Residential Business Tax Application 2024-2026

What is the Residential Business Tax Application

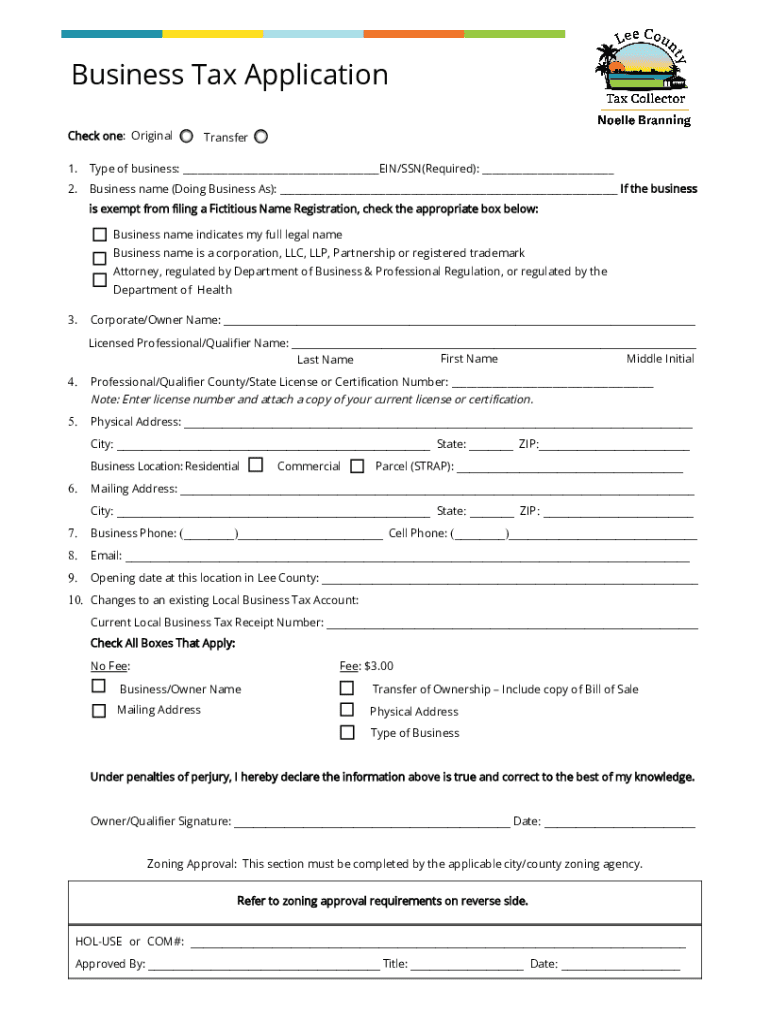

The Residential Business Tax Application is a form required by Lee County for individuals operating a business from their home. This application ensures compliance with local tax regulations and helps the county track business activities within residential areas. It is essential for homeowners who wish to legally operate a business, as it provides the necessary documentation to support local business operations.

Steps to complete the Residential Business Tax Application

Completing the Residential Business Tax Application involves several key steps:

- Gather necessary information, including your business name, address, and type of business.

- Provide personal identification details, such as your Social Security number or Employer Identification Number (EIN).

- Detail the nature of your business operations, including any services offered or products sold.

- Review local zoning regulations to ensure your business complies with residential area requirements.

- Submit the completed application to the appropriate county office, either online or by mail.

Required Documents

When submitting the Residential Business Tax Application, certain documents may be required to verify your business activities. These may include:

- A copy of your identification, such as a driver's license or state ID.

- Proof of residence, like a utility bill or lease agreement.

- Any relevant business licenses or permits that may be required for your specific business type.

Form Submission Methods

The Residential Business Tax Application can typically be submitted through various methods to accommodate different preferences:

- Online: Many counties offer an online submission portal for convenience.

- By Mail: You can print the application and send it via postal service to the designated county office.

- In-Person: Submitting the application in person allows for immediate assistance and confirmation of receipt.

Penalties for Non-Compliance

Failing to file the Residential Business Tax Application or operating a business without the necessary permits can result in penalties. These may include:

- Fines imposed by the county for non-compliance with local tax regulations.

- Potential legal action if the business is found to be operating unlawfully.

- Loss of the ability to operate the business legally within the residential area.

Eligibility Criteria

To be eligible for the Residential Business Tax Application, applicants must meet specific criteria, including:

- Being a resident of Lee County and operating the business from a primary residence.

- Complying with local zoning laws that permit business activities in residential areas.

- Providing accurate information regarding the nature and scope of the business.

Quick guide on how to complete residential business tax application

Complete Residential Business Tax Application smoothly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can find the required form and securely keep it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly and without interruptions. Handle Residential Business Tax Application on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related operation today.

The easiest way to modify and eSign Residential Business Tax Application effortlessly

- Find Residential Business Tax Application and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Residential Business Tax Application and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct residential business tax application

Create this form in 5 minutes!

How to create an eSignature for the residential business tax application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the lee county local business tax?

The lee county local business tax is a fee imposed on businesses operating within Lee County. It is essential for local businesses to understand this tax to ensure compliance and avoid penalties. This tax supports local services and infrastructure that benefit businesses and the community.

-

How can airSlate SignNow help with managing the lee county local business tax?

airSlate SignNow provides an efficient way to manage documents related to the lee county local business tax. With our eSigning capabilities, you can quickly sign and send tax-related documents, ensuring timely submissions. This streamlines your tax management process and helps you stay compliant.

-

What are the pricing options for airSlate SignNow for businesses in Lee County?

airSlate SignNow offers flexible pricing plans tailored for businesses, including those dealing with the lee county local business tax. Our plans are designed to be cost-effective, ensuring that you get the best value for your investment. You can choose a plan that fits your business needs and budget.

-

What features does airSlate SignNow offer for handling local business taxes?

airSlate SignNow includes features such as document templates, eSigning, and secure storage, which are beneficial for managing the lee county local business tax. These features simplify the process of preparing and submitting tax documents. Additionally, our platform ensures that your documents are legally binding and secure.

-

Can airSlate SignNow integrate with accounting software for tax purposes?

Yes, airSlate SignNow can integrate with various accounting software, making it easier to manage the lee county local business tax. This integration allows for seamless data transfer and document management, ensuring that your tax records are accurate and up-to-date. It enhances your overall efficiency in handling tax-related tasks.

-

What are the benefits of using airSlate SignNow for local business tax documentation?

Using airSlate SignNow for your lee county local business tax documentation offers numerous benefits, including time savings and improved accuracy. Our platform reduces the need for physical paperwork, allowing for faster processing of tax documents. This efficiency can lead to better compliance and reduced stress during tax season.

-

Is airSlate SignNow suitable for small businesses in Lee County?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses in Lee County. Our user-friendly interface and affordable pricing make it an ideal solution for managing the lee county local business tax without overwhelming your resources. Small businesses can benefit greatly from our efficient document management tools.

Get more for Residential Business Tax Application

Find out other Residential Business Tax Application

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free