Es 903 Nm Tax Form

What is the Es 903 Nm Tax Form

The Es 903 Nm Tax Form is a state-specific tax document used in New Mexico for reporting certain income and tax obligations. This form is primarily utilized by individuals and businesses to ensure compliance with state tax laws. It is essential for accurately reporting income, calculating tax liabilities, and claiming any applicable credits or deductions. Understanding the purpose of this form is crucial for taxpayers to avoid penalties and ensure proper filing.

How to use the Es 903 Nm Tax Form

Using the Es 903 Nm Tax Form involves several key steps. First, gather all necessary financial documents, including income statements and any relevant deductions. Next, carefully complete the form by entering the required information in the designated fields. It is important to double-check all entries for accuracy to prevent errors that could lead to delays or penalties. Once completed, the form can be submitted according to the specified methods, which may include online filing or mailing it to the appropriate tax authority.

Steps to complete the Es 903 Nm Tax Form

Completing the Es 903 Nm Tax Form requires a systematic approach. Begin by downloading the form from the New Mexico tax authority's website or obtaining a physical copy. Follow these steps:

- Fill in your personal information, including name, address, and Social Security number.

- Report your income sources accurately, ensuring to include all taxable income.

- Calculate your total tax liability based on the provided tax rates.

- Claim any deductions or credits you are eligible for, ensuring you have the necessary documentation.

- Review the entire form for accuracy before submission.

Key elements of the Es 903 Nm Tax Form

The Es 903 Nm Tax Form includes several key elements that are critical for accurate reporting. These elements typically consist of:

- Personal Information: Name, address, and taxpayer identification number.

- Income Reporting: Sections to detail various sources of income.

- Tax Calculation: A breakdown of how the tax owed is calculated.

- Deductions and Credits: Areas to claim applicable deductions and tax credits.

- Signature Section: A place for the taxpayer's signature, affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

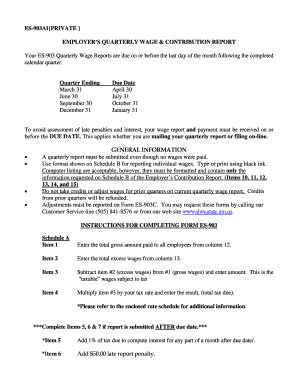

Filing deadlines for the Es 903 Nm Tax Form are crucial for compliance. Typically, the form must be submitted by April 15 for individual taxpayers, aligning with federal tax deadlines. However, specific circumstances, such as extensions or special situations, may alter these dates. It is advisable to check the New Mexico tax authority's website for any updates or changes to deadlines to ensure timely submission.

Who Issues the Form

The Es 903 Nm Tax Form is issued by the New Mexico Taxation and Revenue Department. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. They provide resources and guidance for individuals and businesses to understand their tax obligations and the proper use of the form.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the es 903 nm tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Es 903 Nm Tax Form?

The Es 903 Nm Tax Form is a specific tax document used in New Mexico for reporting certain tax-related information. It is essential for businesses and individuals to understand its requirements to ensure compliance with state tax laws. Utilizing airSlate SignNow can simplify the process of preparing and submitting this form.

-

How can airSlate SignNow help with the Es 903 Nm Tax Form?

airSlate SignNow provides an easy-to-use platform for businesses to create, send, and eSign the Es 903 Nm Tax Form efficiently. With its intuitive interface, users can quickly fill out the form and ensure all necessary signatures are obtained. This streamlines the tax filing process and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the Es 903 Nm Tax Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and reflects the value of the features provided, including eSigning and document management for forms like the Es 903 Nm Tax Form. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for the Es 903 Nm Tax Form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are beneficial for managing the Es 903 Nm Tax Form. These features enhance efficiency and ensure that all parties involved can easily access and sign the document. Additionally, the platform supports collaboration among team members.

-

Can I integrate airSlate SignNow with other software for the Es 903 Nm Tax Form?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage the Es 903 Nm Tax Form alongside your existing tools. This allows for seamless data transfer and enhances your overall workflow, ensuring that you can handle tax documents efficiently.

-

What are the benefits of using airSlate SignNow for tax forms like the Es 903 Nm Tax Form?

Using airSlate SignNow for the Es 903 Nm Tax Form provides numerous benefits, including time savings, reduced paperwork, and enhanced security. The platform ensures that your documents are stored securely and are easily accessible when needed. Additionally, the eSigning feature speeds up the approval process, allowing for quicker submissions.

-

Is airSlate SignNow user-friendly for filing the Es 903 Nm Tax Form?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible for individuals and businesses alike. The straightforward interface allows users to navigate the process of filling out and eSigning the Es 903 Nm Tax Form without any technical expertise. This ensures a smooth experience for all users.

Get more for Es 903 Nm Tax Form

- Cpt code training from the old to the new alameda form

- Biodynamic craniosacral therapy client intake form

- Metabolic monitoring form

- Hmsa facility and ancillary credentialing application form

- Id no military credityesno release know form

- Medical claim form mhbp accessible medical claim form mhbp

- Sending by renaming the sender fax header settings form

- When teens disclose dating violence to health care providers form

Find out other Es 903 Nm Tax Form

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple