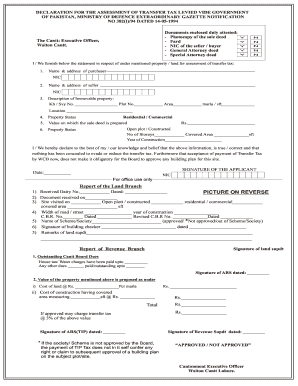

Tip Tax Cantonment Board Lahore Form

What is the Tip Tax Cantonment Board Lahore

The Tip Tax Cantonment Board Lahore is a local government authority responsible for the collection of specific taxes within its jurisdiction. This board administers taxes related to various services and properties, ensuring that funds are allocated for community development and maintenance. Understanding the role of this board is essential for residents and businesses operating in the area, as it impacts local infrastructure and services.

How to use the Tip Tax Cantonment Board Lahore

Utilizing the Tip Tax Cantonment Board Lahore involves understanding the processes for tax assessment and payment. Residents can access information about their tax obligations through official communications or the board's designated channels. Engaging with the board may include submitting required documents, making payments, or seeking clarifications regarding tax rates and regulations.

Steps to complete the Tip Tax Cantonment Board Lahore

Completing the requirements set forth by the Tip Tax Cantonment Board Lahore typically involves several key steps:

- Gather necessary documentation related to your property or business.

- Determine the applicable tax rates based on your specific situation.

- Complete any required forms accurately, ensuring all information is up to date.

- Submit your forms and payments through the designated channels, whether online or in person.

- Keep copies of all submissions for your records and future reference.

Required Documents

To effectively engage with the Tip Tax Cantonment Board Lahore, certain documents are typically required. These may include:

- Proof of identity, such as a government-issued ID.

- Property ownership documents, including deeds or titles.

- Business registration documents if applicable.

- Previous tax returns or assessments for reference.

Form Submission Methods

There are various methods for submitting forms to the Tip Tax Cantonment Board Lahore. These include:

- Online submission through the official website, where forms can often be filled out and submitted electronically.

- Mailing completed forms to the designated office address.

- In-person submissions at the board's office, allowing for direct interaction with staff for assistance.

Penalties for Non-Compliance

Failure to comply with the regulations set by the Tip Tax Cantonment Board Lahore can result in penalties. These may include:

- Fines based on the amount of tax owed or the duration of non-compliance.

- Interest charges on overdue payments.

- Legal action or additional enforcement measures if compliance is not achieved.

Create this form in 5 minutes or less

Related searches to Tip Tax Cantonment Board Lahore

Create this form in 5 minutes!

How to create an eSignature for the tip tax cantonment board lahore

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tip Tax Cantonment Board Lahore?

The Tip Tax Cantonment Board Lahore is a local government authority responsible for managing tax collection and civic services in the Lahore Cantonment area. Understanding its functions can help businesses navigate local regulations effectively.

-

How can airSlate SignNow assist with Tip Tax Cantonment Board Lahore documentation?

airSlate SignNow simplifies the process of preparing and signing documents required by the Tip Tax Cantonment Board Lahore. With its user-friendly interface, businesses can easily create, send, and eSign necessary forms, ensuring compliance with local tax regulations.

-

What are the pricing options for airSlate SignNow related to Tip Tax Cantonment Board Lahore?

airSlate SignNow offers various pricing plans that cater to different business needs, including those dealing with the Tip Tax Cantonment Board Lahore. These plans are designed to be cost-effective, providing essential features without breaking the bank.

-

What features does airSlate SignNow provide for managing Tip Tax Cantonment Board Lahore documents?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing documents related to the Tip Tax Cantonment Board Lahore. These tools enhance efficiency and ensure that all paperwork is handled smoothly.

-

What are the benefits of using airSlate SignNow for Tip Tax Cantonment Board Lahore transactions?

Using airSlate SignNow for transactions related to the Tip Tax Cantonment Board Lahore offers numerous benefits, including faster processing times and reduced paperwork. This solution helps businesses stay organized and compliant with local tax requirements.

-

Can airSlate SignNow integrate with other tools for Tip Tax Cantonment Board Lahore processes?

Yes, airSlate SignNow can integrate with various business tools and software, enhancing the management of processes related to the Tip Tax Cantonment Board Lahore. This integration allows for seamless workflows and improved productivity.

-

Is airSlate SignNow secure for handling Tip Tax Cantonment Board Lahore documents?

Absolutely! airSlate SignNow employs advanced security measures to protect documents related to the Tip Tax Cantonment Board Lahore. This includes encryption and secure access controls, ensuring that sensitive information remains confidential.

Get more for Tip Tax Cantonment Board Lahore

Find out other Tip Tax Cantonment Board Lahore

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application

- How To eSign Texas Home Loan Application

- eSignature Indiana Prenuptial Agreement Template Now

- eSignature Indiana Prenuptial Agreement Template Simple

- eSignature Ohio Prenuptial Agreement Template Safe

- eSignature Oklahoma Prenuptial Agreement Template Safe

- eSignature Kentucky Child Custody Agreement Template Free

- eSignature Wyoming Child Custody Agreement Template Free

- eSign Florida Mortgage Quote Request Online

- eSign Mississippi Mortgage Quote Request Online

- How To eSign Colorado Freelance Contract

- eSign Ohio Mortgage Quote Request Mobile

- eSign Utah Mortgage Quote Request Online

- eSign Wisconsin Mortgage Quote Request Online

- eSign Hawaii Temporary Employment Contract Template Later

- eSign Georgia Recruitment Proposal Template Free