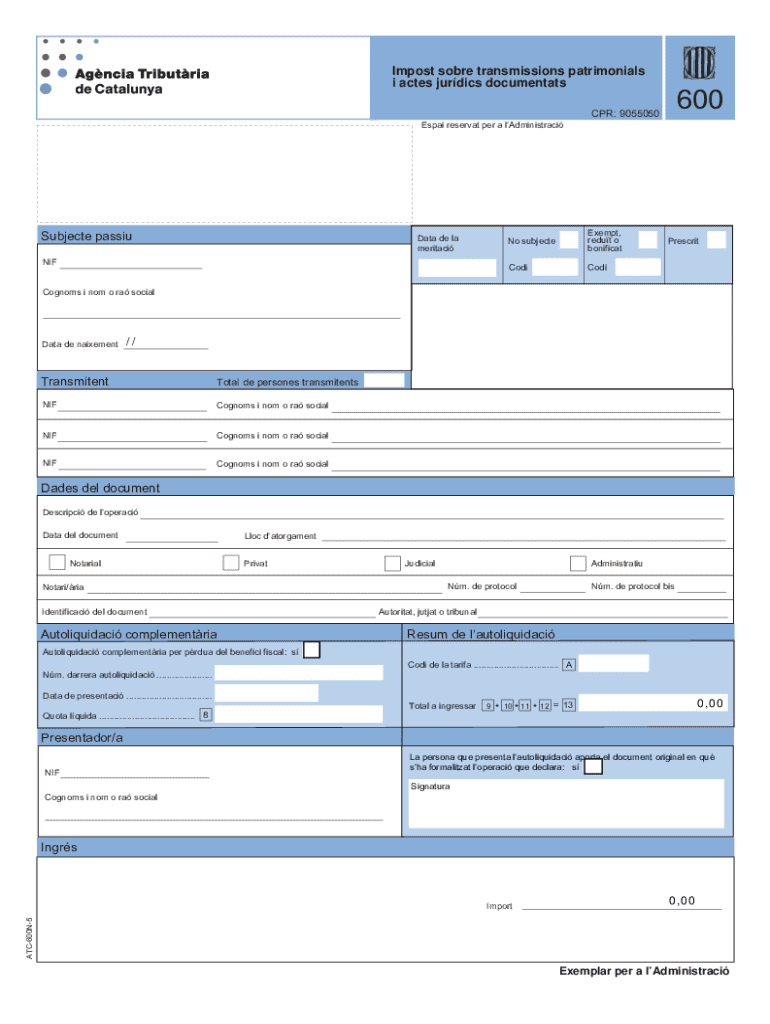

Impost Sobre Transmissions Patrimonials I Actes Jur Dics Documentats Form

What is the Impost Sobre Transmissions Patrimonials I Actes Jurídics Documentats

The Impost Sobre Transmissions Patrimonials I Actes Jurídics Documentats is a tax levied on the transfer of property and certain documented legal acts. This tax applies to various transactions, including the sale of real estate, inheritance, and donations. Understanding this tax is essential for individuals and businesses involved in property transactions, as it can significantly impact the overall cost and legal obligations associated with these activities.

Steps to complete the Impost Sobre Transmissions Patrimonials I Actes Jurídics Documentats

Completing the Impost Sobre Transmissions Patrimonials I Actes Jurídics Documentats involves several steps to ensure compliance. First, gather all necessary documentation related to the transaction, such as purchase agreements or deeds. Next, calculate the tax amount based on the property's value or the nature of the act. After determining the tax owed, fill out the appropriate forms, providing accurate details about the transaction. Finally, submit the forms along with the payment to the designated tax authority, ensuring you keep copies for your records.

Legal use of the Impost Sobre Transmissions Patrimonials I Actes Jurídics Documentats

The legal use of the Impost Sobre Transmissions Patrimonials I Actes Jurídics Documentats is crucial for maintaining compliance with local tax laws. This tax is not only a financial obligation but also a legal requirement that must be fulfilled when engaging in property transfers or executing specific legal acts. Failure to comply can result in penalties, making it vital for taxpayers to understand their responsibilities and ensure timely payment.

Required Documents

When filing the Impost Sobre Transmissions Patrimonials I Actes Jurídics Documentats, several documents are typically required. These may include:

- Proof of property ownership or transfer agreement

- Identification documents of the parties involved

- Valuation reports or appraisals of the property

- Completed tax forms specific to the transaction

Having these documents ready can streamline the filing process and help avoid delays in tax assessment.

Filing Deadlines / Important Dates

Filing deadlines for the Impost Sobre Transmissions Patrimonials I Actes Jurídics Documentats can vary based on the type of transaction and local regulations. Typically, the tax must be filed within a specific period following the transaction date, often ranging from thirty to ninety days. It is important to check with local tax authorities for precise deadlines to avoid late fees or penalties.

Penalties for Non-Compliance

Non-compliance with the Impost Sobre Transmissions Patrimonials I Actes Jurídics Documentats can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. To mitigate these risks, it is essential for taxpayers to understand their obligations and ensure timely and accurate filing of the required forms.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the impost sobre transmissions patrimonials i actes jurdics documentats

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Impost Sobre Transmissions Patrimonials I Actes Jurídics Documentats?

The Impost Sobre Transmissions Patrimonials I Actes Jurídics Documentats is a tax applied to property transfers and documented legal acts in certain jurisdictions. Understanding this tax is crucial for businesses and individuals involved in real estate transactions. airSlate SignNow can help streamline the documentation process related to this tax.

-

How can airSlate SignNow assist with the Impost Sobre Transmissions Patrimonials I Actes Jurídics Documentats?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning documents related to the Impost Sobre Transmissions Patrimonials I Actes Jurídics Documentats. Our solution simplifies the paperwork involved, ensuring compliance and reducing the risk of errors. This allows users to focus on their transactions rather than getting bogged down by documentation.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various users, whether individuals or businesses. Our plans are designed to provide cost-effective solutions for managing documents related to the Impost Sobre Transmissions Patrimonials I Actes Jurídics Documentats. You can choose a plan that best fits your volume of transactions and required features.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning capabilities. These features are particularly beneficial for managing documents associated with the Impost Sobre Transmissions Patrimonials I Actes Jurídics Documentats. Our platform ensures that all documents are handled efficiently and securely.

-

Is airSlate SignNow compliant with legal standards for the Impost Sobre Transmissions Patrimonials I Actes Jurídics Documentats?

Yes, airSlate SignNow is designed to comply with legal standards and regulations surrounding the Impost Sobre Transmissions Patrimonials I Actes Jurídics Documentats. Our platform ensures that all eSigned documents are legally binding and secure, providing peace of mind for users involved in property transactions.

-

Can I integrate airSlate SignNow with other software for managing the Impost Sobre Transmissions Patrimonials I Actes Jurídics Documentats?

Absolutely! airSlate SignNow offers integrations with various software applications to enhance your document management process. This allows you to seamlessly manage the Impost Sobre Transmissions Patrimonials I Actes Jurídics Documentats alongside your existing tools, improving efficiency and workflow.

-

What are the benefits of using airSlate SignNow for the Impost Sobre Transmissions Patrimonials I Actes Jurídics Documentats?

Using airSlate SignNow for the Impost Sobre Transmissions Patrimonials I Actes Jurídics Documentats provides numerous benefits, including time savings, reduced paperwork, and enhanced security. Our platform simplifies the entire process, allowing users to focus on their core business activities while ensuring compliance with tax regulations.

Get more for Impost Sobre Transmissions Patrimonials I Actes Jur dics Documentats

- New zealand visa form

- Ppe matrix format in excel download

- Unitarian house ottawa reviews form

- Cm relief fund application form telangana

- 12 month asq se form

- Pre contract enquiries in relation to units in a multi unit development lawsociety form

- Ffa chapter degree application form

- Chaperone consent form bdagorhirbbcomb

Find out other Impost Sobre Transmissions Patrimonials I Actes Jur dics Documentats

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy