Forma 943 Pr

What is the Forma 943 Pr

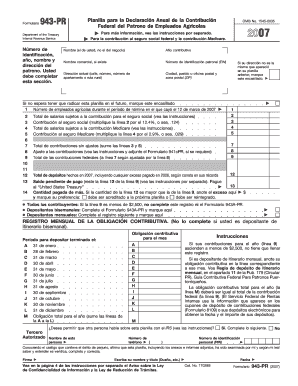

The Forma 943 Pr is a specific tax form used in the United States for reporting agricultural employment taxes. It is essential for employers in the agricultural sector to accurately report wages paid to farmworkers and the associated taxes. This form helps ensure compliance with federal tax regulations and assists in the proper calculation of payroll taxes related to agricultural operations.

How to use the Forma 943 Pr

Using the Forma 943 Pr involves several steps to ensure accurate reporting. First, gather all necessary information regarding employee wages, hours worked, and any applicable deductions. Next, complete the form by entering the required details in the designated fields. It is crucial to double-check all entries for accuracy before submission, as errors can lead to penalties or delays in processing. Once completed, the form can be submitted electronically or via mail, depending on your preference.

Steps to complete the Forma 943 Pr

Completing the Forma 943 Pr requires careful attention to detail. Follow these steps:

- Gather employee wage information and tax data.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Sign and date the form to certify its accuracy.

- Submit the form electronically or by mail to the appropriate tax authority.

Legal use of the Forma 943 Pr

The Forma 943 Pr is legally binding when completed and submitted according to IRS guidelines. It is essential for employers to ensure that the information provided is truthful and accurate, as any discrepancies can lead to legal consequences. Compliance with tax laws is crucial to avoid penalties and maintain good standing with the IRS.

Filing Deadlines / Important Dates

Timely filing of the Forma 943 Pr is critical to avoid penalties. Generally, the form must be submitted by January 31 of the year following the tax year being reported. Employers should also be aware of any additional deadlines related to employee tax payments and other reporting requirements to ensure full compliance.

Form Submission Methods (Online / Mail / In-Person)

The Forma 943 Pr can be submitted through various methods to accommodate different preferences. Employers can choose to file the form electronically through approved e-filing systems, which often provide immediate confirmation of receipt. Alternatively, the form can be mailed directly to the IRS or submitted in person at designated tax offices. Each method has its own advantages, such as convenience or direct interaction with tax officials.

Quick guide on how to complete forma 943 pr 2007

Effortlessly prepare [SKS] on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

The easiest way to modify and eSign [SKS] without hassle

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Modify and eSign [SKS] while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Forma 943 Pr

Create this form in 5 minutes!

How to create an eSignature for the forma 943 pr 2007

How to make an electronic signature for your Forma 943 Pr 2007 online

How to make an eSignature for your Forma 943 Pr 2007 in Google Chrome

How to make an electronic signature for putting it on the Forma 943 Pr 2007 in Gmail

How to make an electronic signature for the Forma 943 Pr 2007 right from your mobile device

How to generate an eSignature for the Forma 943 Pr 2007 on iOS devices

How to make an eSignature for the Forma 943 Pr 2007 on Android

People also ask

-

What is Forma 943 Pr and how does it work with airSlate SignNow?

Forma 943 Pr is a comprehensive document management tool that integrates seamlessly with airSlate SignNow. It allows users to create, send, and eSign important documents quickly and efficiently. This integration enhances the workflow for businesses, ensuring that all documents related to Forma 943 Pr are handled smoothly.

-

What are the key features of airSlate SignNow for managing Forma 943 Pr?

airSlate SignNow offers several key features for managing Forma 943 Pr, including customizable templates, automated workflows, and real-time tracking of document status. These features streamline the signing process, making it easy for users to manage their Forma 943 Pr documents from anywhere. Additionally, the platform ensures compliance and security for all your document handling needs.

-

How much does it cost to use Forma 943 Pr with airSlate SignNow?

The pricing for using Forma 943 Pr with airSlate SignNow varies based on the plan you choose. airSlate SignNow offers affordable subscription options that cater to businesses of all sizes. With its cost-effective solutions, integrating Forma 943 Pr can be budget-friendly while providing immense value.

-

Are there any user benefits when using airSlate SignNow for Forma 943 Pr?

Yes, using airSlate SignNow for Forma 943 Pr provides numerous user benefits, such as enhanced efficiency, reduced turnaround times, and improved document tracking. Users can benefit from the intuitive interface that simplifies document management and signing processes. This leads to quicker approvals and a more streamlined experience overall.

-

Can I integrate Forma 943 Pr with other business tools using airSlate SignNow?

Absolutely! airSlate SignNow offers robust integrations with various business applications, enabling users to connect Forma 943 Pr with tools they already use. This enhances workflow efficiency and allows for better data management across platforms, ensuring a seamless experience for all stakeholders involved.

-

Is airSlate SignNow secure for handling Forma 943 Pr documents?

Yes, airSlate SignNow prioritizes the security of all documents, including Forma 943 Pr. The platform employs advanced encryption protocols and complies with industry standards to protect sensitive information. Users can trust that their documents are secure while being processed and stored within the platform.

-

How can I get started with Forma 943 Pr on airSlate SignNow?

Getting started with Forma 943 Pr on airSlate SignNow is easy! Simply sign up for an account, access the Forma 943 Pr template, and begin customizing it to suit your needs. The user-friendly interface and comprehensive resources ensure that you'll be up and running in no time.

Get more for Forma 943 Pr

- Form 13285 a rev january fill in capable reducing tax burden on american taxpayers

- Form 13315 rev august partner outreach activity report

- Form 13614 t rev january fill in capable telephone excise tax refund 1040ez t intake sheet

- Form 13599 rev july fill in capable

- Form w 8imy rev february fill in capable certificate of foreign intermediary foreign flow through entity or certain u s

- Form 13768 rev may fill in capable electronic tax administration advisory commitee application

- 1 2 3 4 6 9 9 publication 15 a cat form

- 1 1 2 2 6 6 6 6 7 7 7 7 publication 524 cat form

Find out other Forma 943 Pr

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself