TRANSUNION CONSUMER CREDIT REPORT Capital Good Fund Form

What is the TRANSUNION CONSUMER CREDIT REPORT Capital Good Fund

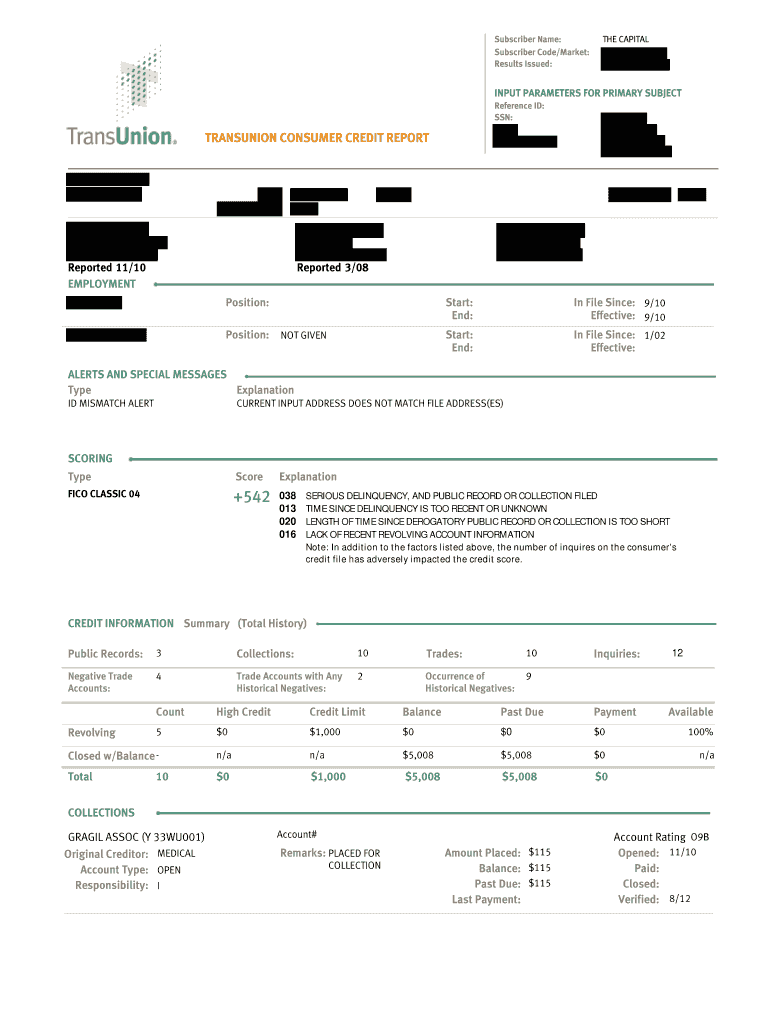

The TRANSUNION CONSUMER CREDIT REPORT is a detailed document that provides a comprehensive overview of an individual's credit history, compiled by TransUnion, one of the major credit reporting agencies in the United States. This report includes information such as credit accounts, payment history, outstanding debts, and inquiries made by lenders. The Capital Good Fund utilizes this report to assess the creditworthiness of individuals applying for financial assistance or loans, ensuring that they have the necessary financial background to qualify for support.

How to obtain the TRANSUNION CONSUMER CREDIT REPORT Capital Good Fund

To obtain the TRANSUNION CONSUMER CREDIT REPORT, individuals can request their report directly from TransUnion's website or through authorized third-party services. It is important to provide personal information, such as Social Security number, date of birth, and address, to verify identity. Consumers are entitled to one free credit report annually from each of the three major credit bureaus, including TransUnion. Additionally, individuals seeking assistance from the Capital Good Fund may need to provide specific documentation or consent for the fund to access their credit report.

Steps to complete the TRANSUNION CONSUMER CREDIT REPORT Capital Good Fund

Completing the process for obtaining the TRANSUNION CONSUMER CREDIT REPORT involves several key steps:

- Gather personal information: Collect necessary details such as your Social Security number, address, and date of birth.

- Visit the TransUnion website: Navigate to the official TransUnion website to access the credit report request section.

- Fill out the request form: Complete the online form with accurate personal information to verify your identity.

- Review your credit report: Once received, carefully review the report for accuracy and completeness.

- Provide consent to Capital Good Fund: If applying for assistance, ensure you authorize the fund to access your credit report as part of the application process.

Key elements of the TRANSUNION CONSUMER CREDIT REPORT Capital Good Fund

The TRANSUNION CONSUMER CREDIT REPORT contains several key elements that are crucial for evaluating an individual's creditworthiness:

- Personal information: This includes your name, address, and Social Security number.

- Credit accounts: A list of open and closed credit accounts, including credit cards, mortgages, and loans.

- Payment history: Records of on-time and late payments, which impact credit scores.

- Credit inquiries: A log of who has accessed your credit report, including lenders and financial institutions.

- Public records: Information on bankruptcies, foreclosures, or other legal actions affecting credit.

Legal use of the TRANSUNION CONSUMER CREDIT REPORT Capital Good Fund

The legal use of the TRANSUNION CONSUMER CREDIT REPORT is governed by the Fair Credit Reporting Act (FCRA), which outlines the rights of consumers and the responsibilities of credit reporting agencies. Financial institutions, including the Capital Good Fund, must obtain consent from individuals before accessing their credit reports. Additionally, they are required to provide a clear reason for the request, ensuring transparency in the lending process. Consumers have the right to dispute inaccuracies found within their reports, which must be investigated by the credit bureau.

Eligibility Criteria

Eligibility for obtaining the TRANSUNION CONSUMER CREDIT REPORT and utilizing it for financial assistance through the Capital Good Fund typically includes:

- Age requirement: Applicants must be at least eighteen years old.

- Residency: Individuals must reside in the United States.

- Credit history: A valid credit history is necessary for the report to be generated.

- Consent: Applicants must provide consent for their credit report to be accessed by the Capital Good Fund.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the transunion consumer credit report capital good fund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TRANSUNION CONSUMER CREDIT REPORT Capital Good Fund?

The TRANSUNION CONSUMER CREDIT REPORT Capital Good Fund is a comprehensive credit report that provides insights into your credit history and score. It helps individuals understand their credit standing and make informed financial decisions. This report is essential for anyone looking to improve their creditworthiness.

-

How can I obtain my TRANSUNION CONSUMER CREDIT REPORT Capital Good Fund?

You can obtain your TRANSUNION CONSUMER CREDIT REPORT Capital Good Fund through various online platforms, including the Capital Good Fund website. Simply follow the instructions to request your report, and ensure you have the necessary identification documents ready for verification.

-

What are the benefits of using the TRANSUNION CONSUMER CREDIT REPORT Capital Good Fund?

Using the TRANSUNION CONSUMER CREDIT REPORT Capital Good Fund allows you to monitor your credit health and identify areas for improvement. It provides detailed information on your credit accounts, payment history, and any negative marks. This knowledge empowers you to take proactive steps towards better financial management.

-

Is there a cost associated with the TRANSUNION CONSUMER CREDIT REPORT Capital Good Fund?

The cost of obtaining the TRANSUNION CONSUMER CREDIT REPORT Capital Good Fund may vary depending on the service provider. Some platforms offer free access, while others may charge a fee for detailed reports or additional services. Always check the pricing details before proceeding.

-

How does the TRANSUNION CONSUMER CREDIT REPORT Capital Good Fund integrate with other financial tools?

The TRANSUNION CONSUMER CREDIT REPORT Capital Good Fund can integrate seamlessly with various financial management tools and applications. This integration allows users to track their credit score alongside other financial metrics, providing a holistic view of their financial health. Check with your chosen platform for specific integration options.

-

Can I dispute inaccuracies in my TRANSUNION CONSUMER CREDIT REPORT Capital Good Fund?

Yes, you can dispute inaccuracies found in your TRANSUNION CONSUMER CREDIT REPORT Capital Good Fund. If you identify any errors, contact the reporting agency directly to initiate a dispute. They are required to investigate and correct any inaccuracies within a specified timeframe.

-

How often should I check my TRANSUNION CONSUMER CREDIT REPORT Capital Good Fund?

It is advisable to check your TRANSUNION CONSUMER CREDIT REPORT Capital Good Fund at least once a year. Regular monitoring helps you stay informed about your credit status and detect any potential fraud early. Additionally, checking your report before applying for loans can help you understand your creditworthiness.

Get more for TRANSUNION CONSUMER CREDIT REPORT Capital Good Fund

- Sellers real estate information statement charles associates

- Printable annual inspector certification form

- Scripts for recruiters greatrecruitertraining com scott love form

- Client supply order form tricore reference laboratories

- Form vrter1 revenue

- Oklahoma new hire reporting form please fill out c

- Business consumer services and housing agency gavin form

- Oklahoma employment security commission form oes 3 fillable

Find out other TRANSUNION CONSUMER CREDIT REPORT Capital Good Fund

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF