Unclaimed Funds Office of the Ohio Treasurer Ohio Gov Form

Understanding Unclaimed Funds from the Office of the Ohio Treasurer

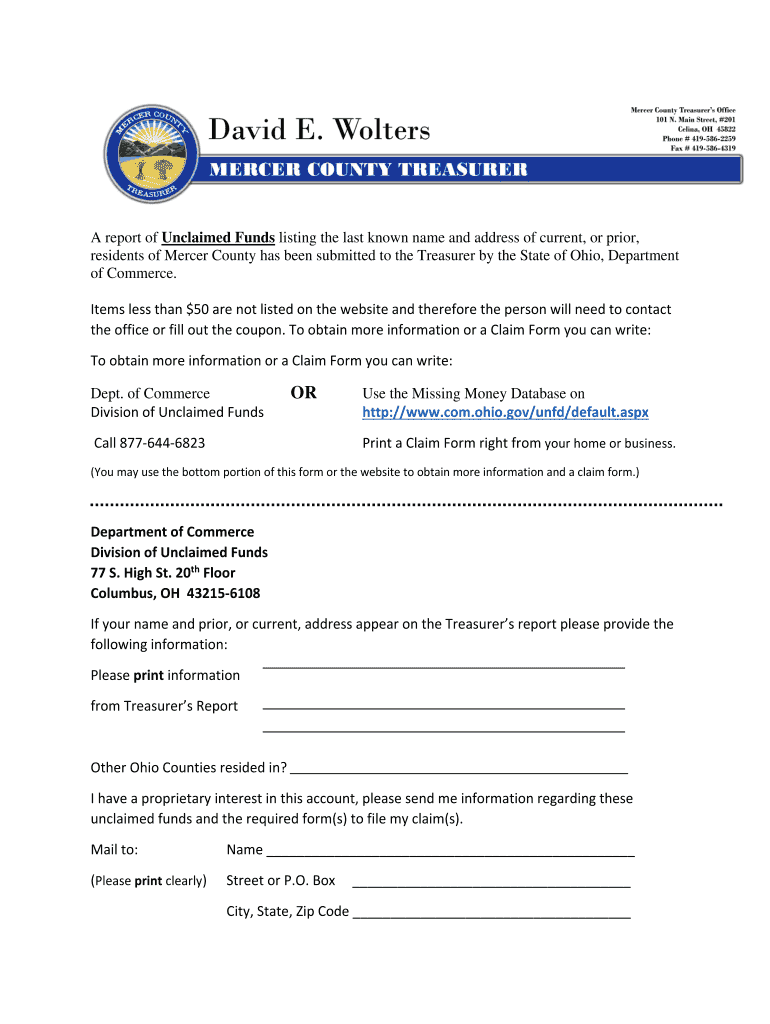

The Unclaimed Funds program managed by the Office of the Ohio Treasurer is designed to reunite individuals and businesses with their lost or forgotten assets. These funds may include bank accounts, insurance policies, and other financial assets that have remained inactive for a specified period. The state holds these funds until the rightful owner claims them, ensuring that unclaimed assets are safeguarded and eventually returned to their owners.

Steps to Access Unclaimed Funds

To access unclaimed funds through the Office of the Ohio Treasurer, follow these steps:

- Visit the official Ohio Treasurer's website dedicated to unclaimed funds.

- Use the search tool to enter your name or business name to check for any unclaimed assets.

- If you find unclaimed funds, click on the relevant link for more details.

- Complete the required claim form, providing necessary identification and documentation.

- Submit the claim form online or via mail, depending on your preference.

Eligibility Criteria for Claiming Funds

To be eligible to claim unclaimed funds, individuals must demonstrate ownership of the assets. This may involve providing identification, proof of address, and any relevant documentation that links them to the unclaimed funds. Businesses must provide similar documentation, including business registration details and identification of authorized representatives.

Required Documentation for Claims

When filing a claim for unclaimed funds, it is essential to gather the necessary documentation to support your claim. Commonly required documents include:

- A valid government-issued photo ID.

- Proof of address, such as a utility bill or bank statement.

- Any documentation that verifies your ownership of the unclaimed funds, such as account statements or policy documents.

Submission Methods for Claims

Claims for unclaimed funds can be submitted through various methods:

- Online: Complete and submit the claim form directly through the Ohio Treasurer's website.

- By Mail: Print the claim form, fill it out, and send it to the address provided on the form.

- In-Person: Visit the Ohio Treasurer's office to submit your claim and receive assistance from staff.

Important Deadlines for Claims

While there are no strict deadlines for claiming unclaimed funds, it is advisable to file your claim as soon as you identify potential assets. The longer you wait, the more complicated the process may become, especially if additional documentation is required. Regularly checking for unclaimed funds can help ensure you do not miss out on any assets that belong to you.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the unclaimed funds office of the ohio treasurer ohio gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Unclaimed Funds and how can I access them through the Office Of The Ohio Treasurer?

Unclaimed Funds refer to money that has been abandoned or unclaimed by its rightful owner. You can access these funds through the Office Of The Ohio Treasurer by visiting their official website, Ohio gov, where you can search for your name and claim any funds that may belong to you.

-

How does airSlate SignNow help in managing documents related to Unclaimed Funds?

airSlate SignNow provides a streamlined solution for managing documents related to Unclaimed Funds. With our easy-to-use platform, you can securely send and eSign necessary documents required by the Office Of The Ohio Treasurer, ensuring a hassle-free process.

-

What are the costs associated with using airSlate SignNow for Unclaimed Funds documentation?

airSlate SignNow offers a cost-effective solution for managing your Unclaimed Funds documentation. Our pricing plans are designed to fit various business needs, allowing you to choose a plan that best suits your requirements while ensuring compliance with the Office Of The Ohio Treasurer's guidelines.

-

Can I integrate airSlate SignNow with other tools for managing Unclaimed Funds?

Yes, airSlate SignNow offers integrations with various tools and platforms that can help you manage Unclaimed Funds more efficiently. By integrating with your existing systems, you can streamline your workflow and ensure that all documentation related to the Office Of The Ohio Treasurer is handled seamlessly.

-

What features does airSlate SignNow offer for handling Unclaimed Funds?

airSlate SignNow includes features such as eSigning, document templates, and secure storage, all of which are essential for handling Unclaimed Funds. These features ensure that your documents are processed quickly and securely, meeting the requirements set by the Office Of The Ohio Treasurer.

-

How can airSlate SignNow improve the efficiency of claiming Unclaimed Funds?

By using airSlate SignNow, you can signNowly improve the efficiency of claiming Unclaimed Funds. Our platform allows for quick document preparation and eSigning, reducing the time it takes to submit your claims to the Office Of The Ohio Treasurer.

-

Is airSlate SignNow compliant with the regulations of the Office Of The Ohio Treasurer?

Yes, airSlate SignNow is designed to be compliant with the regulations set forth by the Office Of The Ohio Treasurer. Our platform ensures that all documentation related to Unclaimed Funds adheres to the necessary legal standards, providing peace of mind for users.

Get more for Unclaimed Funds Office Of The Ohio Treasurer Ohio gov

- Livestock bill of lading form

- Ext 1042 form

- Upholstered and stuffed articles act form

- Ontario application fillable form

- Demande de certificat international damp39importation ext1020 international gc form

- Confidential character reference for authorization to teach in bc form

- Fisheries and oceans vrn form

- Haydounca form

Find out other Unclaimed Funds Office Of The Ohio Treasurer Ohio gov

- Electronic signature Indiana Postnuptial Agreement Template Later

- Electronic signature New York Postnuptial Agreement Template Secure

- How Can I Electronic signature Colorado Prenuptial Agreement Template

- Electronic signature California Divorce Settlement Agreement Template Free

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later