Rp 5217 2010-2026

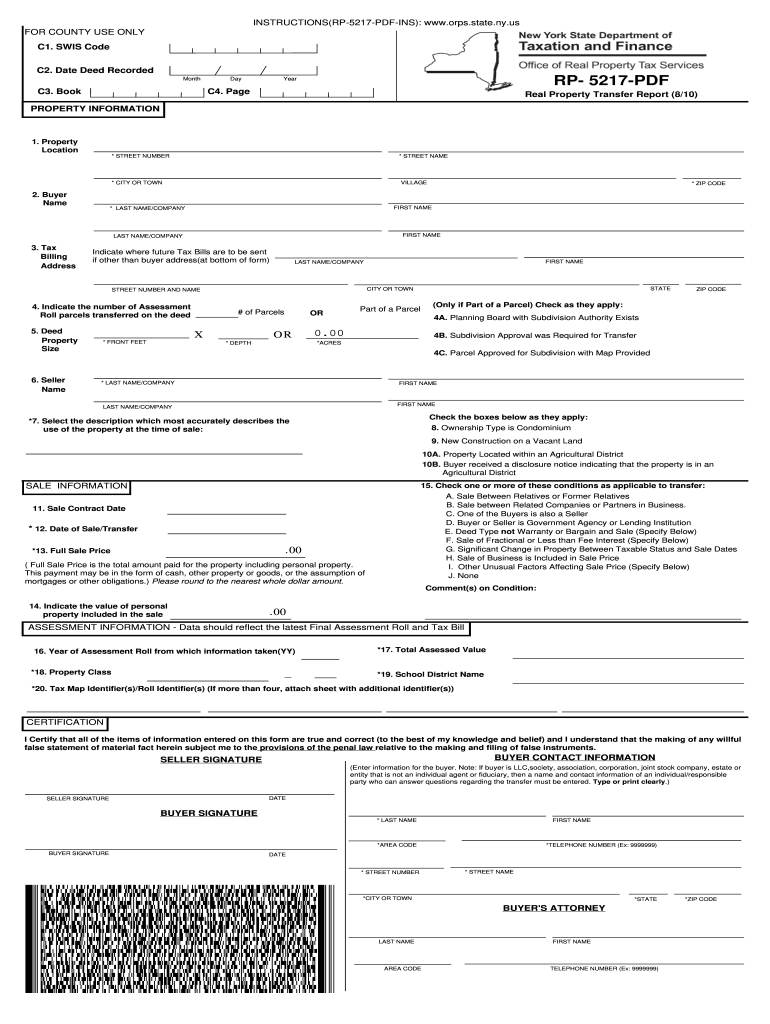

What is the Rp 5217?

The Rp 5217 is a New York State form used primarily for reporting real property tax exemptions. This form allows property owners to claim specific exemptions, which can significantly reduce their property tax liability. It is essential for individuals and businesses that own real estate in New York to understand the purpose and implications of this form to ensure compliance with state tax regulations.

How to use the Rp 5217

To effectively use the Rp 5217, property owners must first determine their eligibility for the exemptions offered. The form requires detailed information about the property, including its location, ownership details, and the specific exemption being claimed. Once completed, the form must be submitted to the appropriate local tax authority. It is advisable to keep a copy for personal records and to ensure all information is accurate to avoid potential penalties.

Steps to complete the Rp 5217

Completing the Rp 5217 involves several key steps:

- Gather necessary information about the property, including its address and ownership details.

- Identify the specific exemption you are eligible for and ensure you meet the criteria.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to your local tax authority by the specified deadline.

Legal use of the Rp 5217

The legal use of the Rp 5217 is governed by New York State tax laws. Property owners must ensure that they are eligible for the exemptions they are claiming and that all information provided is truthful and accurate. Misrepresentation or fraudulent claims can lead to penalties, including fines and loss of exemptions. It is crucial to adhere to all legal requirements when submitting this form.

Filing Deadlines / Important Dates

Filing deadlines for the Rp 5217 vary depending on the type of exemption being claimed. Generally, property owners should submit the form by the first of March for the upcoming tax year. It is important to check with local tax authorities for specific deadlines related to different exemptions to avoid missing out on potential tax savings.

Required Documents

When completing the Rp 5217, property owners may need to provide supporting documentation. This can include proof of ownership, income verification, and any other documents required to substantiate the exemption claim. Having these documents ready can facilitate a smoother application process and ensure compliance with state requirements.

Quick guide on how to complete rp 5217 pdf fillable form

Your assistance manual on how to prepare your Rp 5217

If you’re curious about how to complete and submit your Rp 5217, here are a few straightforward instructions on how to make tax processing easier.

To begin, you simply need to create your airSlate SignNow account to transform your document handling online. airSlate SignNow is an exceptionally user-friendly and powerful document tool that enables you to modify, draft, and finalize your tax forms with ease. With its editor, you can switch among text, checkboxes, and eSignatures, and return to adjust details as necessary. Streamline your tax administration with advanced PDF modification, eSigning, and easy sharing.

Follow the steps below to complete your Rp 5217 in a matter of minutes:

- Set up your account and begin working on PDFs in a flash.

- Utilize our library to obtain any IRS tax form; explore different versions and schedules.

- Click Get form to open your Rp 5217 in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to affix your legally-binding eSignature (if needed).

- Examine your document and correct any discrepancies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Leverage this guide to electronically file your taxes with airSlate SignNow. Be aware that filing on paper may increase return errors and postpone reimbursements. It’s important to check the IRS website for submission rules in your state prior to e-filing your taxes.

