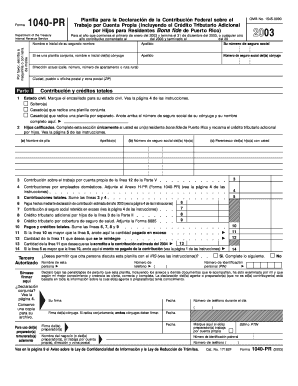

Form 1040 PR Planilla Para La Declaracion De La Contribucion Federal Sobre El Trabajo Por Cuenta Propia Puerto Rico

What is the Form 1040 PR Planilla Para La Declaracion De La Contribucion Federal Sobre El Trabajo Por Cuenta Propia Puerto Rico

The Form 1040 PR is a crucial document for self-employed individuals in Puerto Rico. It serves as the federal income tax return specifically designed for reporting income earned from self-employment activities. This form allows taxpayers to calculate their tax liability based on their net earnings, ensuring compliance with federal tax regulations. Understanding the purpose and requirements of the 1040 PR is essential for accurate reporting and avoiding potential penalties.

How to use the Form 1040 PR Planilla Para La Declaracion De La Contribucion Federal Sobre El Trabajo Por Cuenta Propia Puerto Rico

Using the Form 1040 PR involves several key steps. First, gather all necessary financial documents, including records of income and expenses related to self-employment. Next, accurately fill out the form by entering personal information, income details, and deductions. It is important to review the instructions provided with the form to ensure all sections are completed correctly. Once filled out, the form can be submitted either electronically or by mail, depending on the taxpayer's preference.

Steps to complete the Form 1040 PR Planilla Para La Declaracion De La Contribucion Federal Sobre El Trabajo Por Cuenta Propia Puerto Rico

Completing the Form 1040 PR requires careful attention to detail. Follow these steps for successful completion:

- Start by entering your personal information, including your name, address, and Social Security number.

- Report your total income from self-employment on the designated lines.

- Deduct any allowable business expenses to determine your net earnings.

- Calculate your tax liability based on the net earnings reported.

- Review the form for accuracy and completeness before submission.

Required Documents

To complete the Form 1040 PR, certain documents are necessary. These include:

- Records of all income earned from self-employment.

- Receipts and documentation for business expenses.

- Any prior year tax returns for reference.

- Social Security number or Individual Taxpayer Identification Number (ITIN).

Penalties for Non-Compliance

Failure to file the Form 1040 PR or inaccuracies in reporting can lead to significant penalties. The IRS may impose fines for late filing or underreporting income. Additionally, interest may accrue on any unpaid taxes. It is crucial to adhere to filing deadlines and ensure all information is accurate to avoid these consequences.

Filing Deadlines / Important Dates

Timely submission of the Form 1040 PR is essential. The typical filing deadline is April 15 of each year, aligning with the general tax filing season. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should stay informed about any changes to deadlines to ensure compliance.

Quick guide on how to complete 2003 form 1040 pr planilla para la declaracion de la contribucion federal sobre el trabajo por cuenta propia puerto rico

Effortlessly Prepare Form 1040 PR Planilla Para La Declaracion De La Contribucion Federal Sobre El Trabajo Por Cuenta Propia Puerto Rico on Any Device

Managing documents online has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, enabling you to access the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without any delays. Manage Form 1040 PR Planilla Para La Declaracion De La Contribucion Federal Sobre El Trabajo Por Cuenta Propia Puerto Rico on any platform with the airSlate SignNow apps for Android or iOS, and enhance any document-related process today.

How to Edit and Electronically Sign Form 1040 PR Planilla Para La Declaracion De La Contribucion Federal Sobre El Trabajo Por Cuenta Propia Puerto Rico with Ease

- Locate Form 1040 PR Planilla Para La Declaracion De La Contribucion Federal Sobre El Trabajo Por Cuenta Propia Puerto Rico and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to send your form—via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or mislaid files, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 1040 PR Planilla Para La Declaracion De La Contribucion Federal Sobre El Trabajo Por Cuenta Propia Puerto Rico to ensure effective communication at any step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2003 form 1040 pr planilla para la declaracion de la contribucion federal sobre el trabajo por cuenta propia puerto rico

How to generate an eSignature for your 2003 Form 1040 Pr Planilla Para La Declaracion De La Contribucion Federal Sobre El Trabajo Por Cuenta Propia Puerto Rico online

How to generate an eSignature for your 2003 Form 1040 Pr Planilla Para La Declaracion De La Contribucion Federal Sobre El Trabajo Por Cuenta Propia Puerto Rico in Chrome

How to generate an electronic signature for signing the 2003 Form 1040 Pr Planilla Para La Declaracion De La Contribucion Federal Sobre El Trabajo Por Cuenta Propia Puerto Rico in Gmail

How to create an electronic signature for the 2003 Form 1040 Pr Planilla Para La Declaracion De La Contribucion Federal Sobre El Trabajo Por Cuenta Propia Puerto Rico from your smartphone

How to generate an eSignature for the 2003 Form 1040 Pr Planilla Para La Declaracion De La Contribucion Federal Sobre El Trabajo Por Cuenta Propia Puerto Rico on iOS devices

How to make an eSignature for the 2003 Form 1040 Pr Planilla Para La Declaracion De La Contribucion Federal Sobre El Trabajo Por Cuenta Propia Puerto Rico on Android

People also ask

-

What are planillas federales and why are they important?

Planillas federales are official forms required by federal agencies for tax reporting and compliance. They are essential for businesses to accurately report income, expenses, and deductions, ensuring compliance with federal tax regulations. Understanding and utilizing planillas federales correctly can help avoid penalties and optimize tax returns.

-

How can airSlate SignNow assist with planillas federales?

airSlate SignNow provides a seamless platform for businesses to create, send, and eSign planillas federales. Our solution simplifies the process of managing these forms, allowing for quick approvals and securely storing documents in one place. With airSlate SignNow, users can easily navigate complex paperwork without the hassle.

-

What features does airSlate SignNow offer for handling planillas federales?

airSlate SignNow includes features like customizable templates for planillas federales, secure eSignature options, and audit trails to track document changes. Users can collaborate in real-time and ensure that all necessary stakeholders can review and sign the documents quickly. These features streamline the paperwork process for federal forms.

-

Is airSlate SignNow a cost-effective solution for managing planillas federales?

Yes, airSlate SignNow offers a cost-effective solution for managing planillas federales, with pricing plans tailored to fit different business sizes and needs. By eliminating the need for printing and shipping, our platform also helps reduce overhead costs signNowly. Users can maximize efficiency and save money simultaneously.

-

Can airSlate SignNow integrate with other software for planillas federales?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and CRM software, making it easy to manage planillas federales alongside other business processes. This integration ensures that all data remains consistent and accessible, further streamlining your workflow and enhancing productivity.

-

What benefits do I get from using airSlate SignNow for planillas federales?

Using airSlate SignNow for planillas federales enhances efficiency, reduces turnaround time, and minimizes errors associated with manual handling of documents. Our intuitive interface helps users easily create and manage federal forms, while robust security measures protect sensitive information. Ultimately, this leads to a more organized and professional approach to federal compliance.

-

Is there a free trial available for airSlate SignNow to test planillas federales features?

Yes, airSlate SignNow offers a free trial that allows potential users to explore features related to planillas federales without any commitment. During the trial, you can experience firsthand how our platform simplifies document management and eSigning. This is a great opportunity to evaluate if it meets your business needs.

Get more for Form 1040 PR Planilla Para La Declaracion De La Contribucion Federal Sobre El Trabajo Por Cuenta Propia Puerto Rico

Find out other Form 1040 PR Planilla Para La Declaracion De La Contribucion Federal Sobre El Trabajo Por Cuenta Propia Puerto Rico

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney