TANGIBLE PERSONAL PROPERTY REPORT Supplemental She Form

What is the TANGIBLE PERSONAL PROPERTY REPORT Supplemental She

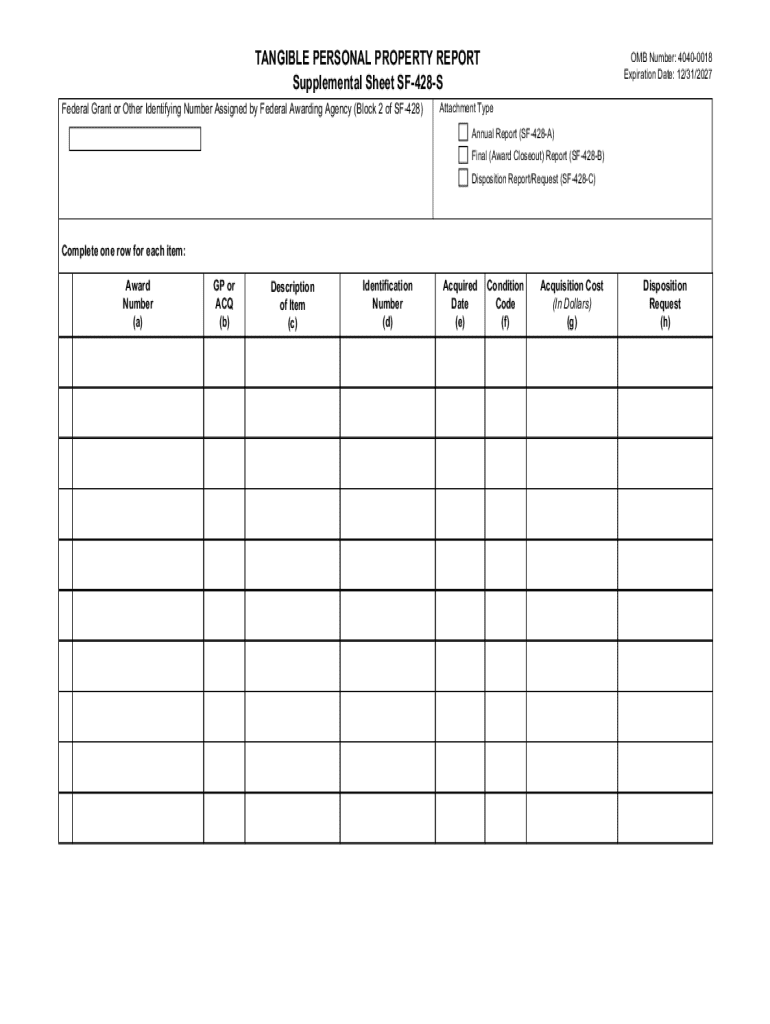

The TANGIBLE PERSONAL PROPERTY REPORT Supplemental Schedule is a form used primarily in the United States for reporting personal property owned by individuals or businesses. This report is crucial for tax assessment purposes, allowing local authorities to determine the value of tangible assets such as machinery, equipment, and other personal property. Proper completion of this form ensures compliance with local tax laws and helps avoid potential penalties associated with inaccurate reporting.

How to use the TANGIBLE PERSONAL PROPERTY REPORT Supplemental She

Using the TANGIBLE PERSONAL PROPERTY REPORT Supplemental Schedule involves several steps. First, gather all necessary documentation related to your tangible personal property, including purchase receipts and previous tax assessments. Next, accurately list all items on the form, providing detailed descriptions and values. It is important to follow the specific instructions provided with the form to ensure that all required information is included. Finally, submit the completed form to the appropriate local tax authority by the specified deadline.

Steps to complete the TANGIBLE PERSONAL PROPERTY REPORT Supplemental She

Completing the TANGIBLE PERSONAL PROPERTY REPORT Supplemental Schedule requires careful attention to detail. Begin by identifying all tangible personal property owned as of the assessment date. For each item, provide a clear description, including the type, model, and year of manufacture. Next, assign a fair market value to each item, which may involve researching similar items or consulting with a professional appraiser. After filling out the form, review it for accuracy before submitting it to ensure compliance with local regulations.

Legal use of the TANGIBLE PERSONAL PROPERTY REPORT Supplemental She

The legal use of the TANGIBLE PERSONAL PROPERTY REPORT Supplemental Schedule is essential for maintaining transparency in property ownership and taxation. This form serves as an official record submitted to local tax authorities, helping to establish the value of personal property for tax assessment. Failing to accurately report this information can result in penalties, fines, or additional tax liabilities. It is important to understand the legal implications of the information provided on this form to avoid potential issues with tax compliance.

Required Documents

To complete the TANGIBLE PERSONAL PROPERTY REPORT Supplemental Schedule, several documents may be required. These typically include:

- Purchase receipts for all tangible personal property

- Previous tax assessments related to the property

- Appraisals or valuations from certified professionals, if applicable

- Any relevant legal documents that may affect property ownership

Having these documents on hand will facilitate the accurate completion of the form and support the values reported.

Filing Deadlines / Important Dates

Filing deadlines for the TANGIBLE PERSONAL PROPERTY REPORT Supplemental Schedule vary by state and local jurisdiction. Typically, these forms must be submitted annually, with deadlines often falling on specific dates, such as April 15 or May 1. It is crucial to check with your local tax authority for the exact deadlines to ensure timely submission and avoid penalties for late filing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tangible personal property report supplemental she

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TANGIBLE PERSONAL PROPERTY REPORT Supplemental She?

The TANGIBLE PERSONAL PROPERTY REPORT Supplemental She is a comprehensive document designed to help businesses accurately report their tangible personal property. This report ensures compliance with local regulations and provides a clear overview of assets, making it essential for effective asset management.

-

How can the TANGIBLE PERSONAL PROPERTY REPORT Supplemental She benefit my business?

Utilizing the TANGIBLE PERSONAL PROPERTY REPORT Supplemental She can streamline your reporting process, saving time and reducing errors. It enhances transparency in asset management and helps in making informed financial decisions, ultimately benefiting your business's bottom line.

-

What features are included in the TANGIBLE PERSONAL PROPERTY REPORT Supplemental She?

The TANGIBLE PERSONAL PROPERTY REPORT Supplemental She includes detailed asset listings, valuation methods, and compliance checklists. These features ensure that your report is thorough and meets all necessary legal requirements, providing peace of mind for your business.

-

Is the TANGIBLE PERSONAL PROPERTY REPORT Supplemental She easy to use?

Yes, the TANGIBLE PERSONAL PROPERTY REPORT Supplemental She is designed with user-friendliness in mind. Its intuitive layout allows users to easily input data and generate reports without extensive training, making it accessible for all team members.

-

What is the pricing structure for the TANGIBLE PERSONAL PROPERTY REPORT Supplemental She?

The pricing for the TANGIBLE PERSONAL PROPERTY REPORT Supplemental She is competitive and designed to fit various business budgets. We offer flexible plans that cater to different needs, ensuring that you receive the best value for your investment.

-

Can the TANGIBLE PERSONAL PROPERTY REPORT Supplemental She integrate with other software?

Absolutely! The TANGIBLE PERSONAL PROPERTY REPORT Supplemental She can seamlessly integrate with various accounting and asset management software. This integration enhances data accuracy and streamlines your overall reporting process.

-

How does the TANGIBLE PERSONAL PROPERTY REPORT Supplemental She ensure compliance?

The TANGIBLE PERSONAL PROPERTY REPORT Supplemental She is designed to adhere to local and federal regulations. By following the guidelines provided in the report, businesses can ensure compliance and avoid potential penalties associated with inaccurate reporting.

Get more for TANGIBLE PERSONAL PROPERTY REPORT Supplemental She

- Bill of sale for automobile or vehicle including odometer statement and promissory note utah form

- Promissory note in connection with sale of vehicle or automobile utah form

- Bill of sale for watercraft or boat utah form

- Bill of sale of automobile and odometer statement for as is sale utah form

- Construction contract cost plus or fixed fee utah form

- Painting contract for contractor utah form

- Trim carpenter contract for contractor utah form

- Fencing contract for contractor utah form

Find out other TANGIBLE PERSONAL PROPERTY REPORT Supplemental She

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free