Create this form in 5 minutes or less

FAQs

-

How do I make a PDF a fillable form?

1. Open it with Foxit PhantomPDF and choose Form > Form Recognition > Run Form Field Recognition . All fillable fields in the document will be recognized and highlighted.2. Add form fields from Form > Form Fields > click a type of form field button and the cursor changes to crosshair . And the Designer Assistant is selected automatically.3. All the corresponding type of form fields will be automatically named with the text near the form fields (Take the text fields for an example as below).4. Click the place you want to add the form field. To edit the form field further, please refer to the properties of different buttons from “Buttons”.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

How can I edit a PDF or fillable PDF form?

You can try out Fill which has a free forever plan and requires no download.This works best if you just want to complete or fill in an fillable PDF.You simply upload your PDF and then fill it in within the browser:If the fields are live, as in the example above, simple fill them in. If the fields are not live you can drag on the fields to complete it quickly.Upload your PDF to get started here

-

What is the simplest way to create PDF fillable forms on a Mac?

A really easy (and FREE) way is using Open Office, an open source alternative to Microsoft Office Suite. It has an export to PDF option that I have found very useful. Here is a blurb from their website...OpenOffice.org 3 is the leading open-sourceoffice software suite for word processing,spreadsheets, presentations, graphics, databasesand more. It is available in many languages and works on all common computers. It stores all your data in an international open standard format and can also read and write files from other common office software packages. It can be downloaded and used completely free of charge for any purpose. You can download it at http://download.openoffice.org/If you need any additional assistance, send me a message in my inbox.

-

How do I fill out a fillable PDF on an iPad?

there is an app for that !signNow Fill & Sign on the App Store

-

How do I transfer data from Google Sheets cells to a PDF fillable form?

I refer you a amazing pdf editor, her name is Puspita, She work in fiverr, She is just amazing, Several time I am use her services. You can contact with her.puspitasaha : I will create fillable pdf form or edit pdf file for $5 on www.fiverr.com

-

In Mac OS X, what's the easiest way to save a non-fillable PDF form?

You can use signNow. On-line PDF form Filler, Editor, Type on PDF ; Fill, Print, Email, Fax and Export to upload any PDF, type on it and then save in PDF format on your computer. You can also esign it, email, fax or share the filled out PDF. You can also convert your Word or PPT documents to PDF format, and then type or fill them out as well. Over 100K people trust signNow to manage their PDF documents and forms.

Create this form in 5 minutes!

How to create an eSignature for the rp 5217 pdf fillable form

How to create an electronic signature for your Rp 5217 Pdf Fillable Form in the online mode

How to create an electronic signature for the Rp 5217 Pdf Fillable Form in Chrome

How to create an eSignature for signing the Rp 5217 Pdf Fillable Form in Gmail

How to make an electronic signature for the Rp 5217 Pdf Fillable Form right from your smartphone

How to generate an electronic signature for the Rp 5217 Pdf Fillable Form on iOS

How to make an electronic signature for the Rp 5217 Pdf Fillable Form on Android devices

People also ask

-

What is the pricing structure for Rp 5217 with airSlate SignNow?

The pricing for Rp 5217 with airSlate SignNow is designed to be cost-effective for businesses of all sizes. You can choose from various plans that cater to different needs, providing flexibility in terms of features and usage. This means you can select the plan that best fits your budget while still accessing essential eSigning capabilities.

-

How does airSlate SignNow support businesses using Rp 5217?

airSlate SignNow provides an intuitive platform that simplifies the process of sending and eSigning documents for businesses utilizing Rp 5217. With its user-friendly interface, teams can easily manage their documents and streamline workflows. This efficiency leads to faster turnaround times and improved productivity.

-

What features are included with the Rp 5217 plan?

The Rp 5217 plan includes a range of features such as unlimited document signing, customizable templates, and real-time tracking of document status. Additionally, it allows for secure storage and easy sharing of documents, making it ideal for businesses that require reliable eSignature solutions.

-

Can I integrate airSlate SignNow with other applications while using Rp 5217?

Yes, airSlate SignNow supports seamless integrations with a variety of applications when using the Rp 5217 plan. This includes popular tools like Salesforce, Google Drive, and Microsoft Office, allowing you to enhance your workflow and maintain efficiency across your business processes.

-

What are the benefits of choosing Rp 5217 for eSigning documents?

Choosing the Rp 5217 plan offers several benefits, including cost savings and enhanced operational efficiency. With its easy-to-use interface, you can quickly send, sign, and manage documents without the hassle of traditional paper-based processes. This not only saves time but also reduces environmental impact.

-

Is there customer support available for users of Rp 5217?

Absolutely! Users of the Rp 5217 plan can access dedicated customer support at airSlate SignNow. Whether you have questions about features, need help with integrations, or require technical assistance, our support team is available to ensure you get the most out of your eSignature experience.

-

How secure is the airSlate SignNow platform for Rp 5217 users?

Security is a top priority for airSlate SignNow, especially for users on the Rp 5217 plan. The platform employs advanced encryption protocols and complies with industry standards to protect your sensitive information. You can confidently send and sign documents knowing that your data is secure.

Get more for Rp 5217

- Physicians return to work pdf form

- Generational differences compiled by dennis gaylor http nctc fws form

- Ra lr1 sj final 7 3 14p65 housing ny form

- Contractors final release and waiver of lien form

- V blades delaware form

- Non hazardous manifest form

- Offer of proof exhibit courts alaska form

- 2013 form mo ptc property tax credit claim dor mo

Find out other Rp 5217

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors