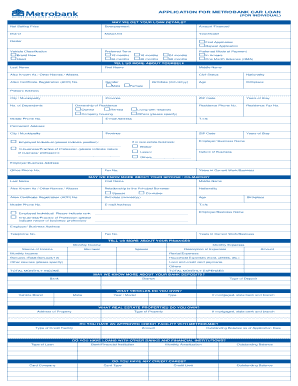

Metrobank Car Loan Application Form 2016

What is the Metrobank Car Loan Application Form

The Metrobank Car Loan Application Form is a crucial document used by individuals seeking to finance the purchase of a vehicle through Metrobank. This form collects essential information about the applicant, including personal details, financial status, and vehicle information. It serves as the foundation for the loan approval process, allowing the bank to assess the applicant's eligibility and determine the loan amount and terms.

Required Documents

To successfully complete the Metrobank car loan application, applicants must prepare several documents. These typically include:

- Proof of identity, such as a government-issued ID.

- Proof of income, including recent pay stubs or tax returns.

- Credit history report to assess creditworthiness.

- Details of the vehicle, including the make, model, and purchase price.

- Proof of residence, like a utility bill or lease agreement.

Having these documents ready can streamline the application process and improve the chances of approval.

Steps to Complete the Metrobank Car Loan Application Form

Completing the Metrobank car loan application form involves several key steps:

- Gather all required documents to support your application.

- Fill out the application form accurately, providing all requested information.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with the required documents to Metrobank, either online or in person.

Following these steps can help ensure a smooth application process.

How to Obtain the Metrobank Car Loan Application Form

The Metrobank car loan application form can be obtained through various channels. Applicants can visit the official Metrobank website to download the form in PDF format. Alternatively, forms are available at any Metrobank branch, where staff can assist with the application process. It is advisable to ensure that you have the most current version of the form to avoid any issues during submission.

Application Process & Approval Time

The application process for a Metrobank car loan typically begins once the application form and supporting documents are submitted. After submission, the bank will review the application, which may involve checking the applicant's credit history and financial status. The approval time can vary, but applicants can generally expect a response within a few business days. Timely communication from the bank will keep applicants informed about the status of their loan application.

Legal Use of the Metrobank Car Loan Application Form

The Metrobank car loan application form is legally binding once submitted. It is important that applicants provide accurate information, as any discrepancies can lead to complications or denial of the loan. Additionally, the electronic submission of the form must comply with relevant eSignature regulations to ensure its validity. Using a secure platform for signing and submitting the form can enhance legal compliance and protect personal information.

Quick guide on how to complete metrobank car loan application form

Complete Metrobank Car Loan Application Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents quickly and without interruptions. Handle Metrobank Car Loan Application Form on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign Metrobank Car Loan Application Form with ease

- Locate Metrobank Car Loan Application Form and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from your device of choice. Edit and eSign Metrobank Car Loan Application Form and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct metrobank car loan application form

Create this form in 5 minutes!

How to create an eSignature for the metrobank car loan application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the basic metrobank car loan requirements?

The basic Metrobank car loan requirements include a valid government ID, proof of income, and a completed loan application form. Additionally, applicants must provide details about the vehicle they intend to purchase. Meeting these requirements will help streamline your application process.

-

Are there specific income requirements for Metrobank car loans?

Yes, Metrobank requires applicants to have a stable income to qualify for their car loan. Generally, a minimum gross monthly income is stipulated, but this amount can vary depending on the vehicle's price and loan amount. It's essential to check the latest metrobank car loan requirements for updated figures.

-

What documents do I need to submit for my Metrobank car loan application?

To successfully apply for a Metrobank car loan, you will need to submit several documents, including a government-issued ID, proof of income such as salary certificates or payslips, and any other documents that support your financial stability. Ensure you have all necessary documentation ready to avoid delays.

-

How long does the approval process take for Metrobank car loans?

Typically, the approval process for Metrobank car loans takes around three to five business days after submitting all required documents. The speed of the approval can depend on the completeness of your application and the specific metrobank car loan requirements at the time.

-

Are there flexible payment options with Metrobank car loans?

Metrobank offers various flexible payment options for their car loans. Customers can choose between short-term and long-term payment plans tailored to their financial situations. This flexibility makes it easier for borrowers to meet their obligations under the metrobank car loan requirements.

-

What are the benefits of choosing a Metrobank car loan?

Choosing a Metrobank car loan comes with several benefits, including competitive interest rates, customizable loan amounts, and tailored repayment terms. These features are designed to accommodate the unique financial situations of borrowers, making meeting metrobank car loan requirements more achievable.

-

Is insurance required for a Metrobank car loan?

Yes, insurance is generally required when applying for a Metrobank car loan to protect the vehicle and the lender's investment. Applicants must provide proof of insurance before loan disbursement to comply with the metrobank car loan requirements.

Get more for Metrobank Car Loan Application Form

Find out other Metrobank Car Loan Application Form

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form