8879 Pe Form

What is the 8879 Pe

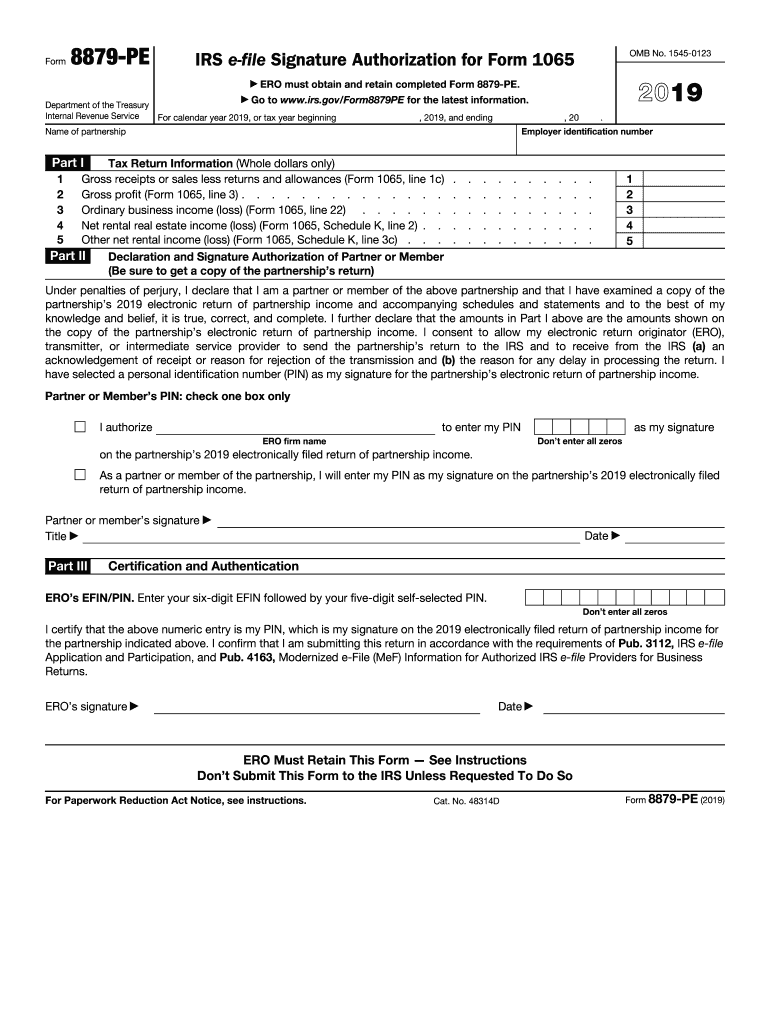

The 8879 Pe, also known as the IRS e-file Signature Authorization form, is a crucial document for taxpayers who wish to electronically file their tax returns. This form serves as a declaration that the taxpayer has reviewed their return and authorizes the electronic submission. It is particularly important for tax professionals who file on behalf of clients, as it ensures compliance with IRS regulations regarding electronic signatures.

How to use the 8879 Pe

To effectively use the 8879 Pe, taxpayers need to follow specific steps. First, ensure that all necessary tax information is accurately completed on the tax return. Once the return is ready, the taxpayer or their representative must fill out the 8879 Pe, providing personal information such as name, Social Security number, and the tax year. After reviewing the return, the taxpayer must sign the form, either electronically or by hand, depending on the method of submission. This signed form must then be retained by the tax preparer, as it may be requested by the IRS.

Steps to complete the 8879 Pe

Completing the 8879 Pe involves a series of straightforward steps:

- Gather all necessary tax documents and information.

- Complete your tax return using tax preparation software or manually.

- Fill out the 8879 Pe form with the required personal details.

- Review the completed tax return and the 8879 Pe for accuracy.

- Sign the 8879 Pe to authorize the e-filing of your tax return.

- Keep a copy of the signed form for your records.

Legal use of the 8879 Pe

The legal use of the 8879 Pe is governed by IRS regulations that outline the requirements for electronic signatures. The form must be signed by the taxpayer to validate the e-filing process. It is essential to ensure that the signature is obtained in a manner that complies with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). This compliance ensures that the form is considered legally binding and acceptable for IRS purposes.

Filing Deadlines / Important Dates

Filing deadlines for the 8879 Pe align with the standard tax filing deadlines set by the IRS. Typically, individual tax returns are due on April fifteenth of each year. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions they may file for additional time, which can affect the submission of the 8879 Pe.

Form Submission Methods (Online / Mail / In-Person)

The 8879 Pe can be submitted electronically as part of the e-filing process through tax preparation software. It is not submitted directly to the IRS but is retained by the tax preparer. In cases where taxpayers choose to file by mail, they must print and sign the tax return and the 8879 Pe, then send them together. In-person submission is less common but may occur if a taxpayer visits a tax professional's office for assistance.

Quick guide on how to complete about form 8879 pe irs e file signature authorization for

Accomplish 8879 Pe seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed papers, as you can obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage 8879 Pe on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to alter and eSign 8879 Pe effortlessly

- Locate 8879 Pe and then select Get Form to begin.

- Utilize the features we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and eSign 8879 Pe and guarantee superior communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form 8879 pe irs e file signature authorization for

How to generate an electronic signature for your About Form 8879 Pe Irs E File Signature Authorization For in the online mode

How to generate an eSignature for the About Form 8879 Pe Irs E File Signature Authorization For in Chrome

How to make an eSignature for putting it on the About Form 8879 Pe Irs E File Signature Authorization For in Gmail

How to make an electronic signature for the About Form 8879 Pe Irs E File Signature Authorization For from your mobile device

How to make an eSignature for the About Form 8879 Pe Irs E File Signature Authorization For on iOS

How to generate an electronic signature for the About Form 8879 Pe Irs E File Signature Authorization For on Android

People also ask

-

What is form 8879 pe and how is it used?

Form 8879 pe is a tax document used by tax preparers to obtain electronic signatures from clients for filing their tax returns electronically. This form allows for a secure and efficient way to authorize e-filing, ensuring compliance with IRS requirements.

-

How does airSlate SignNow streamline the process of signing form 8879 pe?

airSlate SignNow simplifies the signing process for form 8879 pe by providing an intuitive platform for sending and eSigning documents. With just a few clicks, clients can review, sign, and submit their forms, signNowly reducing the time and effort involved in traditional signing methods.

-

What are the pricing options for using airSlate SignNow to manage form 8879 pe?

airSlate SignNow offers a variety of pricing plans tailored to different business needs. Our plans are cost-effective and provide access to all essential features for managing form 8879 pe, making it easy for businesses to choose the right option for their budget.

-

Can I track the status of form 8879 pe once it's sent via airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all documents sent, including form 8879 pe. Users can easily monitor the status of their documents, ensuring peace of mind and a streamlined workflow as they await client signatures.

-

Does airSlate SignNow integrate with any tax software for handling form 8879 pe?

Absolutely! airSlate SignNow seamlessly integrates with various tax software applications. This compatibility ensures that handling form 8879 pe becomes a hassle-free task, aligning perfectly with the tools you already use.

-

What are the benefits of using airSlate SignNow for form 8879 pe?

Using airSlate SignNow for form 8879 pe offers numerous benefits, such as enhanced security for sensitive tax information, improved efficiency in obtaining signatures, and an overall streamlined process. These advantages help tax professionals save time and reduce errors in their workflows.

-

Is it easy to use airSlate SignNow for clients signing form 8879 pe?

Yes, airSlate SignNow is designed with user-friendliness in mind. Clients can easily navigate the platform to sign form 8879 pe, requiring minimal tech-savvy, which helps enhance the overall client experience and satisfaction.

Get more for 8879 Pe

- County tax sale procedural manual california state controlleramp39s sco ca form

- Nyc rpt form 2015 2019

- D 2848 power of attorney and declaration of representation form

- Sctc 111 2018 2019 form

- Form mvu 25 affidavit in support of a claim for massgov

- Planilla corta caudal relicto 2010 2019 form

- K 40 form 2015 2019

- 65 5300 form

Find out other 8879 Pe

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form