KW 5 Withholding Tax Deposit Report Rev 6 19 Withholding Tax 2022-2026

What is the KW 5 Withholding Tax Deposit Report Rev 6 19 Withholding Tax

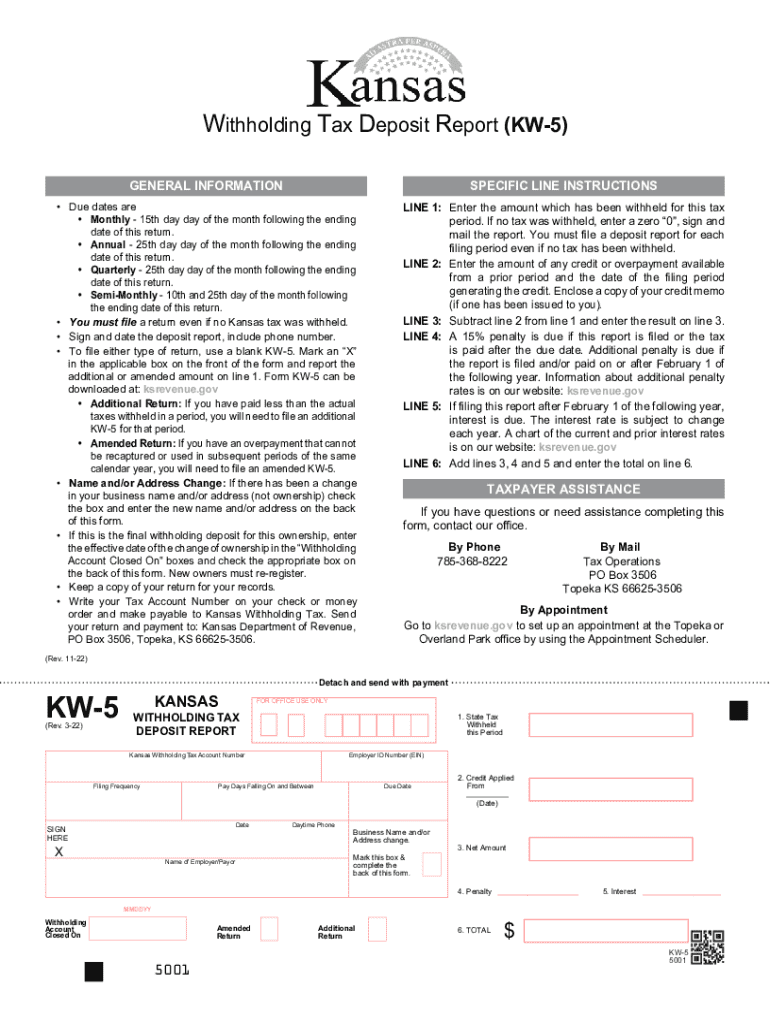

The KW 5 Withholding Tax Deposit Report Rev 6 19 is a crucial document used by businesses to report and deposit withheld taxes. This form is specifically designed for employers to report federal income tax withheld from employee wages, as well as other applicable taxes. It is essential for compliance with Internal Revenue Service (IRS) regulations, ensuring that businesses fulfill their tax obligations accurately and timely.

How to use the KW 5 Withholding Tax Deposit Report Rev 6 19 Withholding Tax

To effectively use the KW 5 Withholding Tax Deposit Report, businesses must first gather all necessary information regarding the taxes withheld during the reporting period. This includes employee wages, the amount of federal income tax withheld, and any additional taxes applicable. Once the information is compiled, the form can be filled out, detailing the total amounts and submitted to the IRS along with the payment. It is important to ensure that all figures are accurate to avoid penalties.

Steps to complete the KW 5 Withholding Tax Deposit Report Rev 6 19 Withholding Tax

Completing the KW 5 Withholding Tax Deposit Report involves several key steps:

- Gather all relevant payroll records and tax withholding information.

- Fill out the form, ensuring that all fields are completed accurately.

- Calculate the total amount of taxes withheld and any additional deposits required.

- Review the completed form for accuracy before submission.

- Submit the form along with the payment to the IRS by the specified deadline.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the KW 5 Withholding Tax Deposit Report. These guidelines include instructions on how to accurately report withheld amounts, deadlines for submission, and acceptable payment methods. It is important for businesses to familiarize themselves with these guidelines to ensure compliance and avoid potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the KW 5 Withholding Tax Deposit Report are critical for compliance. Generally, employers must submit their deposits on a monthly or semi-weekly basis, depending on the amount of tax withheld in previous periods. It is essential to keep track of these deadlines to avoid late fees and interest charges. The IRS typically provides a calendar outlining these important dates, which can be a helpful resource for businesses.

Penalties for Non-Compliance

Failure to properly complete and submit the KW 5 Withholding Tax Deposit Report can result in significant penalties. These may include fines for late submissions, interest on unpaid taxes, and potential legal repercussions. To mitigate these risks, businesses should ensure they understand their obligations and maintain accurate records of all tax withholdings and deposits.

Create this form in 5 minutes or less

Find and fill out the correct kw 5 withholding tax deposit report rev 6 19 withholding tax

Create this form in 5 minutes!

How to create an eSignature for the kw 5 withholding tax deposit report rev 6 19 withholding tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the KW 5 Withholding Tax Deposit Report Rev 6 19 Withholding Tax?

The KW 5 Withholding Tax Deposit Report Rev 6 19 Withholding Tax is a crucial document for businesses to report their withholding tax deposits accurately. This report ensures compliance with tax regulations and helps businesses avoid penalties. Utilizing airSlate SignNow can streamline the process of generating and submitting this report.

-

How does airSlate SignNow help with the KW 5 Withholding Tax Deposit Report Rev 6 19 Withholding Tax?

airSlate SignNow simplifies the creation and eSigning of the KW 5 Withholding Tax Deposit Report Rev 6 19 Withholding Tax. Our platform allows users to fill out the report electronically, ensuring accuracy and efficiency. This reduces the time spent on paperwork and enhances compliance with tax requirements.

-

Is there a cost associated with using airSlate SignNow for the KW 5 Withholding Tax Deposit Report Rev 6 19 Withholding Tax?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions provide access to features that facilitate the completion of the KW 5 Withholding Tax Deposit Report Rev 6 19 Withholding Tax. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the KW 5 Withholding Tax Deposit Report Rev 6 19 Withholding Tax?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking for the KW 5 Withholding Tax Deposit Report Rev 6 19 Withholding Tax. These tools enhance the user experience and ensure that all necessary information is captured accurately. Additionally, our platform allows for easy collaboration among team members.

-

Can I integrate airSlate SignNow with other software for the KW 5 Withholding Tax Deposit Report Rev 6 19 Withholding Tax?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software to streamline the process of managing the KW 5 Withholding Tax Deposit Report Rev 6 19 Withholding Tax. This ensures that your data flows seamlessly between platforms, reducing manual entry and potential errors.

-

What are the benefits of using airSlate SignNow for the KW 5 Withholding Tax Deposit Report Rev 6 19 Withholding Tax?

Using airSlate SignNow for the KW 5 Withholding Tax Deposit Report Rev 6 19 Withholding Tax provides numerous benefits, including increased efficiency, enhanced accuracy, and improved compliance. Our platform allows for quick document turnaround and reduces the risk of errors associated with manual processes. This ultimately saves time and resources for your business.

-

Is airSlate SignNow secure for handling the KW 5 Withholding Tax Deposit Report Rev 6 19 Withholding Tax?

Yes, airSlate SignNow prioritizes security and compliance when handling sensitive documents like the KW 5 Withholding Tax Deposit Report Rev 6 19 Withholding Tax. Our platform employs advanced encryption and security protocols to protect your data. You can trust that your information is safe while using our services.

Get more for KW 5 Withholding Tax Deposit Report Rev 6 19 Withholding Tax

Find out other KW 5 Withholding Tax Deposit Report Rev 6 19 Withholding Tax

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template