17 116 General Answer to a Petition 2023-2026

What is the 17 116 General Answer To A Petition

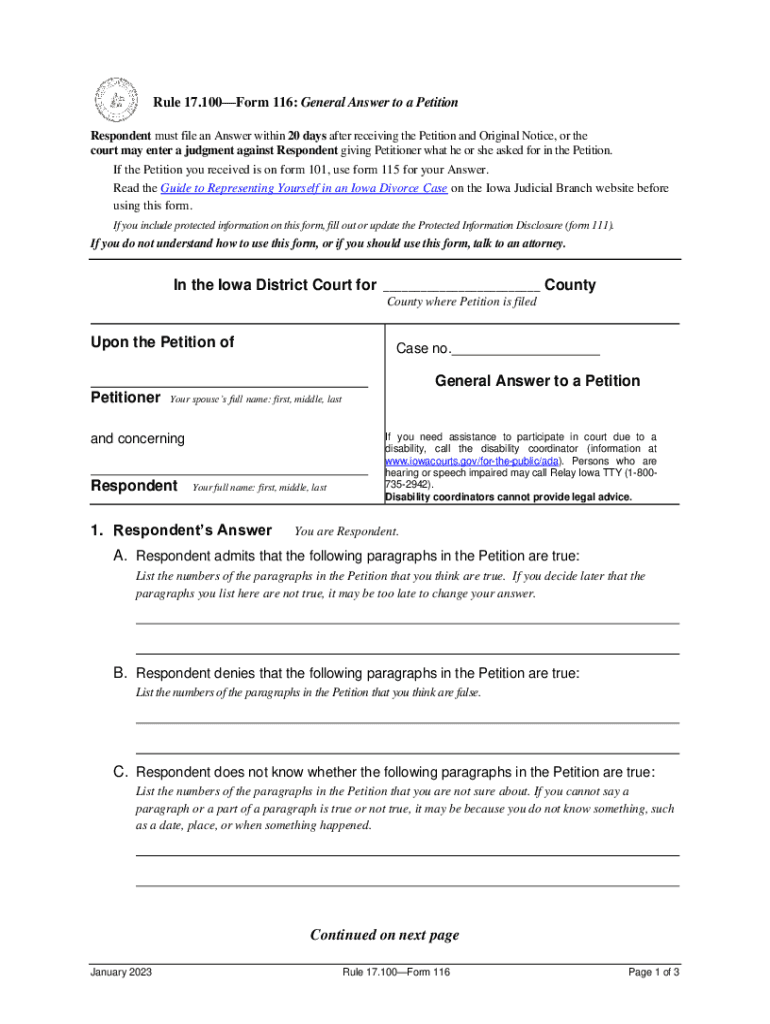

The 17 116 General Answer To A Petition is a legal document used in the United States to respond to a petition filed in court. This form is essential for individuals or entities who are named in a petition and wish to formally present their position or defense. It provides a structured way to articulate responses to the claims made in the original petition, ensuring that the responding party's arguments are clearly communicated to the court.

Key elements of the 17 116 General Answer To A Petition

Understanding the key elements of the 17 116 General Answer To A Petition is crucial for effective completion. This form typically includes:

- Caption: Identifies the court and the parties involved.

- Response Section: Where the respondent addresses each allegation made in the petition.

- Affirmative Defenses: Any defenses that the respondent wishes to assert, which can counter the claims made in the petition.

- Verification: A statement affirming the truth of the contents, often requiring a signature.

Steps to complete the 17 116 General Answer To A Petition

Completing the 17 116 General Answer To A Petition involves several important steps:

- Read the Petition: Thoroughly review the petition to understand the claims being made.

- Draft Your Response: Address each allegation specifically, stating whether you admit, deny, or lack sufficient information to respond.

- Include Affirmative Defenses: If applicable, outline any defenses that support your position.

- Review and Edit: Ensure clarity and accuracy in your response, checking for completeness.

- Sign and Date: Provide your signature and the date to validate the document.

Legal use of the 17 116 General Answer To A Petition

The legal use of the 17 116 General Answer To A Petition is to provide a formal reply to the allegations made in a petition. This document serves as a critical part of the legal process, allowing the respondent to assert their rights and present their side of the case. Properly completing and filing this form is essential to ensure that the court considers the respondent's arguments during proceedings.

How to obtain the 17 116 General Answer To A Petition

To obtain the 17 116 General Answer To A Petition, individuals can typically access the form through the court's website or directly from the courthouse. Many jurisdictions provide downloadable versions of legal forms, which can be filled out electronically or printed for manual completion. It is advisable to verify that you are using the most current version of the form, as requirements may vary by state.

Filing Deadlines / Important Dates

Filing deadlines for the 17 116 General Answer To A Petition are critical to adhere to in order to avoid default judgments. Generally, the respondent must file their answer within a specified time frame after being served with the petition, often ranging from twenty to thirty days, depending on the jurisdiction. It is essential to check local court rules for specific deadlines applicable to your case.

Create this form in 5 minutes or less

Find and fill out the correct 17 116 general answer to a petition

Create this form in 5 minutes!

How to create an eSignature for the 17 116 general answer to a petition

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 17 116 General Answer To A Petition?

The 17 116 General Answer To A Petition is a legal document used to respond to a petition in court. It outlines the respondent's position and arguments against the claims made in the petition. Understanding this document is crucial for anyone involved in legal proceedings.

-

How can airSlate SignNow help with the 17 116 General Answer To A Petition?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning the 17 116 General Answer To A Petition. Our user-friendly interface allows you to customize your document quickly and efficiently, ensuring you meet all legal requirements.

-

What are the pricing options for using airSlate SignNow for legal documents?

airSlate SignNow offers various pricing plans to accommodate different business needs. Whether you are a solo practitioner or a large firm, you can find a plan that fits your budget while providing access to essential features for managing documents like the 17 116 General Answer To A Petition.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow. You can connect it with tools like Google Drive, Dropbox, and CRM systems to manage your documents, including the 17 116 General Answer To A Petition, more effectively.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning. These tools simplify the process of preparing and managing documents like the 17 116 General Answer To A Petition, making it easier for users to stay organized.

-

Is airSlate SignNow secure for handling legal documents?

Absolutely! airSlate SignNow prioritizes security with advanced encryption and compliance with legal standards. This ensures that your documents, including the 17 116 General Answer To A Petition, are protected throughout the signing process.

-

Can I track the status of my documents with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all your documents. You can easily monitor the status of your 17 116 General Answer To A Petition and receive notifications when it has been viewed or signed, ensuring you stay informed.

Get more for 17 116 General Answer To A Petition

- W 7 sp en espanol form

- Nwea l th of ke lex et justitiartcase no cour form

- Ucs840 rev 0729request for judicial inter form

- Gf 129 satisfaction of judgment or partial satisfaction of lien wi state courts form

- Fa 4113v response and counterclaim form

- Pr 1815 estate receipt informal and formal administration

- Wisconsin application for absentee ballot form

- Maxorplus prior authorization form

Find out other 17 116 General Answer To A Petition

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple