Irs F Instructions Form

What is the IRS F Instructions?

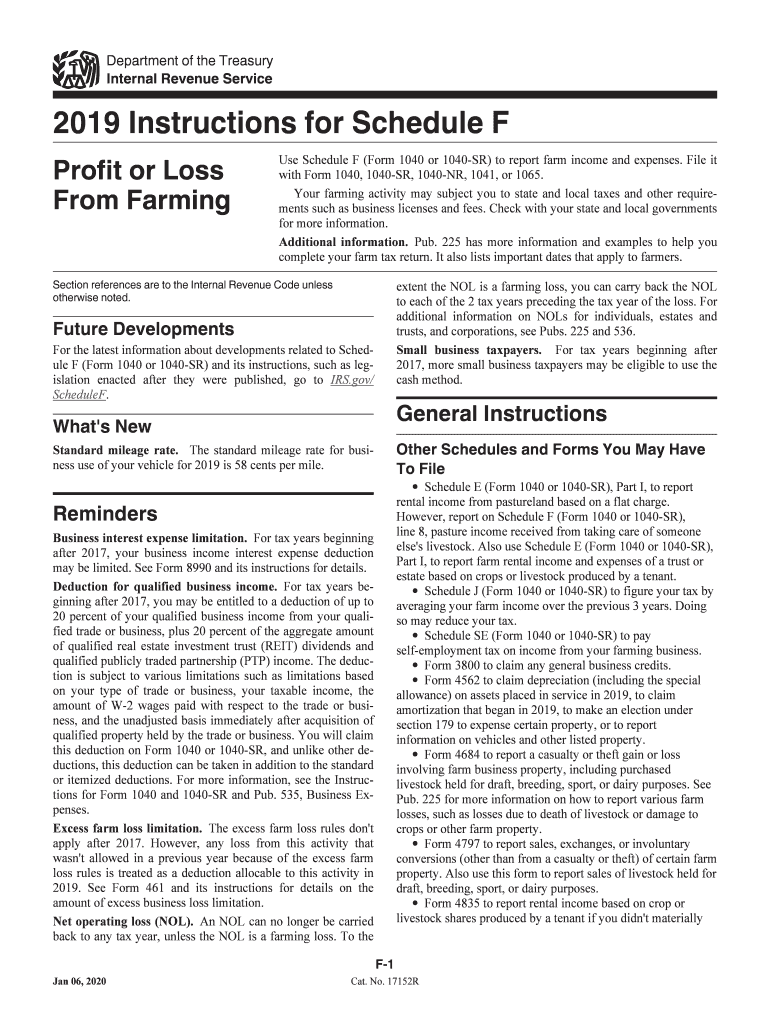

The IRS F Instructions provide essential guidance for taxpayers who need to complete the Schedule F form. This form is primarily used by farmers and ranchers to report their income and expenses from farming activities. Understanding these instructions is crucial for accurate reporting and compliance with federal tax regulations. The instructions detail how to calculate net profit or loss from farming operations, including allowable deductions and credits that can reduce taxable income.

Steps to Complete the IRS F Instructions

Completing the IRS F Instructions involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records related to farming operations, including income statements and expense receipts. Next, follow the instructions to fill out the Schedule F form, ensuring that each section is completed accurately. Pay close attention to the specific line items that require detailed information about income sources and deductible expenses. Finally, review the completed form for any errors before submission.

Legal Use of the IRS F Instructions

The legal use of the IRS F Instructions is essential for ensuring that taxpayers comply with federal tax laws. These instructions outline the requirements for reporting farming income and expenses accurately. Adhering to these guidelines helps prevent issues with the IRS, including audits or penalties for incorrect filings. It is important to understand that any misrepresentation or failure to follow the instructions can lead to legal repercussions, making it vital to approach the completion of the form with diligence.

Key Elements of the IRS F Instructions

Key elements of the IRS F Instructions include detailed explanations of income categories, allowable deductions, and specific calculations required for reporting. Taxpayers must understand what constitutes farm income, such as sales of livestock, produce, and other agricultural products. Additionally, the instructions specify which expenses can be deducted, including operating costs, depreciation, and other relevant expenditures. Familiarity with these elements ensures that taxpayers maximize their deductions while remaining compliant.

Filing Deadlines / Important Dates

Filing deadlines for the IRS F Instructions are critical to avoid penalties and interest on unpaid taxes. Generally, the deadline for submitting the Schedule F form aligns with the individual tax return deadline, which is typically April fifteenth. However, if additional time is needed, taxpayers can file for an extension, allowing for a later submission date. It is important to stay informed about any changes to tax deadlines that may occur each year.

Required Documents

To complete the IRS F Instructions accurately, several documents are necessary. Taxpayers should gather records of all income generated from farming activities, including sales receipts and invoices. Additionally, documentation of all expenses, such as equipment purchases, maintenance costs, and operational expenses, is essential. Keeping organized records will facilitate a smoother completion process and ensure that all required information is readily available.

Form Submission Methods

Submitting the IRS F Instructions can be done through various methods, depending on taxpayer preference. The form can be filed electronically using tax preparation software, which often simplifies the process and reduces errors. Alternatively, taxpayers may choose to submit the form by mail, ensuring that it is sent to the correct IRS address. In-person submissions are less common but may be an option for those needing direct assistance. Regardless of the method chosen, timely submission is crucial to avoid penalties.

Quick guide on how to complete inst 1040 schedule f

Complete Irs F Instructions effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly without delays. Manage Irs F Instructions on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Irs F Instructions without hassle

- Find Irs F Instructions and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method of delivering your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Irs F Instructions to guarantee outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the inst 1040 schedule f

How to make an eSignature for the Inst 1040 Schedule F online

How to generate an electronic signature for your Inst 1040 Schedule F in Google Chrome

How to generate an electronic signature for signing the Inst 1040 Schedule F in Gmail

How to create an eSignature for the Inst 1040 Schedule F straight from your smart phone

How to make an eSignature for the Inst 1040 Schedule F on iOS

How to generate an eSignature for the Inst 1040 Schedule F on Android

People also ask

-

What are the basic instructions profit farming available with airSlate SignNow?

The basic instructions profit farming with airSlate SignNow include easy document workflow management, secure eSigning, and streamlined sharing options. Users can create templates, automate processes, and track document status for maximum efficiency. This empowers businesses to enhance productivity without complex setups.

-

How does airSlate SignNow help reduce costs with instructions profit farming?

By implementing instructions profit farming, airSlate SignNow offers a cost-effective solution to manage documents electronically. Eliminating paper usage and reducing mailing costs signNowly saves money. Additionally, the platform enables quicker transaction times, allowing businesses to focus on growth and profitability.

-

Can I integrate airSlate SignNow with other tools for better instructions profit farming?

Yes, airSlate SignNow provides seamless integrations with various applications, enhancing your instructions profit farming strategy. Users can connect with CRMs, cloud storage, and project management tools to streamline operations further. This interconnected approach creates a more efficient workflow for your business.

-

Are there specific features that enhance instructions profit farming?

Absolutely! Key features such as document templates, real-time tracking, and multi-party signing enhance your instructions profit farming experience. These tools simplify the document management process, making it easier for businesses to execute and monitor transactions securely and efficiently.

-

What pricing plans are available for instructions profit farming with airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs for instructions profit farming. Each plan includes essential features and varying levels of document management capabilities. Potential customers can choose a plan that aligns with their operational scale and budget, ensuring maximum value.

-

How quickly can I implement airSlate SignNow for instructions profit farming?

Implementation of airSlate SignNow is swift, allowing users to start utilizing instructions profit farming almost immediately. The user-friendly interface and intuitive setup process reduce the learning curve signNowly. Most businesses can begin eSigning documents within minutes of signing up.

-

What benefits can I expect from using instructions profit farming?

Using instructions profit farming with airSlate SignNow delivers numerous benefits, including enhanced operational efficiency and improved document accuracy. Businesses can expect reduced turnaround times on contracts and agreements, leading to faster decision-making. Overall, this positively impacts customer satisfaction and retention.

Get more for Irs F Instructions

Find out other Irs F Instructions

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer