAtWork Preservation Funds Withdrawal Form, individuals must meet certain criteria. Generally, these include:

- Having an active preservation fund account.

- Being of legal age, typically eighteen years or older.

- Meeting any specific conditions set by the fund provider regarding withdrawals.

Understanding these criteria is crucial to ensure that your withdrawal request is valid and processed without delays.

Create this form in 5 minutes or less

Find and fill out the correct fundsatwork preservation funds withdrawal form

Create this form in 5 minutes!

How to create an eSignature for the fundsatwork preservation funds withdrawal form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FundsAtWork Preservation Funds Withdrawal Form?

The FundsAtWork Preservation Funds Withdrawal Form is a document that allows individuals to request the withdrawal of their funds from a preservation fund. This form is essential for ensuring that the withdrawal process is compliant with regulatory requirements and is processed efficiently.

-

How do I complete the FundsAtWork Preservation Funds Withdrawal Form?

To complete the FundsAtWork Preservation Funds Withdrawal Form, you need to provide personal details, fund information, and the amount you wish to withdraw. Ensure that all sections are filled out accurately to avoid delays in processing your request.

-

Is there a fee associated with the FundsAtWork Preservation Funds Withdrawal Form?

Typically, there are no direct fees for submitting the FundsAtWork Preservation Funds Withdrawal Form. However, it's advisable to check with your fund provider for any potential charges related to the withdrawal process.

-

What are the benefits of using the FundsAtWork Preservation Funds Withdrawal Form?

Using the FundsAtWork Preservation Funds Withdrawal Form streamlines the withdrawal process, ensuring that your request is handled promptly and accurately. It also helps maintain compliance with financial regulations, providing peace of mind during the withdrawal process.

-

Can I submit the FundsAtWork Preservation Funds Withdrawal Form online?

Yes, many providers allow you to submit the FundsAtWork Preservation Funds Withdrawal Form online for convenience. Check with your fund administrator to see if they offer an online submission option, which can expedite the processing time.

-

What information do I need to provide on the FundsAtWork Preservation Funds Withdrawal Form?

You will need to provide personal identification details, your fund account number, and the specific amount you wish to withdraw on the FundsAtWork Preservation Funds Withdrawal Form. Additional documentation may be required depending on your fund provider's policies.

-

How long does it take to process the FundsAtWork Preservation Funds Withdrawal Form?

The processing time for the FundsAtWork Preservation Funds Withdrawal Form can vary depending on the fund provider. Generally, you can expect a response within a few business days, but it may take longer during peak periods or if additional information is required.

Get more for FundsAtWork Preservation Funds Withdrawal Form

- Changing attitudes by changing behaviorprinciples of social form

- Promoting quality standards for form

- Prcoeedings of the royal society of medicine a form of progressive

- This article appeared in a journal published by elsevier the weslaco tamu form

- Form 700schc

- Tin old maine gov maine form

- Film production company contract template form

- Filmmaker contract template form

Find out other FundsAtWork Preservation Funds Withdrawal Form

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate