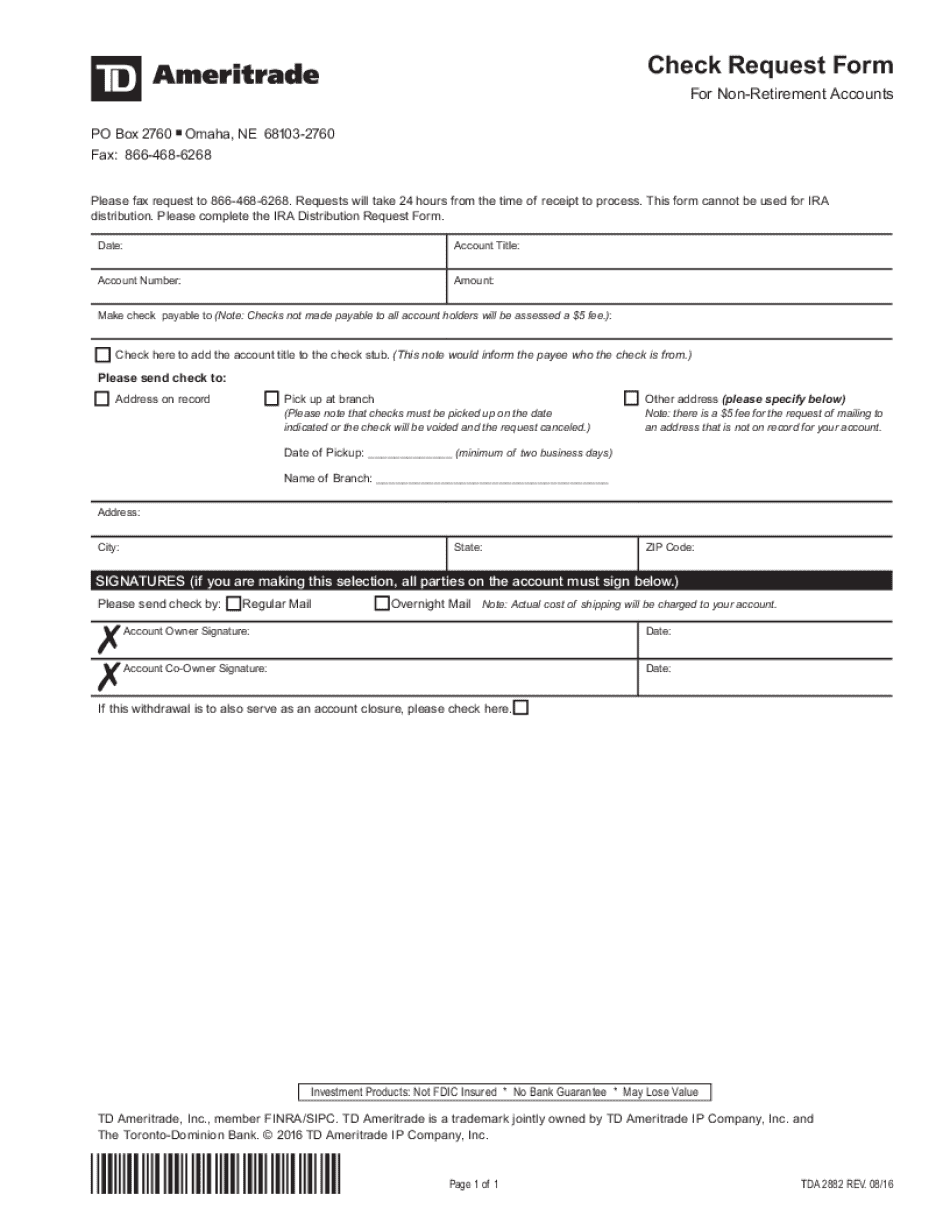

For Non Retirement Accounts Form

What is the For Non Retirement Accounts

The term "For Non Retirement Accounts" refers to financial accounts that are not specifically designated for retirement savings. These accounts can include checking accounts, savings accounts, brokerage accounts, and other investment vehicles. They are typically used for everyday transactions and investments, allowing individuals to access their funds without the restrictions associated with retirement accounts. Understanding the characteristics of these accounts is essential for effective financial planning and management.

How to use the For Non Retirement Accounts

Using non-retirement accounts involves several straightforward steps. First, individuals should identify their financial goals, which may include saving for a major purchase, investing for growth, or maintaining liquidity for emergencies. Next, they can open an account with a financial institution that meets their needs, such as a bank or brokerage firm. Once the account is established, users can deposit funds, make withdrawals, and manage investments according to their financial objectives. Regular monitoring of account performance and adjusting strategies as needed is also advisable.

Steps to complete the For Non Retirement Accounts

Completing the necessary processes for non-retirement accounts involves several key steps:

- Determine the type of account needed based on financial goals.

- Research and select a financial institution that offers favorable terms and services.

- Gather required documentation, such as identification and proof of address.

- Fill out the application form accurately, providing all necessary information.

- Submit the application and any required documents to the financial institution.

- Once approved, fund the account to begin using it for transactions or investments.

Legal use of the For Non Retirement Accounts

Non-retirement accounts must be used in compliance with relevant laws and regulations. This includes understanding the tax implications of earnings and withdrawals. For instance, interest earned on savings accounts is typically taxable, and capital gains from investments may also be subject to taxation. It is important for account holders to maintain accurate records and report income as required by the Internal Revenue Service (IRS) to avoid penalties and ensure compliance with federal and state laws.

Required Documents

To open and manage non-retirement accounts, individuals typically need to provide specific documentation. Commonly required documents include:

- Government-issued identification, such as a driver’s license or passport.

- Social Security number or taxpayer identification number.

- Proof of address, such as a utility bill or lease agreement.

- Income verification documents, if applicable, such as pay stubs or tax returns.

Examples of using the For Non Retirement Accounts

Non-retirement accounts are versatile and can serve various purposes. For example, individuals may use a savings account to set aside funds for a vacation, while a brokerage account can be utilized for investing in stocks or mutual funds. Additionally, checking accounts are commonly used for daily expenses, such as paying bills or making purchases. Each type of account offers unique benefits that align with different financial strategies.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the for non retirement accounts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for non-retirement accounts?

airSlate SignNow provides a range of features tailored for non-retirement accounts, including customizable templates, secure eSignature capabilities, and document tracking. These features streamline the signing process, making it efficient and user-friendly. Additionally, users can easily manage their documents and ensure compliance with legal standards.

-

How does airSlate SignNow ensure the security of documents for non-retirement accounts?

Security is a top priority for airSlate SignNow, especially for non-retirement accounts. The platform employs advanced encryption protocols and secure cloud storage to protect sensitive information. Furthermore, it complies with industry standards to ensure that all documents are handled safely and securely.

-

What is the pricing structure for airSlate SignNow for non-retirement accounts?

airSlate SignNow offers flexible pricing plans designed for various needs, including those specifically for non-retirement accounts. Users can choose from monthly or annual subscriptions, with options that cater to both individuals and businesses. This cost-effective solution ensures that you only pay for the features you need.

-

Can I integrate airSlate SignNow with other tools for non-retirement accounts?

Yes, airSlate SignNow supports integration with a variety of third-party applications, making it ideal for non-retirement accounts. Users can connect it with popular tools like Google Drive, Salesforce, and more to enhance their workflow. This seamless integration helps streamline document management and eSigning processes.

-

What are the benefits of using airSlate SignNow for non-retirement accounts?

Using airSlate SignNow for non-retirement accounts offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration. The platform simplifies the signing process, allowing users to send and receive documents quickly. Additionally, it helps businesses save time and resources, ultimately improving productivity.

-

Is airSlate SignNow user-friendly for non-retirement accounts?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy to navigate for non-retirement accounts. The intuitive interface allows users to quickly create, send, and sign documents without any technical expertise. This accessibility ensures that everyone can benefit from its features.

-

What types of documents can I manage with airSlate SignNow for non-retirement accounts?

airSlate SignNow allows you to manage a wide variety of documents for non-retirement accounts, including contracts, agreements, and forms. The platform supports multiple file formats, ensuring that you can work with the documents you need. This versatility makes it a valuable tool for businesses of all sizes.

Get more for For Non Retirement Accounts

Find out other For Non Retirement Accounts

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF