ARTICLES of INCORPORATION for DOMESTIC NONPROFIT 2017-2026

Understanding the Articles of Incorporation for Domestic Nonprofit

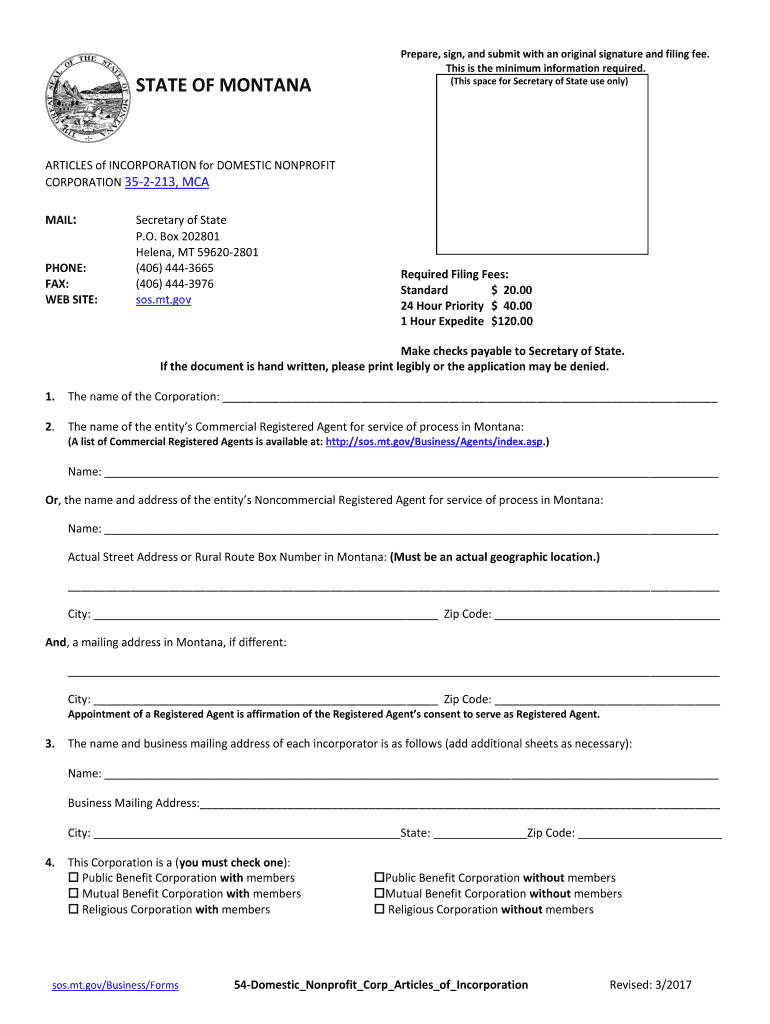

The Articles of Incorporation for Domestic Nonprofit is a legal document that establishes a nonprofit organization in the United States. This document outlines the organization's purpose, structure, and governance. It is essential for obtaining tax-exempt status and allows the organization to operate legally within its state. The Articles typically include the name of the nonprofit, its mission statement, the names and addresses of the initial directors, and the registered agent's information. Filing this document is a crucial first step in the formation of a nonprofit entity.

Key Elements of the Articles of Incorporation for Domestic Nonprofit

When preparing the Articles of Incorporation, several key elements must be included:

- Name of the Organization: The chosen name must be unique and comply with state naming requirements.

- Purpose Statement: A clear description of the nonprofit's mission and activities.

- Registered Agent: The individual or entity designated to receive legal documents on behalf of the organization.

- Directors: Names and addresses of the initial board members responsible for governance.

- Membership Structure: Information on whether the organization will have members and how they will be governed.

Steps to Complete the Articles of Incorporation for Domestic Nonprofit

Completing the Articles of Incorporation involves several important steps:

- Choose a Name: Ensure the name is available and complies with state regulations.

- Draft the Document: Include all required elements, such as the purpose statement and board member details.

- Review State Requirements: Check specific state guidelines for any additional requirements or forms.

- File the Document: Submit the Articles to the appropriate state agency, typically the Secretary of State.

- Pay Filing Fees: Include any necessary fees required by the state for processing.

Legal Use of the Articles of Incorporation for Domestic Nonprofit

The Articles of Incorporation serve as the foundational legal document for a nonprofit organization. They establish the entity's existence and provide legal protection to its directors and officers by limiting personal liability. Additionally, having properly filed Articles is often a prerequisite for obtaining tax-exempt status from the IRS. Nonprofits must adhere to the stipulations outlined in their Articles to maintain compliance and good standing with state regulations.

Filing Deadlines and Important Dates

Filing deadlines for the Articles of Incorporation can vary by state. It is important to check with the state’s Secretary of State office for specific timelines. Generally, organizations should aim to file as soon as possible to avoid delays in starting operations. Some states may offer expedited processing for an additional fee, which can be beneficial for organizations needing to begin activities quickly.

Obtaining the Articles of Incorporation for Domestic Nonprofit

To obtain the Articles of Incorporation, organizations can typically download the form from their state’s Secretary of State website. Many states provide templates that guide users in filling out the necessary information. It is advisable to review state-specific instructions carefully to ensure all required information is included. After completing the form, it must be submitted to the appropriate state agency along with any applicable fees.

Create this form in 5 minutes or less

Find and fill out the correct articles of incorporation for domestic nonprofit

Create this form in 5 minutes!

How to create an eSignature for the articles of incorporation for domestic nonprofit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are ARTICLES Of INCORPORATION For DOMESTIC NONPROFIT?

ARTICLES Of INCORPORATION For DOMESTIC NONPROFIT are legal documents that establish a nonprofit organization in the United States. They outline the organization's purpose, structure, and governance. Filing these articles is essential for gaining tax-exempt status and ensuring compliance with state regulations.

-

How can airSlate SignNow help with ARTICLES Of INCORPORATION For DOMESTIC NONPROFIT?

airSlate SignNow simplifies the process of creating and signing ARTICLES Of INCORPORATION For DOMESTIC NONPROFIT. Our platform allows you to easily draft, edit, and eSign these documents, ensuring that you meet all legal requirements efficiently. This saves time and reduces the hassle of paperwork.

-

What features does airSlate SignNow offer for managing ARTICLES Of INCORPORATION For DOMESTIC NONPROFIT?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking for ARTICLES Of INCORPORATION For DOMESTIC NONPROFIT. These tools help streamline the incorporation process, making it easier to manage and store important documents securely.

-

Is there a cost associated with using airSlate SignNow for ARTICLES Of INCORPORATION For DOMESTIC NONPROFIT?

Yes, airSlate SignNow offers various pricing plans to suit different needs when handling ARTICLES Of INCORPORATION For DOMESTIC NONPROFIT. Our plans are designed to be cost-effective, providing excellent value for the features and support offered. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other tools for ARTICLES Of INCORPORATION For DOMESTIC NONPROFIT?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your workflow for ARTICLES Of INCORPORATION For DOMESTIC NONPROFIT. Whether you use CRM systems, cloud storage, or project management tools, our integrations help streamline your document management process.

-

What are the benefits of using airSlate SignNow for ARTICLES Of INCORPORATION For DOMESTIC NONPROFIT?

Using airSlate SignNow for ARTICLES Of INCORPORATION For DOMESTIC NONPROFIT offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, allowing you to focus on your nonprofit's mission without administrative burdens.

-

How secure is airSlate SignNow when handling ARTICLES Of INCORPORATION For DOMESTIC NONPROFIT?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your ARTICLES Of INCORPORATION For DOMESTIC NONPROFIT and other sensitive documents. You can trust that your information is safe and compliant with industry standards.

Get more for ARTICLES Of INCORPORATION For DOMESTIC NONPROFIT

- United states v imotexas lawyer form

- Chapter 1 preliminary instructions before opening statements form

- Employment family and medical united states courts form

- Abs services incorporated et al v new york mari no 12 form

- Aging accounts payable form

- Agency airfare employees travel uncw form

- Principles of audit chapter 23 flashcardsquizlet form

- Fillable online draft indonesia rcm questionnaire farmer form

Find out other ARTICLES Of INCORPORATION For DOMESTIC NONPROFIT

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors