W7 Form

What is the W7 Form

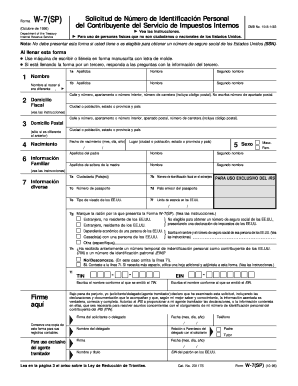

The W7 form, also known as the W-7 Certificate of Accuracy, is a document used by individuals who need to apply for an Individual Taxpayer Identification Number (ITIN) from the Internal Revenue Service (IRS). This form is essential for non-resident aliens, their spouses, and dependents who are not eligible for a Social Security Number but need to report income or file taxes in the United States. The W7 form helps ensure compliance with U.S. tax laws and facilitates proper identification for tax purposes.

How to Obtain the W7 Form

To obtain the W7 form, individuals can visit the official IRS website, where the form is available for download in PDF format. Alternatively, the form can be requested by contacting the IRS directly. It is important to ensure that you are using the most current version of the W7 form, as outdated forms may not be accepted. The form is also available at various tax preparation offices and community organizations that assist with tax-related issues.

Steps to Complete the W7 Form

Completing the W7 form involves several key steps:

- Provide personal information, including your name, mailing address, and date of birth.

- Indicate your foreign status and reason for needing an ITIN by selecting the appropriate box.

- Attach any required documentation that supports your application, such as proof of identity and foreign status.

- Sign and date the form to certify that the information provided is accurate.

It is crucial to double-check all entries for accuracy to avoid delays in processing.

Legal Use of the W7 Form

The W7 form is legally recognized by the IRS for individuals who require an ITIN. It is important to complete the form accurately and submit it according to IRS guidelines to ensure its legal validity. The form must be used solely for tax purposes and should not be used for any other identification needs. Compliance with IRS regulations is essential to avoid potential penalties or issues with tax filings.

Required Documents

When submitting the W7 form, applicants must include specific documents to verify their identity and foreign status. Required documents typically include:

- A valid passport or other government-issued identification.

- Birth certificates for dependents, if applicable.

- Any documents that support the reason for needing an ITIN, such as tax returns or other IRS forms.

It is important to provide original documents or certified copies, as photocopies may not be accepted.

Filing Deadlines / Important Dates

Filing deadlines for the W7 form align with the tax filing season in the United States. Typically, the form should be submitted along with your tax return by April 15th of each year. However, if you are applying for an ITIN outside of the regular tax season, it is advisable to check the IRS website for any updates on deadlines or changes in procedure. Late submissions may result in penalties or delays in processing.

Quick guide on how to complete w 7 sp en espanol form

Complete W7 Form effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing for proper form retrieval and safe online storage. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage W7 Form on any device using airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

How to modify and eSign W7 Form easily

- Locate W7 Form and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this task.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to confirm your changes.

- Choose your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign W7 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w 7 sp en espanol form

How to generate an eSignature for the W 7 Sp En Espanol Form online

How to generate an eSignature for your W 7 Sp En Espanol Form in Google Chrome

How to generate an electronic signature for putting it on the W 7 Sp En Espanol Form in Gmail

How to create an eSignature for the W 7 Sp En Espanol Form straight from your smart phone

How to create an eSignature for the W 7 Sp En Espanol Form on iOS devices

How to generate an electronic signature for the W 7 Sp En Espanol Form on Android OS

People also ask

-

What is the w7 coa feature in airSlate SignNow?

The w7 coa feature in airSlate SignNow allows users to easily manage and sign documents electronically. It streamlines the signing process, ensuring that all necessary documents are organized and accessible in one place. Businesses can enhance productivity and reduce turnaround time using this powerful tool.

-

How much does the w7 coa feature cost?

The pricing for the w7 coa feature in airSlate SignNow varies based on the subscription plan you choose. Users can opt for monthly or annual pricing, with options that cater to small businesses and large enterprises alike. Check our pricing page for detailed information on costs and available plans.

-

What are the key benefits of using w7 coa in airSlate SignNow?

Using w7 coa in airSlate SignNow provides businesses with several key benefits, including increased efficiency, improved document tracking, and enhanced security. This feature simplifies the eSigning process, allowing teams to collaborate seamlessly. It ensures that your document workflow is optimized for speed and convenience.

-

Is the w7 coa feature secure?

Yes, the w7 coa feature in airSlate SignNow is designed with security in mind. The platform employs advanced encryption methods to protect your documents while in transit and at rest. Compliance with industry standards ensures that your sensitive information remains safe and confidential.

-

Can I integrate other tools with the w7 coa feature?

AirSlate SignNow's w7 coa feature offers the ability to integrate seamlessly with many popular applications, including CRMs and project management tools. This flexibility allows you to connect your existing software with eSigning capabilities, enhancing your overall workflow. Check our integrations page for a full list of compatible tools.

-

How does the w7 coa feature improve the signing process?

The w7 coa feature simplifies and accelerates the signing process by automating document management and notifications. Users can send reminders and track the status of signatures in real-time, ensuring that documents are signed and returned promptly. This efficiency can signNowly reduce delays in business transactions.

-

Is there a free trial available for the w7 coa feature?

Yes, airSlate SignNow offers a free trial that allows you to explore the w7 coa feature without any commitment. During the trial period, you can test its functionalities, including eSigning and document organization, to see how it fits your business needs. Sign up today to experience the benefits firsthand.

Get more for W7 Form

- Forms syracuse housing authority

- Suffolk county dss housing packet form

- Www ssmaps com201703sample assisted living resident agreement senior service form

- Hpd rent increase form fill online printable fillable blank

- New construction contract checklist form

- Apartments rules and regulations bell top apartments form

- Exclusive right to rent agreement 239970831 form

- Holding deposit 250138049 form

Find out other W7 Form

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form