K Ben Form

What is the K Ben?

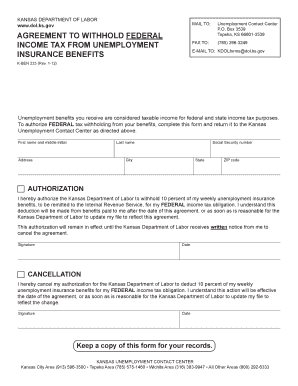

The K Ben form, often referred to as K Ben 233, is a specific document used in various legal and tax-related contexts. It is essential for individuals and businesses to understand its purpose and application. This form typically serves to report certain financial information to the IRS or other regulatory bodies, ensuring compliance with federal and state laws. Understanding the K Ben is crucial for accurate reporting and avoiding potential penalties.

How to Use the K Ben

Using the K Ben form involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents that pertain to the information being reported. Next, carefully fill out the form, ensuring that all fields are completed accurately. It is important to double-check the entries for any errors before submission. Finally, submit the form according to the specified guidelines, whether online or by mail, to ensure it is received by the appropriate authorities.

Steps to Complete the K Ben

Completing the K Ben form requires careful attention to detail. Here are the steps to follow:

- Collect all relevant financial documents, including income statements and previous tax returns.

- Download the K Ben form from the official source or access it through a trusted platform.

- Fill out the form, ensuring that all information is accurate and complete.

- Review the form for any mistakes or missing information.

- Submit the form as directed, either electronically or by mailing a physical copy.

Legal Use of the K Ben

The K Ben form must be used in accordance with legal guidelines to ensure its validity. This includes adhering to IRS regulations and state-specific laws regarding financial reporting. Failure to comply with these regulations can lead to penalties or legal repercussions. It is advisable to consult with a tax professional or legal advisor to ensure that the form is used correctly and that all necessary legal requirements are met.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the K Ben form. These guidelines outline the necessary information to include, deadlines for submission, and any penalties for non-compliance. It is important to stay informed about any updates to these guidelines to ensure compliance and avoid issues with the IRS. Regularly checking the IRS website or consulting with a tax professional can provide valuable insights into current requirements.

Form Submission Methods

The K Ben form can be submitted through various methods, depending on the preferences of the filer and the requirements of the IRS. Common submission methods include:

- Online submission through the IRS e-filing system.

- Mailing a physical copy to the designated IRS address.

- In-person submission at local IRS offices, if applicable.

Choosing the appropriate submission method is important for ensuring timely processing and compliance with IRS regulations.

Quick guide on how to complete k ben

Complete K Ben effortlessly on any device

Web-based document administration has gained traction with companies and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your files quickly without delays. Manage K Ben on any device using airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign K Ben without any hassle

- Locate K Ben and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you want to share your form, either via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign K Ben and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the k ben

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is k ben 233 and how does it relate to airSlate SignNow?

K ben 233 refers to the effective features and benefits that airSlate SignNow offers for businesses looking to enhance their document workflows. By utilizing k ben 233, users can streamline the process of sending and eSigning documents, ensuring efficiency and compliance, which are critical for modern businesses.

-

How much does airSlate SignNow cost in relation to k ben 233?

The pricing for airSlate SignNow is structured to provide a cost-effective solution for businesses while still delivering the exceptional features associated with k ben 233. We offer various plans to suit different business sizes and needs, ensuring that everyone can benefit from the powerful functionalities that k ben 233 encompasses.

-

What features does airSlate SignNow offer that align with k ben 233?

AirSlate SignNow includes features such as unlimited eSigning, customizable templates, and detailed analytics, all of which are foundational to the concept of k ben 233. These features help businesses optimize their document management processes, making k ben 233 a vital component of streamlining operations.

-

Can airSlate SignNow be integrated with other tools using k ben 233?

Yes, airSlate SignNow can be integrated with various popular applications, enhancing the capabilities that k ben 233 offers. This means you can seamlessly connect your eSigning workflows with CRM systems, cloud storage, and other business tools, supporting a more interconnected approach to document management.

-

What are the main benefits of using airSlate SignNow with k ben 233?

The main benefits of combining airSlate SignNow with k ben 233 include increased efficiency, reduced turnaround time for documents, and enhanced security for sensitive information. By employing these tools together, businesses can ensure smoother workflows and greater satisfaction among clients and employees alike.

-

Is there a free trial available for k ben 233 with airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows prospective users to explore the benefits of k ben 233 without any commitment. This trial period enables businesses to understand how the platform can facilitate their eSigning needs and enhance their overall document processes.

-

How does airSlate SignNow ensure compliance when using k ben 233?

AirSlate SignNow maintains strict compliance with industry regulations and standards, which corresponds with the principles of k ben 233. Our platform implements advanced security features, such as encryption and audit trails, to ensure that all eSigned documents are legally binding and meet necessary compliance requirements.

Get more for K Ben

- Ia form 843

- Pbt report ets form

- Schwangerschaftsabbruch formular a sg ch

- Medical leave packet for employeeamp39s own serious state of indiana in form

- Vp024 form

- Mathematics success grade 7 s37 lesson 4 unit rates homework name date directions for questions 1 10 identify the unit rate form

- Unclaimed property claim form doc

- Form w 8 rev november certificate of foreign status

Find out other K Ben

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free