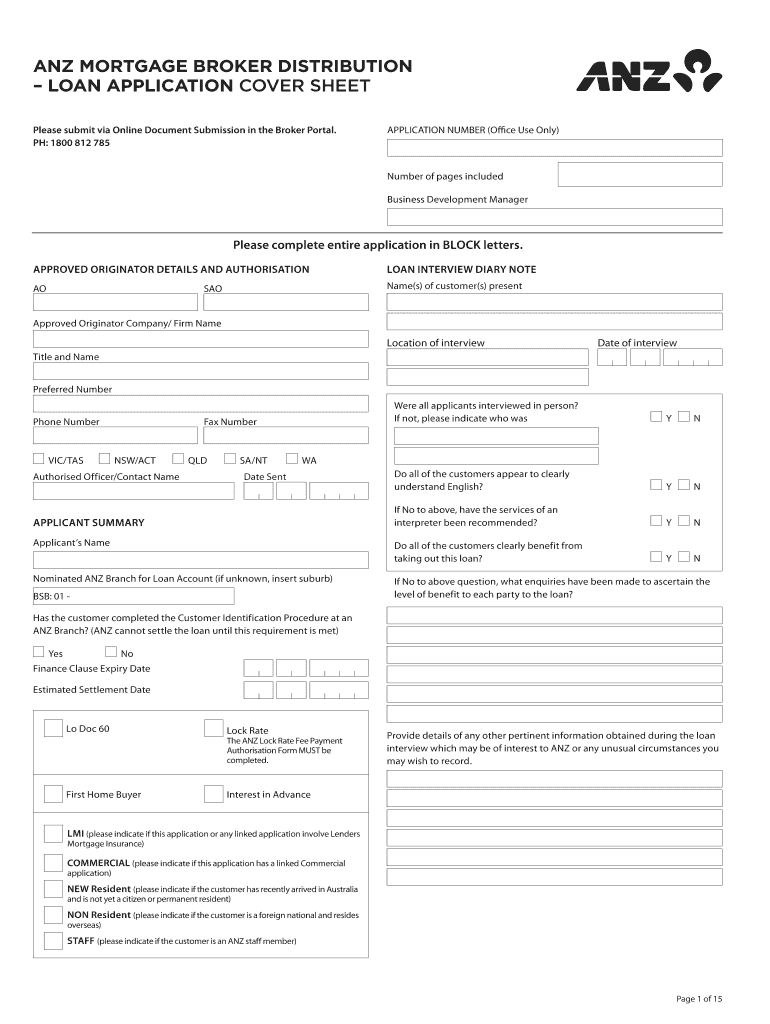

ANZ MORTGAGE BROKER DISTRIBUTION Form

What is the ANZ Mortgage Broker Distribution

The ANZ Mortgage Broker Distribution refers to the structured process through which mortgage brokers distribute and manage mortgage products offered by ANZ (Australia and New Zealand Banking Group). This distribution framework is designed to facilitate the connection between lenders and borrowers, ensuring that potential homeowners can access a variety of mortgage options tailored to their financial needs. It includes various roles such as brokers, agents, and financial institutions, all working collaboratively to provide comprehensive mortgage solutions.

How to Use the ANZ Mortgage Broker Distribution

Utilizing the ANZ Mortgage Broker Distribution involves several key steps. First, potential borrowers should engage with a licensed mortgage broker who is part of the ANZ distribution network. The broker will assess the borrower’s financial situation and preferences to recommend suitable mortgage products. Next, the broker will assist in gathering necessary documentation and submitting applications to ANZ on behalf of the borrower. Throughout the process, the broker serves as a liaison, providing updates and guidance until the mortgage is finalized.

Steps to Complete the ANZ Mortgage Broker Distribution

Completing the ANZ Mortgage Broker Distribution process typically involves the following steps:

- Initial Consultation: Meet with a mortgage broker to discuss your financial situation and mortgage needs.

- Document Preparation: Gather required documents such as proof of income, credit history, and identification.

- Product Selection: The broker will present various mortgage options available through ANZ.

- Application Submission: The broker submits your mortgage application to ANZ, ensuring all information is accurate.

- Approval Process: ANZ reviews the application, which may involve additional requests for information.

- Finalization: Upon approval, finalize the mortgage agreement and complete any required paperwork.

Key Elements of the ANZ Mortgage Broker Distribution

Several key elements define the ANZ Mortgage Broker Distribution framework:

- Broker Relationships: Strong partnerships between ANZ and mortgage brokers enhance the distribution network.

- Product Range: A variety of mortgage products are offered, catering to different borrower needs.

- Compliance Standards: Adherence to regulatory requirements ensures that all transactions are conducted legally and ethically.

- Training and Support: Continuous training for brokers to keep them updated on product offerings and market trends.

Legal Use of the ANZ Mortgage Broker Distribution

The legal use of the ANZ Mortgage Broker Distribution is governed by various regulations that ensure consumer protection and fair lending practices. Brokers must be licensed and comply with federal and state laws regarding mortgage lending. This includes providing accurate information about mortgage products, disclosing fees, and ensuring that borrowers understand the terms of their loans. Compliance with these laws is essential to maintain the integrity of the mortgage distribution process.

Eligibility Criteria

Eligibility for accessing the ANZ Mortgage Broker Distribution typically includes several criteria that borrowers must meet. These may include:

- Minimum credit score requirements.

- Proof of stable income and employment history.

- Debt-to-income ratio assessments.

- Age and residency status, as some products may have specific requirements.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the anz mortgage broker distribution

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ANZ MORTGAGE BROKER DISTRIBUTION?

ANZ MORTGAGE BROKER DISTRIBUTION refers to the network and processes through which ANZ Bank collaborates with mortgage brokers to distribute its mortgage products. This system allows brokers to offer a variety of ANZ mortgage options to their clients, enhancing accessibility and choice in the mortgage market.

-

How does airSlate SignNow support ANZ MORTGAGE BROKER DISTRIBUTION?

airSlate SignNow streamlines the document signing process for ANZ MORTGAGE BROKER DISTRIBUTION by providing an easy-to-use platform for eSigning and document management. This efficiency helps brokers close deals faster and improves client satisfaction by simplifying the paperwork involved in mortgage applications.

-

What are the pricing options for using airSlate SignNow with ANZ MORTGAGE BROKER DISTRIBUTION?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those involved in ANZ MORTGAGE BROKER DISTRIBUTION. You can choose from monthly or annual subscriptions, ensuring that you only pay for the features you need to enhance your mortgage brokerage operations.

-

What features does airSlate SignNow offer for ANZ MORTGAGE BROKER DISTRIBUTION?

Key features of airSlate SignNow for ANZ MORTGAGE BROKER DISTRIBUTION include customizable templates, automated workflows, and secure cloud storage. These features help brokers manage their documents efficiently, ensuring compliance and reducing the time spent on administrative tasks.

-

What are the benefits of using airSlate SignNow for ANZ MORTGAGE BROKER DISTRIBUTION?

Using airSlate SignNow for ANZ MORTGAGE BROKER DISTRIBUTION provides numerous benefits, including increased efficiency, reduced turnaround times, and enhanced client experience. By automating the signing process, brokers can focus more on client relationships and less on paperwork.

-

Can airSlate SignNow integrate with other tools used in ANZ MORTGAGE BROKER DISTRIBUTION?

Yes, airSlate SignNow offers integrations with various CRM and financial software commonly used in ANZ MORTGAGE BROKER DISTRIBUTION. This allows brokers to seamlessly connect their existing tools, ensuring a smooth workflow and better data management.

-

Is airSlate SignNow secure for handling documents related to ANZ MORTGAGE BROKER DISTRIBUTION?

Absolutely, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents in ANZ MORTGAGE BROKER DISTRIBUTION. The platform employs advanced encryption and security protocols to protect your data and ensure confidentiality.

Get more for ANZ MORTGAGE BROKER DISTRIBUTION

- Form ps 404 2014

- Nyc form vr 66 fillable 2015 2019

- Ny fingerprint waiver form submission online 2014 2019

- Day care home child menu fill in child menu for day care homes form

- Request information private 2009 2019

- Blank immunization consent form 2014 2019

- Emedny 436701 2015 2019 form

- Doh 352 2012 2019 form

Find out other ANZ MORTGAGE BROKER DISTRIBUTION

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form