Tax Calculation Summary 2025-2026

What is the Tax Calculation Summary

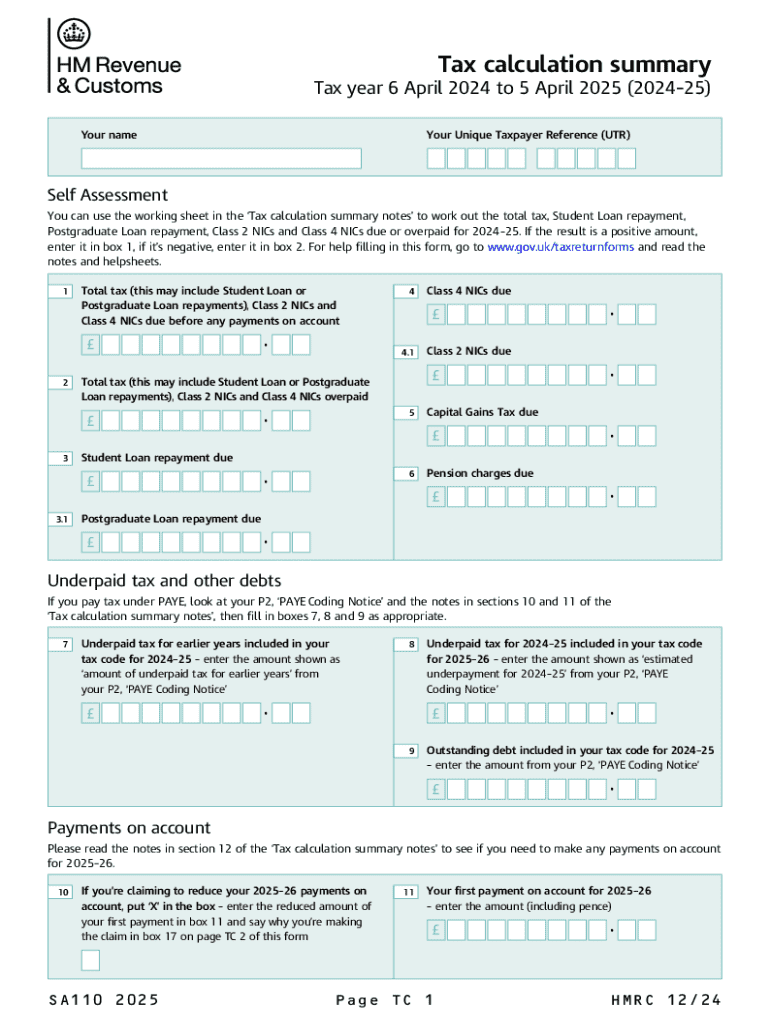

The Tax Calculation Summary is an essential document that provides a detailed overview of an individual's or business's tax obligations for a specific tax year. It consolidates various income sources, deductions, credits, and other relevant tax information into a single summary. This form is crucial for taxpayers as it helps them understand their overall tax liability and ensures compliance with federal and state tax regulations. The summary typically includes details such as total income, taxable income, calculated tax, and any payments made throughout the year.

How to use the Tax Calculation Summary

Using the Tax Calculation Summary involves several steps to ensure accurate reporting of tax information. Taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and receipts for deductible expenses. Once the relevant data is collected, individuals can fill out the summary by entering their total income, applicable deductions, and any tax credits they qualify for. After completing the form, it is advisable to review all entries for accuracy before submission to avoid potential penalties or delays in processing.

Steps to complete the Tax Calculation Summary

Completing the Tax Calculation Summary requires careful attention to detail. Here are the steps to follow:

- Gather all income documents, such as W-2 and 1099 forms.

- Compile a list of deductible expenses, including mortgage interest and charitable contributions.

- Calculate total income by adding all sources of income.

- Determine taxable income by subtracting deductions from total income.

- Apply any tax credits to reduce the overall tax liability.

- Review the summary for accuracy and completeness.

Key elements of the Tax Calculation Summary

The Tax Calculation Summary includes several key elements that are vital for accurate tax reporting. Important components typically consist of:

- Total Income: The sum of all income sources.

- Taxable Income: The income amount subject to tax after deductions.

- Calculated Tax: The total tax owed based on taxable income.

- Payments Made: Any tax payments made throughout the year.

- Refund or Balance Due: The final amount owed or the refund expected.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for completing the Tax Calculation Summary. Taxpayers should refer to the IRS publications relevant to their tax situation, which outline acceptable deductions, credits, and filing requirements. It's important to stay updated on any changes in tax law that may affect how the summary is filled out. Adhering to IRS guidelines helps ensure compliance and minimizes the risk of audits or penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Calculation Summary are crucial for taxpayers to meet. Typically, the deadline for submitting individual tax returns is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any state-specific deadlines that may differ from federal requirements. Timely filing is essential to avoid late fees and interest on unpaid taxes.

Create this form in 5 minutes or less

Find and fill out the correct tax calculation summary

Create this form in 5 minutes!

How to create an eSignature for the tax calculation summary

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Tax Calculation Summary?

A Tax Calculation Summary is a detailed report that outlines the tax obligations for a specific period. It helps businesses understand their tax liabilities and ensures compliance with tax regulations. Using airSlate SignNow, you can easily generate and manage your Tax Calculation Summary for efficient record-keeping.

-

How does airSlate SignNow assist with Tax Calculation Summaries?

airSlate SignNow streamlines the process of creating and signing Tax Calculation Summaries. Our platform allows you to prepare documents quickly and securely, ensuring that all necessary tax information is accurately captured. This simplifies your workflow and enhances your overall tax management.

-

Is there a cost associated with generating a Tax Calculation Summary using airSlate SignNow?

Yes, there are pricing plans available for using airSlate SignNow, which include features for generating Tax Calculation Summaries. Our plans are designed to be cost-effective, providing great value for businesses of all sizes. You can choose a plan that best fits your needs and budget.

-

Can I integrate airSlate SignNow with my accounting software for Tax Calculation Summaries?

Absolutely! airSlate SignNow offers integrations with various accounting software, allowing you to seamlessly manage your Tax Calculation Summaries. This integration ensures that your tax data is synchronized, reducing errors and saving you time during tax season.

-

What are the benefits of using airSlate SignNow for Tax Calculation Summaries?

Using airSlate SignNow for your Tax Calculation Summaries provides numerous benefits, including enhanced accuracy, time savings, and improved compliance. Our platform simplifies document management, making it easier to track and sign tax-related documents. This ultimately helps you focus on your core business activities.

-

How secure is my data when using airSlate SignNow for Tax Calculation Summaries?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your data, including Tax Calculation Summaries. You can trust that your sensitive information is safe and secure while using our platform.

-

Can I customize my Tax Calculation Summary templates in airSlate SignNow?

Yes, airSlate SignNow allows you to customize your Tax Calculation Summary templates to fit your specific needs. You can add your branding, adjust the layout, and include any necessary fields to ensure that your summaries meet your requirements. This flexibility enhances your document management process.

Get more for Tax Calculation Summary

Find out other Tax Calculation Summary

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe