Employee's Withholding Certificate for Pensions and Arkansas State Ar 2007

What is the Employee's Withholding Certificate For Pensions And Arkansas State AR

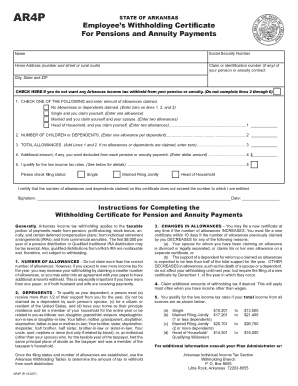

The Employee's Withholding Certificate for Pensions and Arkansas State AR is a crucial document that allows pension recipients to specify the amount of state income tax to be withheld from their pension payments. This form is essential for ensuring that the correct tax amount is deducted, helping individuals manage their tax obligations effectively. It is particularly relevant for retirees and those receiving pension benefits in Arkansas, as it aligns withholding practices with state tax laws.

How to use the Employee's Withholding Certificate For Pensions And Arkansas State AR

Using the Employee's Withholding Certificate for Pensions and Arkansas State AR involves several straightforward steps. First, individuals must fill out the form accurately, providing personal information such as name, address, and Social Security number. Next, recipients should indicate their filing status and the amount they wish to have withheld from their pension payments. Once completed, the form should be submitted to the pension plan administrator or the appropriate state agency to ensure proper processing.

Steps to complete the Employee's Withholding Certificate For Pensions And Arkansas State AR

Completing the Employee's Withholding Certificate for Pensions and Arkansas State AR requires careful attention to detail. Follow these steps:

- Obtain the form from the relevant state or pension office.

- Fill in your personal information, including your full name and address.

- Provide your Social Security number for identification purposes.

- Choose your filing status, such as single or married.

- Specify the amount of state tax you want withheld from your pension.

- Review the completed form for accuracy.

- Submit the form to your pension plan administrator or the designated state office.

Key elements of the Employee's Withholding Certificate For Pensions And Arkansas State AR

The Employee's Withholding Certificate for Pensions and Arkansas State AR includes several key elements that are vital for accurate tax withholding. These elements consist of the recipient's personal details, the selection of filing status, and the specific amount to be withheld. Additionally, the form may require the recipient to indicate any additional withholding preferences or exemptions that apply to their situation. Understanding these components ensures that the form is filled out correctly and meets state requirements.

State-specific rules for the Employee's Withholding Certificate For Pensions And Arkansas State AR

Arkansas has specific rules governing the use of the Employee's Withholding Certificate for Pensions. These regulations dictate how much tax should be withheld based on the recipient's income level and filing status. It is important for pension recipients to familiarize themselves with these state-specific guidelines to ensure compliance and avoid potential penalties. The state may also provide updates or changes to withholding rates, which should be monitored regularly.

Legal use of the Employee's Withholding Certificate For Pensions And Arkansas State AR

The legal use of the Employee's Withholding Certificate for Pensions and Arkansas State AR is essential for both recipients and pension providers. This form serves as a formal request for withholding adjustments, ensuring that pension payments are compliant with state tax laws. Proper completion and submission of the form protect individuals from under-withholding, which can lead to tax liabilities and penalties. It is advisable to keep a copy of the submitted form for personal records.

Create this form in 5 minutes or less

Find and fill out the correct employee39s withholding certificate for pensions and arkansas state ar

Create this form in 5 minutes!

How to create an eSignature for the employee39s withholding certificate for pensions and arkansas state ar

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Employee's Withholding Certificate For Pensions And Arkansas State Ar?

The Employee's Withholding Certificate For Pensions And Arkansas State Ar is a form used by employees to determine the amount of state tax to withhold from pension payments. This certificate helps ensure that the correct amount of taxes is withheld, preventing underpayment or overpayment issues. It's essential for retirees and pensioners in Arkansas to complete this form accurately.

-

How can airSlate SignNow help with the Employee's Withholding Certificate For Pensions And Arkansas State Ar?

airSlate SignNow provides a streamlined platform for completing and eSigning the Employee's Withholding Certificate For Pensions And Arkansas State Ar. Our user-friendly interface allows you to fill out the form quickly and securely, ensuring compliance with state regulations. Plus, you can easily send it to relevant parties for signatures.

-

What are the pricing options for using airSlate SignNow for the Employee's Withholding Certificate For Pensions And Arkansas State Ar?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including options for individuals and enterprises. Our plans are designed to be cost-effective, ensuring you can manage the Employee's Withholding Certificate For Pensions And Arkansas State Ar without breaking the bank. You can choose a plan that fits your usage and budget.

-

What features does airSlate SignNow offer for managing the Employee's Withholding Certificate For Pensions And Arkansas State Ar?

With airSlate SignNow, you gain access to features like customizable templates, secure eSigning, and document tracking. These tools simplify the process of managing the Employee's Withholding Certificate For Pensions And Arkansas State Ar, making it easier to ensure all necessary signatures are obtained. Additionally, our platform supports collaboration among multiple users.

-

Are there any benefits to using airSlate SignNow for the Employee's Withholding Certificate For Pensions And Arkansas State Ar?

Using airSlate SignNow for the Employee's Withholding Certificate For Pensions And Arkansas State Ar offers numerous benefits, including increased efficiency and reduced paperwork. Our digital solution minimizes the time spent on document management, allowing you to focus on more critical tasks. Furthermore, it enhances security and compliance with state regulations.

-

Can I integrate airSlate SignNow with other software for the Employee's Withholding Certificate For Pensions And Arkansas State Ar?

Yes, airSlate SignNow offers integrations with various software applications, making it easy to incorporate the Employee's Withholding Certificate For Pensions And Arkansas State Ar into your existing workflows. Whether you use CRM systems, accounting software, or other tools, our platform can seamlessly connect to enhance your document management processes.

-

Is airSlate SignNow secure for handling the Employee's Withholding Certificate For Pensions And Arkansas State Ar?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your Employee's Withholding Certificate For Pensions And Arkansas State Ar is handled with the utmost care. Our platform employs advanced encryption and security protocols to protect your sensitive information, giving you peace of mind while managing your documents.

Get more for Employee's Withholding Certificate For Pensions And Arkansas State Ar

Find out other Employee's Withholding Certificate For Pensions And Arkansas State Ar

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online