Salary Sacrifice External Private Form

What is the Salary Sacrifice External Private

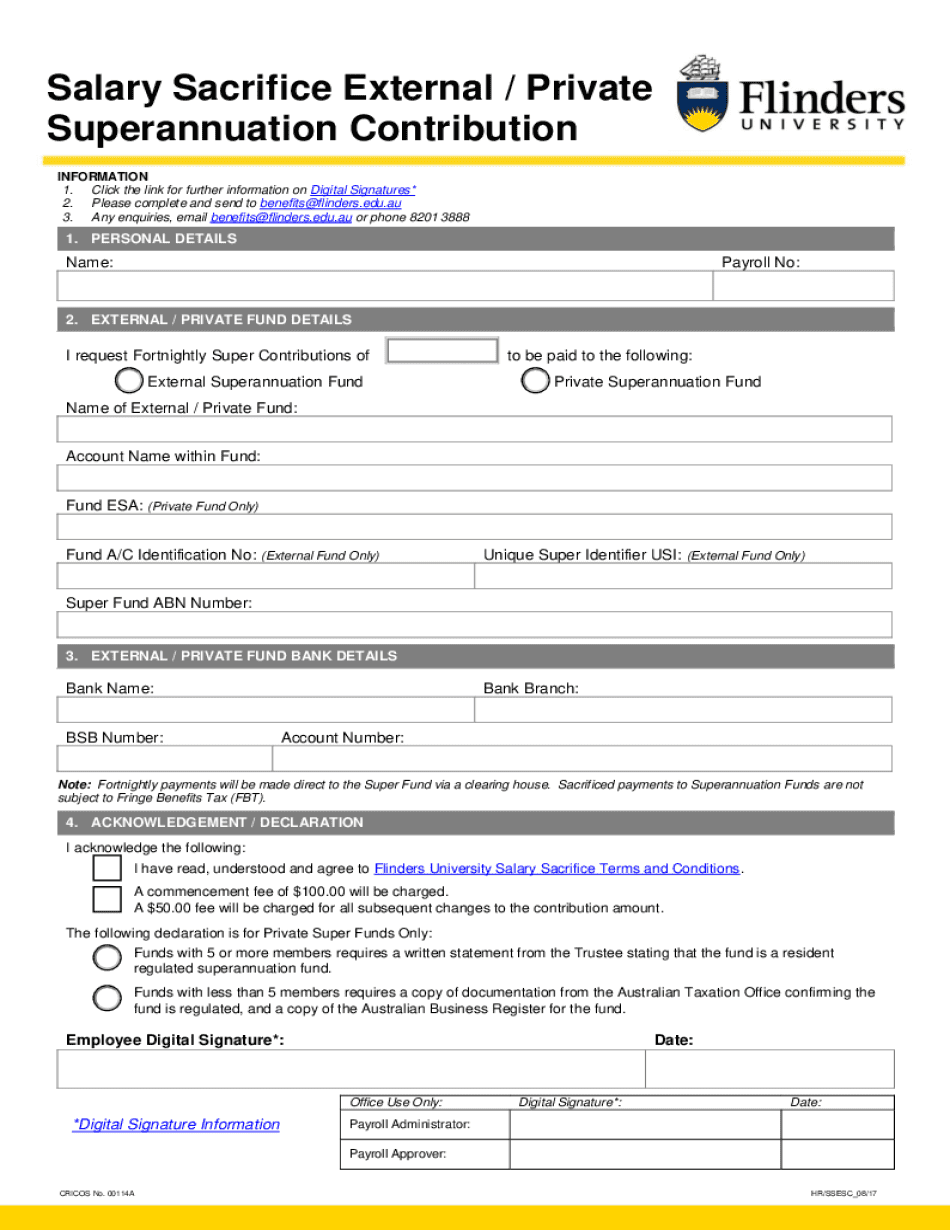

The Salary Sacrifice External Private is a financial arrangement where an employee agrees to forgo a portion of their salary in exchange for non-cash benefits. This approach allows employees to receive benefits such as additional retirement contributions, health insurance, or other perks while potentially reducing their taxable income. The arrangement is typically formalized through a written agreement between the employer and employee, outlining the terms and conditions of the sacrifice.

How to use the Salary Sacrifice External Private

To utilize the Salary Sacrifice External Private, an employee must first discuss the option with their employer. Once an agreement is reached, the employee will need to complete any necessary forms provided by the employer. This may include specifying the amount of salary to be sacrificed and the desired benefits. It is essential for employees to understand how this decision impacts their overall compensation and tax situation.

Steps to complete the Salary Sacrifice External Private

Completing the Salary Sacrifice External Private involves several key steps:

- Consult with your employer to discuss available benefits and the salary sacrifice option.

- Review your current salary and determine the amount you wish to sacrifice.

- Complete the required forms as provided by your employer.

- Submit the forms to your employer for processing.

- Monitor your pay statements to ensure the salary sacrifice is correctly applied.

Legal use of the Salary Sacrifice External Private

The Salary Sacrifice External Private is legal in the United States, provided that the arrangement complies with federal and state employment laws. Employers must ensure that the salary sacrifice does not violate minimum wage laws or other regulations. Additionally, it is crucial for both employers and employees to keep accurate records of the agreements and transactions related to the salary sacrifice.

Key elements of the Salary Sacrifice External Private

Several key elements define the Salary Sacrifice External Private:

- Written Agreement: A formal document outlining the terms of the salary sacrifice.

- Benefit Options: The types of non-cash benefits available to employees.

- Tax Implications: Understanding how the sacrifice affects taxable income.

- Employer Responsibilities: The obligations of the employer in administering the arrangement.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines regarding the tax treatment of salary sacrifice arrangements. Employees should be aware that while the sacrificed amount may reduce taxable income, it may also impact future benefits such as Social Security and retirement contributions. Consulting a tax professional can help clarify the implications of participating in a salary sacrifice program.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the salary sacrifice external private

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Salary Sacrifice External Private?

Salary Sacrifice External Private is a financial arrangement where employees can choose to give up part of their salary in exchange for non-cash benefits, such as private health insurance or additional superannuation contributions. This can lead to tax savings for both employees and employers, making it an attractive option for many businesses.

-

How does Salary Sacrifice External Private work?

In a Salary Sacrifice External Private arrangement, employees agree to reduce their gross salary in exchange for specific benefits. This reduction is pre-tax, which can lower the employee's taxable income and result in tax savings. Employers can also benefit from reduced payroll tax liabilities.

-

What are the benefits of using Salary Sacrifice External Private?

The primary benefits of Salary Sacrifice External Private include tax savings, increased employee satisfaction, and improved retention rates. Employees can access valuable benefits at a lower cost, while employers can enhance their compensation packages without signNowly increasing payroll expenses.

-

Are there any costs associated with Salary Sacrifice External Private?

While Salary Sacrifice External Private itself does not typically incur direct costs, there may be administrative fees associated with setting up and managing the program. It's essential for businesses to evaluate these costs against the potential tax savings and employee benefits to determine overall value.

-

Can Salary Sacrifice External Private be integrated with existing payroll systems?

Yes, Salary Sacrifice External Private can often be integrated with existing payroll systems, making it easier for businesses to manage deductions and benefits. Many payroll software solutions offer features specifically designed to accommodate salary sacrifice arrangements, ensuring seamless processing.

-

Who is eligible for Salary Sacrifice External Private?

Eligibility for Salary Sacrifice External Private typically depends on the employer's policies and the specific benefits offered. Generally, full-time and part-time employees may participate, but it's essential to check with your HR department for specific eligibility criteria and available options.

-

How can businesses implement Salary Sacrifice External Private?

To implement Salary Sacrifice External Private, businesses should first assess their current compensation structure and determine which benefits to offer. Next, they should communicate the program to employees, ensuring they understand the benefits and tax implications. Finally, businesses can work with payroll providers to set up the necessary systems for managing salary sacrifices.

Get more for Salary Sacrifice External Private

- Operating agreement xyz llc regular an indiana limited form

- Krs chapter 202a hospitalization of the mentally ill form

- La 00llc 1 form

- How to form an llc in massachusettsnolo

- How to form an llc in marylandnolo

- Maryland warranty deed of sale personal us legal forms

- Hereinafter referred to as grantor does hereby release convey form

- In the circuit court for name of county county form

Find out other Salary Sacrifice External Private

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online