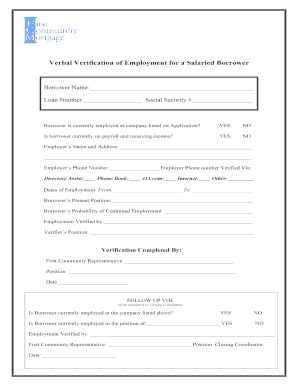

Verbal Verification of Employment for a Salaried Borrower Form

What is the Verbal Verification Of Employment For A Salaried Borrower

The Verbal Verification Of Employment For A Salaried Borrower is a process used by lenders to confirm a borrower's employment status and income. This verification typically involves a phone call to the borrower's employer, where the lender seeks to validate the information provided in the loan application. The purpose is to ensure that the borrower has a stable income source, which is crucial for assessing their ability to repay the loan. This process is particularly important in the mortgage lending industry, where financial stability is a key factor in loan approval.

How to obtain the Verbal Verification Of Employment For A Salaried Borrower

To obtain a Verbal Verification Of Employment, lenders usually initiate the process by contacting the borrower's employer directly. The lender will need to gather specific details, including the borrower's job title, length of employment, and salary information. It is advisable for borrowers to inform their employer in advance about the verification request to ensure a smooth process. Employers may require a signed release from the borrower before providing this information, so it is important for borrowers to be prepared with the necessary documentation.

Steps to complete the Verbal Verification Of Employment For A Salaried Borrower

Completing the Verbal Verification Of Employment involves several key steps:

- The lender contacts the employer's human resources department or direct supervisor.

- The lender verifies the borrower's employment status, including job title and duration of employment.

- The lender confirms the borrower's income, which may include base salary and any bonuses or commissions.

- The lender documents the information received during the call for their records.

These steps help ensure that the verification process is thorough and accurate, contributing to the overall assessment of the borrower's financial situation.

Key elements of the Verbal Verification Of Employment For A Salaried Borrower

Several key elements are essential in the Verbal Verification Of Employment process:

- Employer Information: The name, address, and contact details of the employer.

- Borrower Details: The borrower's full name, job title, and employment start date.

- Income Verification: Confirmation of the borrower's salary, including any additional compensation.

- Employment Status: Verification that the borrower is currently employed and in good standing.

These elements are crucial for lenders to make informed decisions regarding loan approval.

Legal use of the Verbal Verification Of Employment For A Salaried Borrower

The Verbal Verification Of Employment is governed by various legal standards, including privacy laws that protect employee information. Lenders must ensure that they obtain consent from the borrower before contacting their employer. Additionally, the information gathered must be used solely for the purpose of evaluating the borrower's loan application. Compliance with the Fair Credit Reporting Act (FCRA) is also necessary, as it outlines the requirements for obtaining and using consumer information.

Examples of using the Verbal Verification Of Employment For A Salaried Borrower

Examples of situations where the Verbal Verification Of Employment is used include:

- A borrower applying for a mortgage to purchase a new home.

- A salaried employee seeking a personal loan for debt consolidation.

- A borrower refinancing an existing loan to secure a lower interest rate.

In each of these scenarios, the lender relies on the verbal verification process to confirm the borrower's employment and income stability, which are critical factors in the decision-making process.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the verbal verification of employment for a salaried borrower

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Verbal Verification Of Employment For A Salaried Borrower?

Verbal Verification Of Employment For A Salaried Borrower is a process where lenders confirm a borrower's employment status through direct communication with their employer. This verification helps ensure that the borrower has a stable income, which is crucial for loan approval. Using airSlate SignNow, this process can be streamlined and documented efficiently.

-

How does airSlate SignNow facilitate Verbal Verification Of Employment For A Salaried Borrower?

airSlate SignNow simplifies the Verbal Verification Of Employment For A Salaried Borrower by allowing users to send and eSign necessary documents quickly. The platform provides templates and automated workflows that help in managing the verification process seamlessly. This ensures that all parties involved can access and complete the verification in a timely manner.

-

What are the benefits of using airSlate SignNow for Verbal Verification Of Employment?

Using airSlate SignNow for Verbal Verification Of Employment For A Salaried Borrower offers numerous benefits, including increased efficiency and reduced turnaround time. The platform's user-friendly interface allows for easy document management and tracking. Additionally, it enhances compliance and security, ensuring that sensitive information is handled appropriately.

-

Is there a cost associated with using airSlate SignNow for Verbal Verification Of Employment?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. Pricing plans vary based on features and usage, allowing you to choose the best option for your needs. Investing in airSlate SignNow can save time and resources in the Verbal Verification Of Employment For A Salaried Borrower process.

-

Can airSlate SignNow integrate with other tools for Verbal Verification Of Employment?

Absolutely! airSlate SignNow offers integrations with various CRM and document management systems, enhancing the Verbal Verification Of Employment For A Salaried Borrower process. These integrations allow for seamless data transfer and improved workflow efficiency. This means you can manage all your verification needs within your existing software ecosystem.

-

How secure is the Verbal Verification Of Employment process with airSlate SignNow?

The security of the Verbal Verification Of Employment For A Salaried Borrower process is a top priority for airSlate SignNow. The platform employs advanced encryption and security protocols to protect sensitive information. Additionally, it complies with industry standards to ensure that all data is handled securely throughout the verification process.

-

What features does airSlate SignNow offer for managing Verbal Verification Of Employment?

airSlate SignNow provides a range of features for managing Verbal Verification Of Employment For A Salaried Borrower, including customizable templates, automated reminders, and real-time tracking. These features help streamline the verification process and ensure that all necessary steps are completed efficiently. Users can also access analytics to monitor the status of their verifications.

Get more for Verbal Verification Of Employment For A Salaried Borrower

- Employee application employee application form

- Form c4

- Himp 1109 workersamp39 compensation board new york state wcb ny form

- New york state department of labor customer registration form

- Dwc ad form 1013353sjdb

- Notice of offer of modified or alternative work state of california dir ca form

- De9adj instructions form

- County of los angeles youthwork program form

Find out other Verbal Verification Of Employment For A Salaried Borrower

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document