Modelo Sc 2800 a 2010

What is the Modelo Sc 2800 A

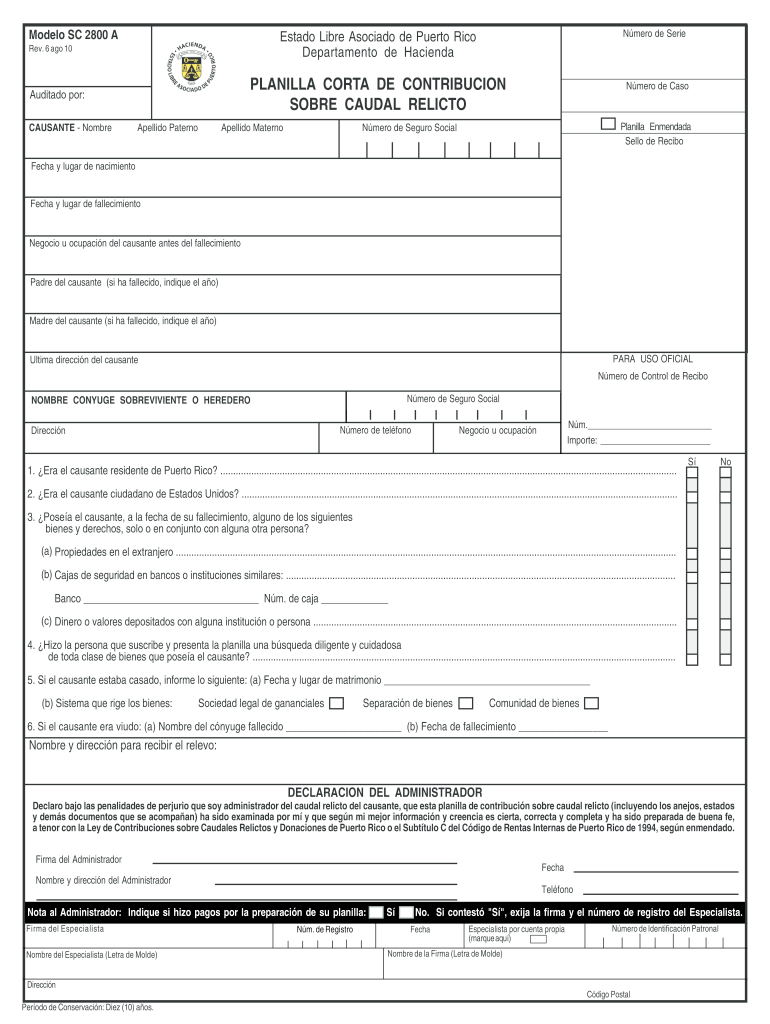

The Modelo Sc 2800 A is a specific tax form used in Puerto Rico for reporting income and calculating tax liabilities. This form is particularly relevant for individuals and businesses who need to declare their income, deductions, and credits accurately. It is essential for ensuring compliance with local tax regulations and for facilitating the proper assessment of taxes owed. The Modelo Sc 2800 A is designed to streamline the reporting process, making it easier for taxpayers to fulfill their obligations while minimizing errors.

How to use the Modelo Sc 2800 A

Using the Modelo Sc 2800 A involves several key steps. First, gather all necessary financial documents, including income statements, receipts for deductions, and any relevant tax credits. Next, fill out the form accurately, ensuring that all information is complete and correct. It is advisable to review the form thoroughly to avoid mistakes that could lead to penalties or delays in processing. Once the form is completed, it can be submitted either online or via traditional mail, depending on the preferences of the taxpayer.

Steps to complete the Modelo Sc 2800 A

Completing the Modelo Sc 2800 A involves a systematic approach:

- Collect all necessary financial documents, including W-2s, 1099s, and receipts.

- Begin filling out the form by entering personal information, such as your name and Social Security number.

- Report all sources of income accurately, including wages, dividends, and business income.

- Include any deductions you are eligible for, such as mortgage interest or educational expenses.

- Calculate your total tax liability based on the information provided.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or by mail as per your preference.

Legal use of the Modelo Sc 2800 A

The Modelo Sc 2800 A is legally recognized as a valid document for tax reporting in Puerto Rico. It must be filled out in accordance with the guidelines set by the Puerto Rico Department of Treasury. Failure to use this form correctly can result in legal penalties, including fines or audits. It is crucial for taxpayers to ensure that they are using the most current version of the form and that they comply with all relevant tax laws to avoid complications.

Required Documents

To complete the Modelo Sc 2800 A, several documents are typically required:

- Income statements, such as W-2 forms or 1099 forms.

- Receipts for deductible expenses.

- Documentation for any tax credits you plan to claim.

- Previous year’s tax return for reference.

Form Submission Methods (Online / Mail / In-Person)

The Modelo Sc 2800 A can be submitted through various methods, providing flexibility for taxpayers. Submissions can be made online via the Puerto Rico Department of Treasury's official website, which offers a secure platform for electronic filing. Alternatively, taxpayers can choose to mail the completed form to the appropriate tax office. In-person submissions may also be possible at designated tax offices, allowing for direct interaction with tax officials for any questions or clarifications.

