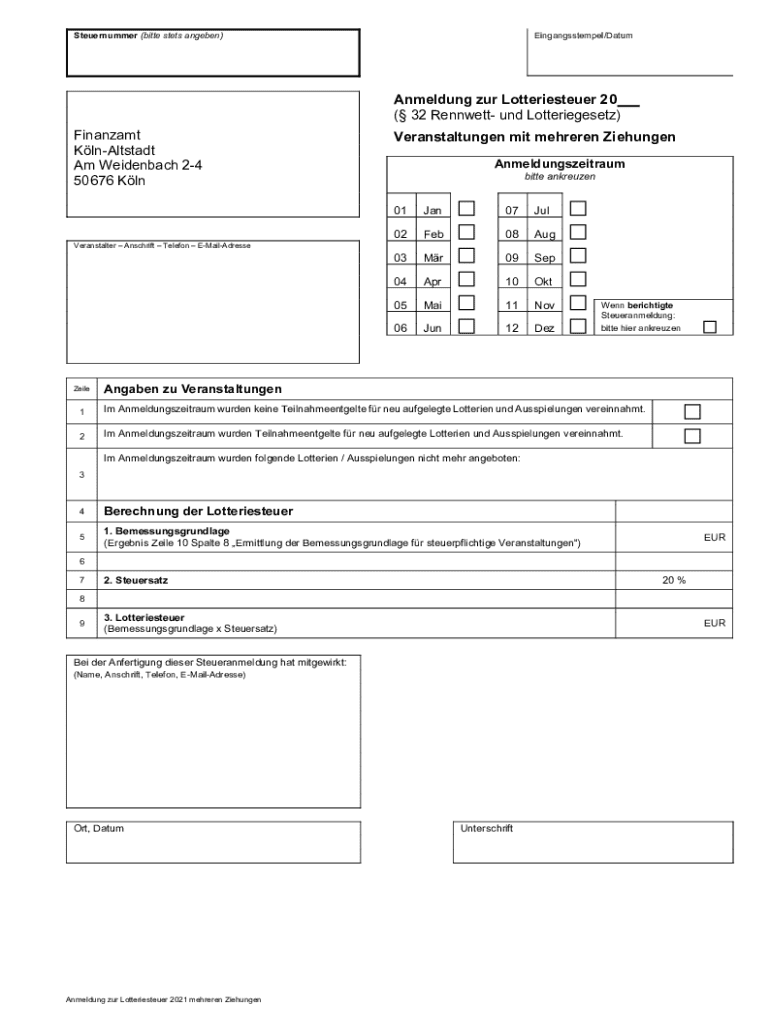

Anmeldung Zur Lotteriesteuer Form

What is the Anmeldung Zur Lotteriesteuer

The Anmeldung Zur Lotteriesteuer is a tax registration form used to report lottery winnings to the relevant tax authorities. In the context of U.S. tax regulations, this form is essential for individuals who have won money through lotteries, raffles, or similar games of chance. It ensures that the appropriate taxes are calculated and paid on winnings, which can often be substantial. Understanding this form is crucial for compliance with tax obligations and avoiding potential penalties.

Steps to complete the Anmeldung Zur Lotteriesteuer

Completing the Anmeldung Zur Lotteriesteuer involves several straightforward steps:

- Gather necessary information: Collect details about the lottery winnings, including the amount won and the date of the win.

- Obtain the form: Access the official Anmeldung Zur Lotteriesteuer form from the relevant tax authority's website or office.

- Fill out the form: Provide personal information, including your name, address, and Social Security number, along with details of the winnings.

- Review for accuracy: Ensure all information is correct to prevent delays or issues with processing.

- Submit the form: Follow the submission guidelines, which may include online filing, mailing the form, or delivering it in person.

Required Documents

When completing the Anmeldung Zur Lotteriesteuer, certain documents may be required to support your claim. These may include:

- Proof of winnings: Documentation such as a lottery ticket or a statement from the lottery organization confirming the amount won.

- Identification: A valid government-issued ID, such as a driver's license or passport, to verify your identity.

- Tax identification number: Your Social Security number or Employer Identification Number (EIN) may be necessary for accurate tax reporting.

Legal use of the Anmeldung Zur Lotteriesteuer

The Anmeldung Zur Lotteriesteuer serves a legal purpose by ensuring that lottery winnings are reported in compliance with tax laws. Failure to file this form can lead to legal repercussions, including fines and penalties. It is important for winners to understand their obligations under U.S. tax law, as the IRS requires that all gambling winnings be reported as income. This form helps facilitate that process and provides a clear record of the winnings for tax purposes.

Filing Deadlines / Important Dates

Filing deadlines for the Anmeldung Zur Lotteriesteuer can vary based on state regulations and the timing of the lottery winnings. Generally, it is advisable to file as soon as possible after receiving winnings to ensure compliance with tax laws. Important dates to keep in mind include:

- Lottery win date: The date you won the lottery is crucial for determining the tax year for reporting.

- Tax filing deadline: Typically, the deadline for filing tax returns in the U.S. is April fifteenth, but check local regulations for specific dates.

- State-specific deadlines: Be aware of any additional state deadlines that may apply to your winnings.

Who Issues the Form

The Anmeldung Zur Lotteriesteuer is typically issued by the state tax authority or the Internal Revenue Service (IRS) in the United States. Each state may have its own version of the form, tailored to its specific tax regulations regarding lottery winnings. It is essential to obtain the correct form from the appropriate authority to ensure compliance with local laws.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the anmeldung zur lotteriesteuer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for Anmeldung Zur Lotteriesteuer?

The process for Anmeldung Zur Lotteriesteuer involves registering your lottery winnings with the tax authorities. You will need to provide necessary documentation and details about your winnings. airSlate SignNow can help streamline this process by allowing you to eSign and send documents securely.

-

How much does it cost to use airSlate SignNow for Anmeldung Zur Lotteriesteuer?

Using airSlate SignNow for Anmeldung Zur Lotteriesteuer is cost-effective, with various pricing plans available to suit different needs. You can choose a plan that fits your budget while ensuring you have all the features necessary for efficient document management. Check our pricing page for detailed information.

-

What features does airSlate SignNow offer for Anmeldung Zur Lotteriesteuer?

airSlate SignNow offers a range of features for Anmeldung Zur Lotteriesteuer, including eSigning, document templates, and secure cloud storage. These features make it easy to manage your lottery tax documents efficiently. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other tools for Anmeldung Zur Lotteriesteuer?

Yes, airSlate SignNow can be integrated with various tools and applications to enhance your experience with Anmeldung Zur Lotteriesteuer. This includes CRM systems, cloud storage services, and more. Integrations help streamline your workflow and improve productivity.

-

What are the benefits of using airSlate SignNow for Anmeldung Zur Lotteriesteuer?

Using airSlate SignNow for Anmeldung Zur Lotteriesteuer provides numerous benefits, including time savings and increased efficiency. The platform simplifies the document signing process, allowing you to focus on other important tasks. Additionally, it ensures compliance with legal requirements.

-

Is airSlate SignNow secure for handling Anmeldung Zur Lotteriesteuer documents?

Absolutely, airSlate SignNow prioritizes security for all documents, including those related to Anmeldung Zur Lotteriesteuer. The platform uses advanced encryption and security protocols to protect your sensitive information. You can trust that your documents are safe and secure.

-

How can I get support for Anmeldung Zur Lotteriesteuer using airSlate SignNow?

airSlate SignNow offers comprehensive support for users dealing with Anmeldung Zur Lotteriesteuer. You can access a variety of resources, including FAQs, tutorials, and customer support. Our team is ready to assist you with any questions or issues you may encounter.

Get more for Anmeldung Zur Lotteriesteuer

Find out other Anmeldung Zur Lotteriesteuer

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document