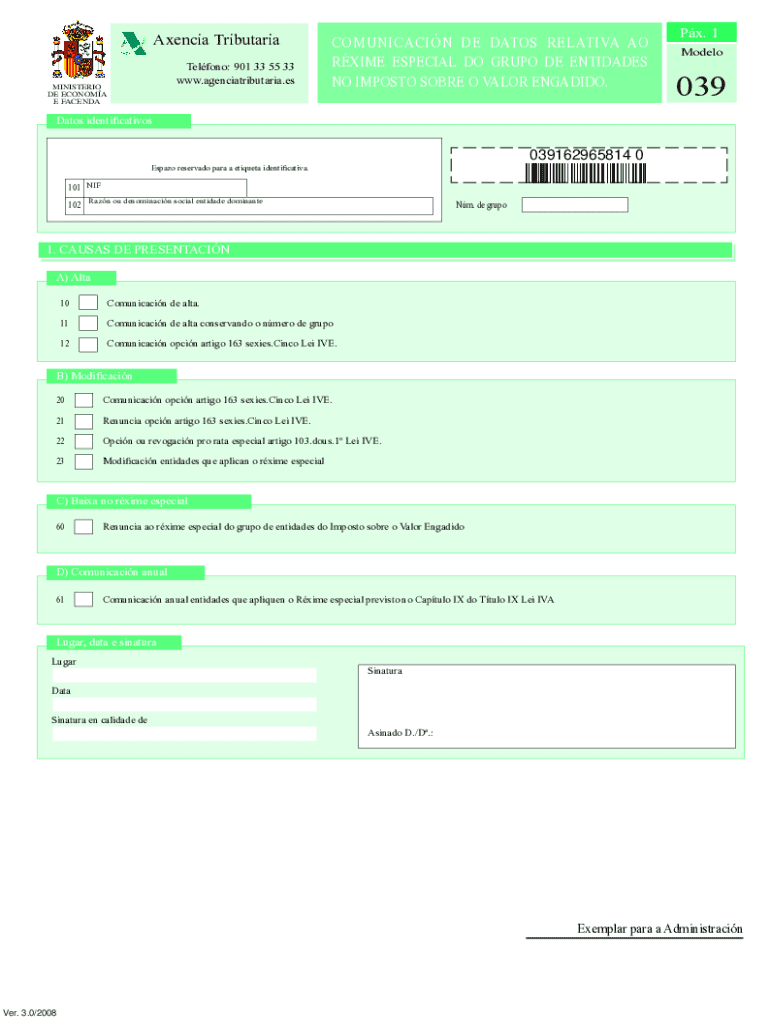

Formulario 039

What is the Formulario 039

The Formulario 039 is a specific document utilized primarily for tax-related purposes in the United States. It is often associated with the reporting of various financial activities, ensuring compliance with federal regulations. This form is essential for individuals and businesses alike, as it helps maintain accurate records for tax filings and other financial disclosures.

How to obtain the Formulario 039

Obtaining the Formulario 039 is a straightforward process. Individuals can access the form through the official IRS website or other authorized platforms. It is available for download in a printable format, allowing users to fill it out manually. Additionally, some tax preparation software may include the form, streamlining the process for users who prefer digital solutions.

Steps to complete the Formulario 039

Completing the Formulario 039 involves several key steps:

- Gather necessary information, including personal identification details and financial data.

- Carefully read the instructions provided with the form to ensure compliance with all requirements.

- Fill out the form accurately, paying close attention to each section to avoid errors.

- Review the completed form for accuracy before submission.

- Submit the form through the appropriate channels, whether online, by mail, or in person.

Legal use of the Formulario 039

The Formulario 039 serves a legal purpose in the context of tax compliance. It is designed to collect essential information that the IRS requires for processing tax returns and ensuring that individuals and businesses adhere to federal laws. Proper use of this form is crucial to avoid potential legal issues, including penalties for non-compliance.

Filing Deadlines / Important Dates

Understanding filing deadlines associated with the Formulario 039 is vital for compliance. Typically, the form must be submitted by specific dates, which may vary based on individual circumstances and the type of financial reporting required. It is advisable to consult the IRS calendar or relevant tax guidelines to ensure timely submission and avoid late fees.

Required Documents

When preparing to complete the Formulario 039, it is important to have all required documents ready. Commonly needed documents include:

- Personal identification, such as a Social Security number or taxpayer identification number.

- Financial statements or records relevant to the information being reported.

- Previous tax returns, if applicable, to provide context for the current filing.

Form Submission Methods

The Formulario 039 can be submitted through several methods, depending on user preference and specific requirements:

- Online submission through authorized tax software platforms.

- Mailing a printed copy to the designated IRS address.

- In-person submission at local IRS offices, if necessary.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the formulario 039

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Formulario 039 and how can it be used with airSlate SignNow?

Formulario 039 is a specific document format that can be easily managed using airSlate SignNow. Our platform allows you to upload, edit, and eSign Formulario 039, streamlining your document workflow and ensuring compliance with legal standards.

-

How much does it cost to use airSlate SignNow for Formulario 039?

airSlate SignNow offers competitive pricing plans that cater to different business needs. You can choose a plan that fits your budget while efficiently managing Formulario 039 and other documents without hidden fees.

-

What features does airSlate SignNow provide for managing Formulario 039?

With airSlate SignNow, you can easily create, edit, and eSign Formulario 039. Our platform includes features like templates, automated workflows, and secure storage, making it a comprehensive solution for document management.

-

Can I integrate airSlate SignNow with other applications for Formulario 039?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your ability to manage Formulario 039. You can connect it with CRM systems, cloud storage, and other tools to streamline your workflow.

-

What are the benefits of using airSlate SignNow for Formulario 039?

Using airSlate SignNow for Formulario 039 offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. Our platform ensures that your documents are handled professionally and securely.

-

Is airSlate SignNow user-friendly for handling Formulario 039?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage Formulario 039. The intuitive interface allows users to navigate the platform effortlessly, even without prior experience.

-

How does airSlate SignNow ensure the security of Formulario 039?

airSlate SignNow prioritizes security by implementing advanced encryption and compliance measures for Formulario 039. Your documents are protected at all stages, ensuring that sensitive information remains confidential.

Get more for Formulario 039

- Sample filled south africa visa application form

- K ben form

- In at 300d for az bilirubin the reading at a1 does blank in accurex form

- Weekly language review q1 3 answer key form

- Bcbs continuity of care form

- Town of clarkstown alarm permit form

- Employee code of conduct acknowledgement form

- Hillbilly fun hold harmless agreement and waiver form

Find out other Formulario 039

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now