Association Dues Payroll Deduction Authorization TRS Form 593 Trta 2003

What is the Association Dues Payroll Deduction Authorization TRS Form 593 TRTA

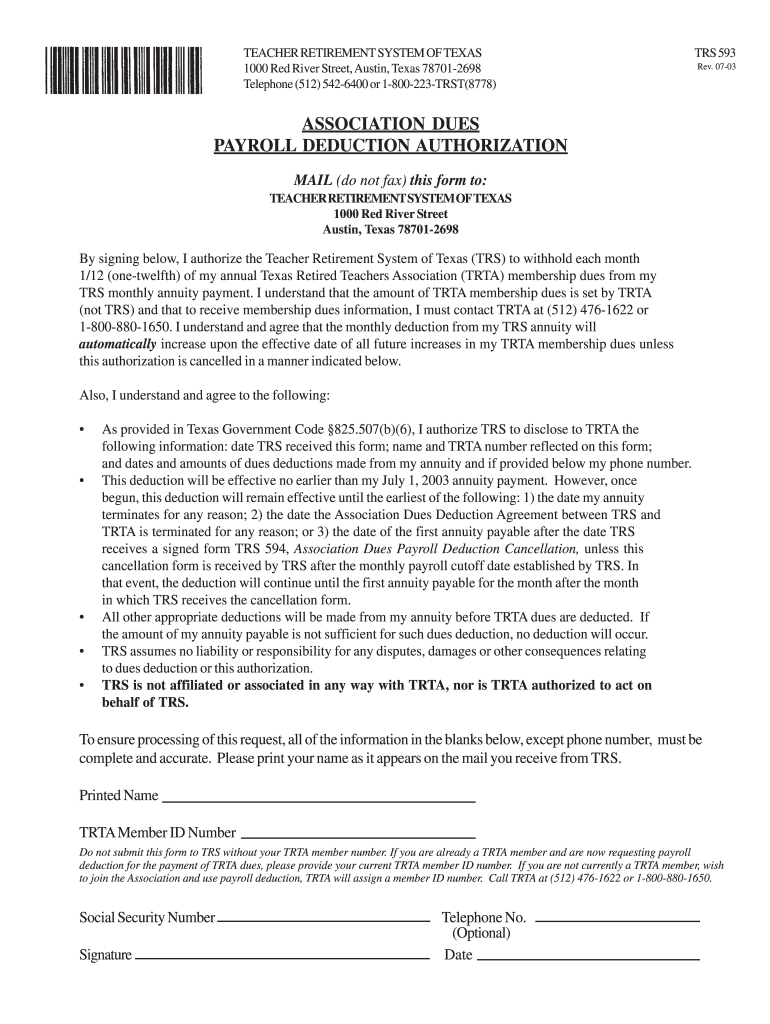

The Association Dues Payroll Deduction Authorization TRS Form 593 TRTA is a specific document used by members of the Texas Retired Teachers Association (TRTA) to authorize the deduction of association dues directly from their payroll. This form facilitates the automatic withdrawal of dues, ensuring that members remain in good standing without the need for manual payments. It is particularly important for retired educators who wish to maintain their membership and access the benefits provided by the association.

How to use the Association Dues Payroll Deduction Authorization TRS Form 593 TRTA

To use the Association Dues Payroll Deduction Authorization TRS Form 593 TRTA, members must first obtain the form, which can typically be found on the TRTA website or through member communications. After filling out the required information, including personal details and payment preferences, members should submit the form to their payroll department. This ensures that dues are deducted from their pension or retirement benefits automatically, streamlining the payment process and reducing the risk of missed payments.

Steps to complete the Association Dues Payroll Deduction Authorization TRS Form 593 TRTA

Completing the Association Dues Payroll Deduction Authorization TRS Form 593 TRTA involves several straightforward steps:

- Obtain the form from the TRTA website or your local chapter.

- Fill in your personal information, including your name, address, and membership ID.

- Specify the amount to be deducted for dues.

- Sign and date the form to authorize the deductions.

- Submit the completed form to your payroll department for processing.

Key elements of the Association Dues Payroll Deduction Authorization TRS Form 593 TRTA

The key elements of the Association Dues Payroll Deduction Authorization TRS Form 593 TRTA include:

- Member Information: Personal details such as name, address, and membership number.

- Deduction Amount: The specific amount to be deducted for association dues.

- Authorization Signature: A signature is required to validate the authorization for deductions.

- Date: The date on which the form is completed and signed.

Legal use of the Association Dues Payroll Deduction Authorization TRS Form 593 TRTA

The legal use of the Association Dues Payroll Deduction Authorization TRS Form 593 TRTA is to ensure compliance with the regulations governing payroll deductions for association dues. By signing this form, members grant their employer permission to deduct specified dues from their retirement benefits. This authorization is legally binding and ensures that members maintain their membership status without interruption, provided that the deductions are made in accordance with the agreed terms.

Who Issues the Form

The Association Dues Payroll Deduction Authorization TRS Form 593 TRTA is issued by the Texas Retired Teachers Association (TRTA). This organization supports retired educators in Texas by providing resources, advocacy, and community engagement opportunities. Members can access the form through official TRTA channels, ensuring they have the most current version for their payroll deduction needs.

Create this form in 5 minutes or less

Find and fill out the correct association dues payroll deduction authorization trs form 593 trta

Create this form in 5 minutes!

How to create an eSignature for the association dues payroll deduction authorization trs form 593 trta

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Association Dues Payroll Deduction Authorization TRS Form 593 Trta?

The Association Dues Payroll Deduction Authorization TRS Form 593 Trta is a document that allows members to authorize payroll deductions for their association dues. This form simplifies the payment process, ensuring timely contributions without manual intervention. Using airSlate SignNow, you can easily eSign and manage this form digitally.

-

How does airSlate SignNow facilitate the completion of the Association Dues Payroll Deduction Authorization TRS Form 593 Trta?

airSlate SignNow provides a user-friendly platform to complete the Association Dues Payroll Deduction Authorization TRS Form 593 Trta electronically. Users can fill out the form, add their signatures, and send it securely, streamlining the entire process. This eliminates the need for physical paperwork and enhances efficiency.

-

What are the pricing options for using airSlate SignNow for the Association Dues Payroll Deduction Authorization TRS Form 593 Trta?

airSlate SignNow offers various pricing plans tailored to different business needs, including options for individual users and teams. Each plan provides access to features that simplify the management of documents like the Association Dues Payroll Deduction Authorization TRS Form 593 Trta. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Association Dues Payroll Deduction Authorization TRS Form 593 Trta?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the management of the Association Dues Payroll Deduction Authorization TRS Form 593 Trta. These tools help ensure that your documents are completed accurately and efficiently, reducing the risk of errors.

-

Can I integrate airSlate SignNow with other software for the Association Dues Payroll Deduction Authorization TRS Form 593 Trta?

Yes, airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow for the Association Dues Payroll Deduction Authorization TRS Form 593 Trta. This means you can connect with your existing systems, such as HR or payroll software, to automate processes and improve efficiency.

-

What are the benefits of using airSlate SignNow for the Association Dues Payroll Deduction Authorization TRS Form 593 Trta?

Using airSlate SignNow for the Association Dues Payroll Deduction Authorization TRS Form 593 Trta offers numerous benefits, including time savings, enhanced security, and improved accuracy. The digital platform reduces the hassle of paperwork and allows for quick access to signed documents, making it easier to manage your association dues.

-

Is airSlate SignNow secure for handling the Association Dues Payroll Deduction Authorization TRS Form 593 Trta?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including the Association Dues Payroll Deduction Authorization TRS Form 593 Trta. With encryption and secure cloud storage, you can trust that your sensitive information is safe and compliant with industry standards.

Get more for Association Dues Payroll Deduction Authorization TRS Form 593 Trta

Find out other Association Dues Payroll Deduction Authorization TRS Form 593 Trta

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile