Affidavit for Initial Taxable Period Form

What is the Affidavit For Initial Taxable Period

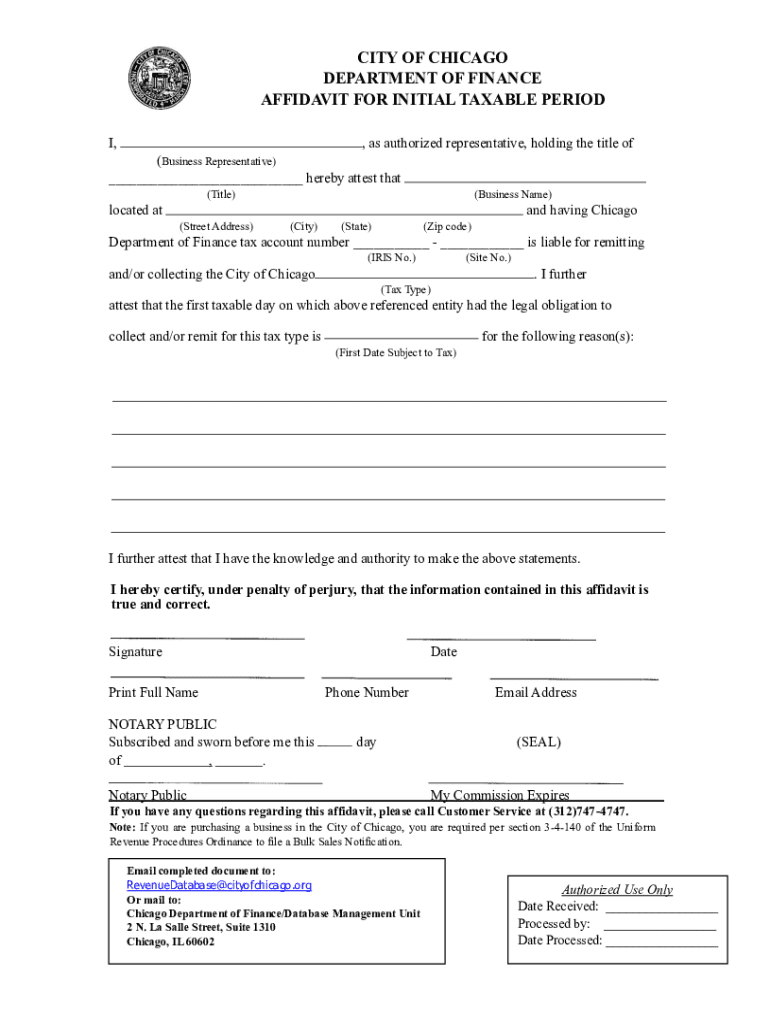

The Affidavit For Initial Taxable Period is a legal document used primarily for tax purposes. It serves as a sworn statement that provides essential information about a taxpayer's initial taxable period. This affidavit is crucial for establishing the start date of tax obligations for individuals or businesses. It may be required by state or federal tax authorities to verify the commencement of taxable activities, ensuring compliance with tax regulations.

How to use the Affidavit For Initial Taxable Period

This affidavit is typically used when a taxpayer is initiating their tax responsibilities for the first time. It can be beneficial for various entities, including sole proprietors, partnerships, and corporations. By submitting this affidavit, taxpayers can clarify their tax status and avoid potential penalties. It is important to follow the specific instructions provided by the relevant tax authority to ensure proper use of the document.

Steps to complete the Affidavit For Initial Taxable Period

Completing the Affidavit For Initial Taxable Period involves several key steps:

- Gather necessary information, including your name, address, and tax identification number.

- Identify the start date of your taxable period.

- Fill out the affidavit form accurately, ensuring all information is correct.

- Sign the affidavit in the presence of a notary public, if required.

- Submit the completed affidavit to the appropriate tax authority.

Key elements of the Affidavit For Initial Taxable Period

The key elements of the Affidavit For Initial Taxable Period include:

- Taxpayer Information: Full name, address, and tax identification number.

- Start Date: The date when the taxpayer's taxable activities began.

- Affirmation Statement: A declaration affirming the truthfulness of the information provided.

- Signature: The taxpayer's signature, often requiring notarization.

Legal use of the Affidavit For Initial Taxable Period

The legal use of the Affidavit For Initial Taxable Period is to provide a formal record of a taxpayer's initial taxable period. This document can be used in legal proceedings or audits to demonstrate compliance with tax laws. It is essential for taxpayers to understand that providing false information on this affidavit can lead to legal repercussions, including fines or penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Affidavit For Initial Taxable Period can vary depending on the state and the type of taxpayer. Generally, it should be submitted as soon as the taxpayer begins taxable activities. It is advisable to check with the local tax authority for specific deadlines to avoid late filing penalties. Keeping track of important dates ensures compliance and helps maintain good standing with tax obligations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the affidavit for initial taxable period

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Affidavit For Initial Taxable Period?

An Affidavit For Initial Taxable Period is a legal document that establishes the beginning of a taxpayer's obligation to file taxes. It is essential for businesses to accurately report their income and expenses from the start of their operations. Using airSlate SignNow, you can easily create and eSign this affidavit to ensure compliance with tax regulations.

-

How can airSlate SignNow help with the Affidavit For Initial Taxable Period?

airSlate SignNow provides a user-friendly platform to create, send, and eSign your Affidavit For Initial Taxable Period. Our solution streamlines the document management process, allowing you to focus on your business while ensuring that all necessary legal documents are properly executed and stored.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Whether you need basic features or advanced functionalities for managing your Affidavit For Initial Taxable Period, we have a plan that fits your budget. Visit our pricing page to find the best option for your needs.

-

Is airSlate SignNow secure for handling sensitive documents like the Affidavit For Initial Taxable Period?

Yes, airSlate SignNow prioritizes the security of your documents. We use advanced encryption and security protocols to protect your Affidavit For Initial Taxable Period and other sensitive information. You can trust that your data is safe with us.

-

Can I integrate airSlate SignNow with other software for managing my Affidavit For Initial Taxable Period?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow. You can easily connect our platform with your existing tools to manage your Affidavit For Initial Taxable Period and other documents efficiently.

-

What features does airSlate SignNow offer for creating an Affidavit For Initial Taxable Period?

airSlate SignNow includes a range of features designed to simplify the creation of your Affidavit For Initial Taxable Period. You can customize templates, add fields for signatures, and track document status in real-time, ensuring a smooth signing process.

-

How quickly can I get my Affidavit For Initial Taxable Period signed using airSlate SignNow?

With airSlate SignNow, you can get your Affidavit For Initial Taxable Period signed in minutes. Our platform allows you to send documents for eSignature instantly, reducing turnaround time and helping you meet important deadlines.

Get more for Affidavit For Initial Taxable Period

Find out other Affidavit For Initial Taxable Period

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template