T183 2020

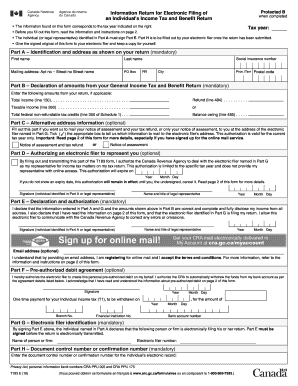

What is the T183

The T183 form, officially known as the "Tax Information Authorization," is a document used in the United States to authorize a representative to receive confidential tax information from the Internal Revenue Service (IRS) on behalf of a taxpayer. This form is essential for individuals who wish to allow someone else, such as a tax professional, to handle their tax matters. The T183 ensures that the representative has the legal authority to act on behalf of the taxpayer, facilitating communication between the taxpayer and the IRS.

How to use the T183

To use the T183 form effectively, a taxpayer must first complete the form by providing their personal information, including their name, address, and taxpayer identification number. The taxpayer must also specify the name and contact information of the representative they are authorizing. Once completed, the T183 must be signed and dated by the taxpayer. It is important to ensure that the form is submitted to the IRS along with any relevant tax returns or documents that require the representative's involvement.

Steps to complete the T183

Completing the T183 form involves several straightforward steps:

- Obtain the T183 form from the IRS website or a tax professional.

- Enter the taxpayer's personal details, including name, address, and taxpayer identification number.

- Provide the representative's information, ensuring accuracy in their name and contact details.

- Sign and date the form, confirming the authorization.

- Submit the completed T183 to the IRS along with any related tax documents.

Legal use of the T183

The T183 form is legally binding once signed by the taxpayer. It grants the authorized representative the right to access the taxpayer's confidential information and communicate with the IRS regarding tax matters. Proper use of the T183 ensures compliance with IRS regulations and protects the taxpayer's rights. It is crucial for both the taxpayer and the representative to understand the scope of the authorization, as it does not grant the representative the authority to sign tax returns on behalf of the taxpayer unless explicitly stated.

Filing Deadlines / Important Dates

Filing deadlines for the T183 form can vary depending on the specific tax situation. Generally, the T183 should be submitted alongside the taxpayer's tax return by the due date of that return. For individual taxpayers, this is typically April 15. If an extension has been filed, the T183 must be submitted by the extended deadline. It is essential to keep track of these dates to ensure that the authorization remains valid and that the representative can act on behalf of the taxpayer without delays.

Required Documents

When completing the T183 form, certain documents may be required to support the authorization process. These may include:

- A copy of the taxpayer's identification, such as a driver's license or Social Security card.

- Any previous correspondence with the IRS that may be relevant to the authorization.

- Additional forms or documents related to the specific tax return being filed.

Having these documents ready can streamline the process and ensure compliance with IRS requirements.

Examples of using the T183

There are various scenarios in which the T183 form may be utilized. For instance:

- A self-employed individual may authorize their accountant to handle tax filings and communications with the IRS.

- A retired taxpayer might need to allow their financial advisor to access tax information for planning purposes.

- Students who receive financial aid may require their parents to manage tax-related matters on their behalf.

These examples illustrate the versatility of the T183 form in facilitating tax-related communications and ensuring that representatives can act effectively for their clients.

Create this form in 5 minutes or less

Find and fill out the correct t183

Create this form in 5 minutes!

How to create an eSignature for the t183

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is T183 in the context of airSlate SignNow?

T183 refers to a specific document type that can be managed and signed using airSlate SignNow. This feature allows users to streamline their document workflows, ensuring that T183 forms are completed efficiently and securely.

-

How does airSlate SignNow handle T183 document signing?

With airSlate SignNow, signing T183 documents is straightforward. Users can easily upload their T183 forms, add signature fields, and send them for eSignature, making the process quick and hassle-free.

-

What are the pricing options for using airSlate SignNow for T183 documents?

airSlate SignNow offers various pricing plans that cater to different business needs, including those specifically for managing T183 documents. Each plan provides access to essential features, ensuring that you can efficiently handle your T183 signing requirements.

-

Can I integrate airSlate SignNow with other tools for T183 document management?

Yes, airSlate SignNow supports integrations with various applications, enhancing your ability to manage T183 documents. This allows for seamless workflows, enabling you to connect with tools you already use for better efficiency.

-

What are the benefits of using airSlate SignNow for T183 forms?

Using airSlate SignNow for T183 forms offers numerous benefits, including improved efficiency, reduced turnaround times, and enhanced security. The platform's user-friendly interface makes it easy for anyone to manage T183 documents without extensive training.

-

Is airSlate SignNow compliant with regulations for T183 document signing?

Absolutely! airSlate SignNow complies with industry regulations, ensuring that your T183 document signing is legally binding and secure. This compliance gives users peace of mind when managing sensitive information.

-

How can I track the status of my T183 documents in airSlate SignNow?

airSlate SignNow provides robust tracking features that allow you to monitor the status of your T183 documents in real-time. You can see when documents are sent, viewed, and signed, ensuring you stay informed throughout the process.

Get more for T183

Find out other T183

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form