Quick guide on how to complete planilla corta caudal relicto 2010 2019 form

Your assistance manual on how to prepare your Modelo Sc 2800 A

If you’re curious about how to generate and submit your Modelo Sc 2800 A, here are a few brief tips on how to simplify the tax submission process.

Firstly, you only need to set up your airSlate SignNow account to transform how you handle documents online. airSlate SignNow is an extremely user-friendly and effective document solution that allows you to edit, create, and finalize your income tax documents effortlessly. With its editor, you can seamlessly navigate between text, checkboxes, and eSignatures, and return to modify responses as necessary. Enhance your tax handling with advanced PDF editing, eSigning, and intuitive sharing.

Follow the instructions below to finalize your Modelo Sc 2800 A in just a few minutes:

- Create your account and begin working on PDFs within moments.

- Utilize our directory to locate any IRS tax form; explore various editions and schedules.

- Click Get form to access your Modelo Sc 2800 A in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to attach your legally-binding eSignature (if needed).

- Examine your document and rectify any inaccuracies.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Use this manual to submit your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can increase return mistakes and delay refunds. Of course, before electronically filing your taxes, review the IRS website for submission guidelines pertinent to your state.

Create this form in 5 minutes or less

Find and fill out the correct planilla corta caudal relicto 2010 2019 form

FAQs

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

Create this form in 5 minutes!

How to create an eSignature for the planilla corta caudal relicto 2010 2019 form

How to create an electronic signature for the Planilla Corta Caudal Relicto 2010 2019 Form online

How to generate an electronic signature for your Planilla Corta Caudal Relicto 2010 2019 Form in Chrome

How to make an eSignature for signing the Planilla Corta Caudal Relicto 2010 2019 Form in Gmail

How to generate an electronic signature for the Planilla Corta Caudal Relicto 2010 2019 Form straight from your mobile device

How to generate an eSignature for the Planilla Corta Caudal Relicto 2010 2019 Form on iOS

How to generate an electronic signature for the Planilla Corta Caudal Relicto 2010 2019 Form on Android devices

People also ask

-

What is the Modelo Sc 2800 A and how does it work?

The Modelo Sc 2800 A is a powerful document signing solution designed for businesses looking to streamline their eSignature processes. It allows users to easily send, sign, and manage documents electronically, enhancing efficiency and reducing turnaround times. With its user-friendly interface, even those without technical expertise can navigate and utilize the features effectively.

-

What are the key features of the Modelo Sc 2800 A?

The Modelo Sc 2800 A boasts several key features including customizable templates, real-time tracking of document status, and automated reminders for signers. Additionally, it offers secure cloud storage for documents and compliance with legal standards, ensuring your business can operate confidently and efficiently. These features make it an ideal choice for organizations of all sizes.

-

How much does the Modelo Sc 2800 A cost?

The pricing for the Modelo Sc 2800 A varies depending on your business needs and the number of users. Generally, it offers flexible subscription plans that cater to different scales of operations, making it cost-effective for small to large enterprises. For specific pricing details, it’s best to check our website or contact our sales team for a tailored quote.

-

Can I integrate the Modelo Sc 2800 A with other software?

Yes, the Modelo Sc 2800 A is designed to seamlessly integrate with a variety of other software applications. This includes popular platforms like CRM systems, document management tools, and cloud storage services, allowing for a smooth workflow. Integration ensures that you can manage your documents and signatures from a centralized location.

-

What benefits does the Modelo Sc 2800 A provide for businesses?

The Modelo Sc 2800 A offers numerous benefits, including enhanced productivity, reduced document turnaround times, and improved compliance with legal standards. By digitizing the signing process, businesses can save time and resources, allowing employees to focus on more critical tasks. Additionally, the environmental impact is minimized by reducing paper usage.

-

Is the Modelo Sc 2800 A secure for sensitive documents?

Absolutely, the Modelo Sc 2800 A prioritizes security and employs advanced encryption methods to protect sensitive documents. It also ensures compliance with various data protection regulations, providing users with peace of mind when handling confidential information. With comprehensive security features, your documents remain safe throughout the signing process.

-

What types of documents can be signed with the Modelo Sc 2800 A?

The Modelo Sc 2800 A can be used to sign a wide variety of documents, including contracts, agreements, waivers, and more. Whether you're in real estate, finance, or any other industry, this eSignature solution adapts to your specific needs. Its versatility makes it a valuable tool for any business looking to streamline their document management.

Get more for Modelo Sc 2800 A

- Cp30 pembahagian pendapatan perkongsian form

- Test of narrative retell tnr schoolage douglas b form

- Kokstad college application forms 2018

- Build a food web activity kehsscienceorg form

- Space above this line for recorders use declaration form

- The edison innovation literacy blueprint power patterns form

- Form ppq 0 2011 2019

- Application for smart steps child care payment assistance tn form

Find out other Modelo Sc 2800 A

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF