45010 Additional Payment Receipt NY 2020-2026

What is the 45010 Additional Payment Receipt NY

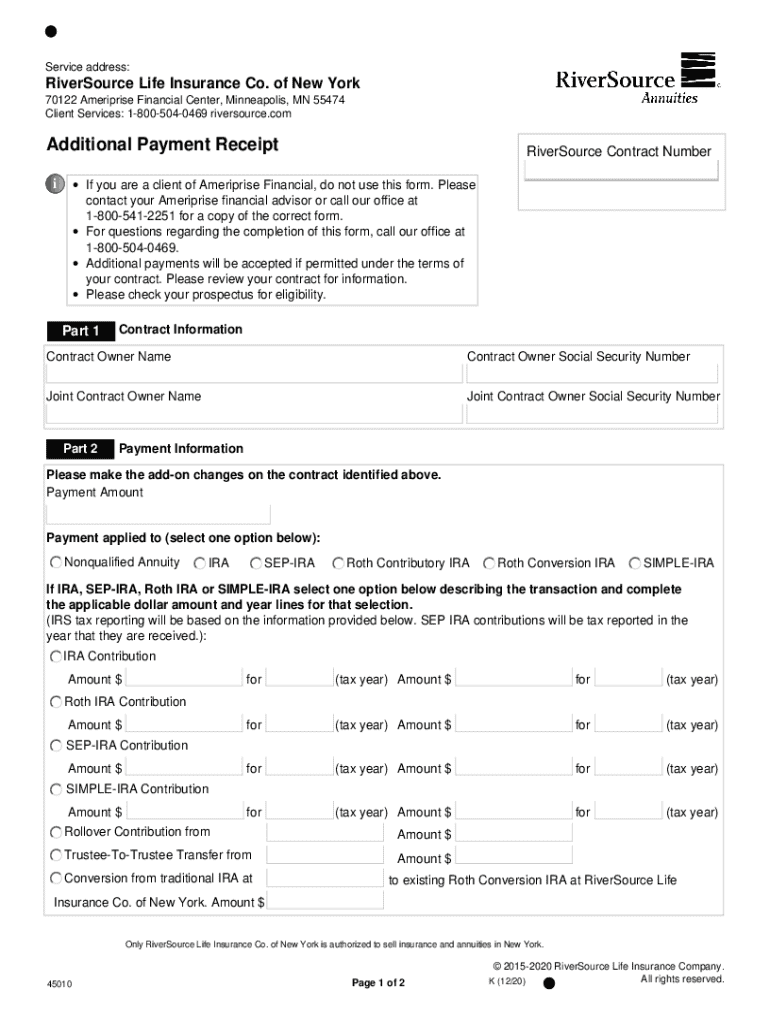

The 45010 Additional Payment Receipt NY is an official document used in New York to acknowledge additional payments made towards various fees, taxes, or other obligations. This receipt serves as proof of payment and is often required for record-keeping purposes, especially for taxpayers who need to verify their payment history with state authorities. Understanding this document is essential for individuals and businesses to ensure compliance with state regulations.

How to use the 45010 Additional Payment Receipt NY

The 45010 Additional Payment Receipt NY is primarily used to confirm that an additional payment has been made. Taxpayers should retain this receipt for their records, as it may be needed for future reference, especially during tax filing or audits. When submitting tax documents, including the receipt can help clarify any discrepancies regarding payments made. It is advisable to keep the receipt in a secure location, as it serves as an important financial record.

Steps to complete the 45010 Additional Payment Receipt NY

Completing the 45010 Additional Payment Receipt NY involves several straightforward steps:

- Gather necessary information, including your taxpayer identification number, payment amount, and the date of payment.

- Fill in the required fields on the form, ensuring accuracy to avoid any issues with processing.

- Double-check all entries for correctness, particularly the payment amount and identification details.

- Sign and date the receipt to validate it.

- Keep a copy for your records and submit the original as required by the relevant authority.

Legal use of the 45010 Additional Payment Receipt NY

The 45010 Additional Payment Receipt NY holds legal significance as it serves as a formal acknowledgment of payment. This document can be used in legal proceedings to demonstrate compliance with state payment obligations. It is essential for taxpayers to understand that retaining this receipt is crucial, as it can be requested by tax authorities during audits or disputes regarding payment history.

Key elements of the 45010 Additional Payment Receipt NY

Several key elements are included in the 45010 Additional Payment Receipt NY that ensure its validity:

- Taxpayer Identification Number: This unique identifier is crucial for tracking payments.

- Payment Amount: Clearly stating the amount paid is essential for record-keeping.

- Date of Payment: This indicates when the payment was made, which is important for tax purposes.

- Signature: A signature validates the receipt and confirms the authenticity of the payment.

Filing Deadlines / Important Dates

It is important to be aware of specific filing deadlines associated with the 45010 Additional Payment Receipt NY. Taxpayers should note that additional payments may have different due dates depending on the type of tax or fee being addressed. Keeping track of these dates ensures that payments are made on time, avoiding penalties or interest charges. Regularly checking state resources for updates on deadlines can help maintain compliance.

Create this form in 5 minutes or less

Find and fill out the correct 45010 additional payment receipt ny

Create this form in 5 minutes!

How to create an eSignature for the 45010 additional payment receipt ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 45010 Additional Payment Receipt NY?

The 45010 Additional Payment Receipt NY is a document used to confirm additional payments made in New York. It serves as an official record for both businesses and customers, ensuring transparency in financial transactions.

-

How can airSlate SignNow help with the 45010 Additional Payment Receipt NY?

airSlate SignNow simplifies the process of creating and signing the 45010 Additional Payment Receipt NY. With our platform, you can easily generate, send, and eSign this document, making it a hassle-free experience for your business.

-

Is there a cost associated with using airSlate SignNow for the 45010 Additional Payment Receipt NY?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions ensure that you can manage the 45010 Additional Payment Receipt NY efficiently without breaking the bank.

-

What features does airSlate SignNow offer for the 45010 Additional Payment Receipt NY?

airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time tracking for the 45010 Additional Payment Receipt NY. These features enhance the efficiency and security of your document management process.

-

Can I integrate airSlate SignNow with other software for managing the 45010 Additional Payment Receipt NY?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to manage the 45010 Additional Payment Receipt NY alongside your existing tools. This integration helps streamline your workflow and improve productivity.

-

What are the benefits of using airSlate SignNow for the 45010 Additional Payment Receipt NY?

Using airSlate SignNow for the 45010 Additional Payment Receipt NY provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled professionally and securely.

-

Is airSlate SignNow compliant with legal standards for the 45010 Additional Payment Receipt NY?

Yes, airSlate SignNow is compliant with legal standards for electronic signatures and document management. This compliance ensures that your 45010 Additional Payment Receipt NY is legally binding and recognized in New York.

Get more for 45010 Additional Payment Receipt NY

- Writ of control form

- Metrobank car loan application form

- Optometry council of tanzania form

- Communication matrix for parents sample page profile pdf 112kb form

- Fraction vocabulary pdf form

- Ns i forgotten security details form

- Calamity loan hqp slf 002 application form pagibigfund gov

- Car accident settlement agreement template form

Find out other 45010 Additional Payment Receipt NY

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe