Keystone Collections Group Forms 2017

Understanding Keystone Collections Group Forms

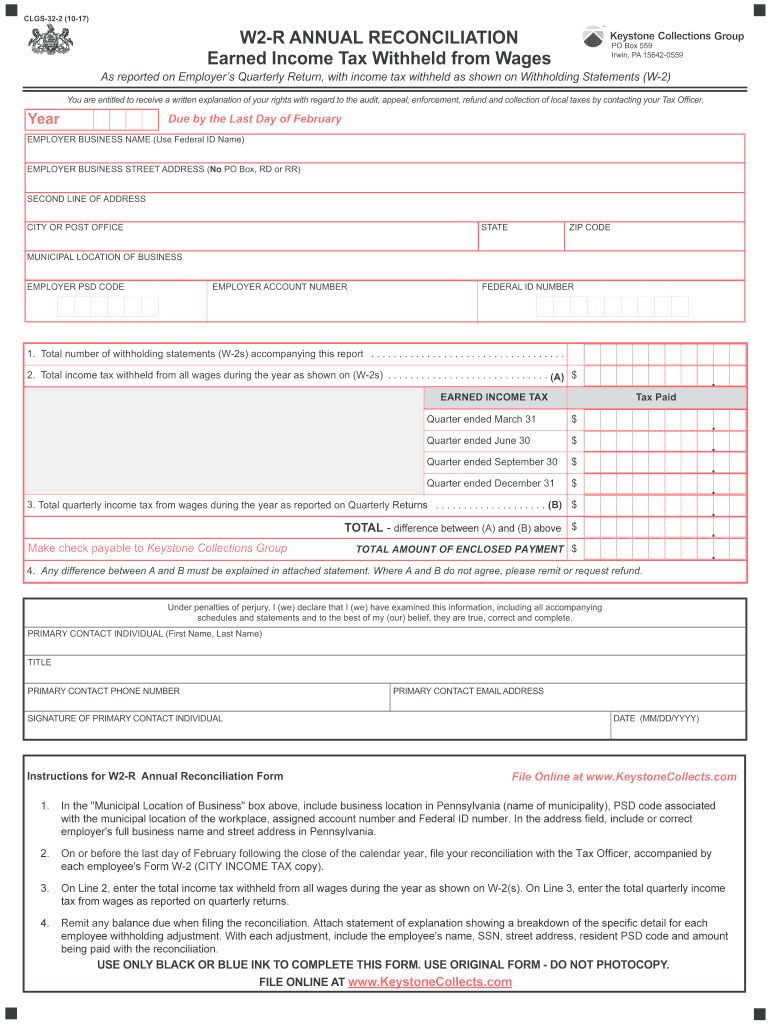

The Keystone Collections Group forms are essential documents used for various tax and compliance purposes in Pennsylvania. These forms facilitate the annual reconciliation process for employers, ensuring that all tax obligations are met accurately. The most common form related to this is the PA Employer's Annual Reconciliation Form, which consolidates the information from employee W-2 forms and other relevant tax documents. Proper use of these forms helps maintain compliance with state tax regulations and supports accurate reporting to the Pennsylvania Department of Revenue.

Steps to Complete Keystone Collections Group Forms

Completing the Keystone Collections Group forms involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documents, including W-2s, payroll records, and any other relevant tax information. Follow these steps:

- Review the specific form requirements and instructions provided by Keystone Collections Group.

- Fill out the form with accurate information, ensuring all fields are completed as required.

- Double-check the calculations for any tax amounts to avoid errors.

- Sign and date the form where indicated.

- Submit the completed form by the specified deadline, either online or via mail.

Legal Use of Keystone Collections Group Forms

The legal use of Keystone Collections Group forms is governed by state tax laws and regulations. These forms must be completed accurately to ensure compliance with Pennsylvania's tax requirements. Failure to submit these forms correctly may result in penalties or fines. It is essential for employers to understand the legal implications of these forms and maintain proper records to support their submissions. Compliance with the guidelines set forth by the Pennsylvania Department of Revenue is crucial for avoiding legal issues.

Filing Deadlines and Important Dates

Timely filing of Keystone Collections Group forms is critical for compliance. The annual reconciliation form typically has a deadline of January 31st for submissions related to the previous calendar year. Employers should be aware of any additional deadlines for quarterly filings or other related forms. Keeping a calendar with these important dates can help ensure that all submissions are made on time, avoiding potential penalties for late filings.

Form Submission Methods

Employers have several options for submitting Keystone Collections Group forms. These include:

- Online Submission: Many forms can be submitted electronically through the Keystone Collections Group website, providing a quick and efficient method.

- Mail Submission: Forms can also be printed and mailed to the appropriate address as specified in the form instructions.

- In-Person Submission: Some employers may choose to submit forms in person at designated offices, ensuring immediate confirmation of receipt.

Required Documents for Keystone Collections Group Forms

When preparing to complete the Keystone Collections Group forms, certain documents are required to ensure accuracy and compliance. These documents typically include:

- W-2 forms for all employees.

- Payroll records that detail earnings and tax withholdings.

- Any additional forms or documentation required by the Pennsylvania Department of Revenue.

Quick guide on how to complete pa dced clgs 32 2 2017

Complete Keystone Collections Group Forms seamlessly on any device

Digital document management has gained traction with businesses and individuals alike. It serves as an ideal eco-conscious substitute to conventional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without interruptions. Handle Keystone Collections Group Forms on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Keystone Collections Group Forms with ease

- Find Keystone Collections Group Forms and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of the documents or obscure sensitive details with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misfiled documents, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Keystone Collections Group Forms and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pa dced clgs 32 2 2017

Create this form in 5 minutes!

How to create an eSignature for the pa dced clgs 32 2 2017

How to make an electronic signature for the Pa Dced Clgs 32 2 2017 online

How to generate an eSignature for the Pa Dced Clgs 32 2 2017 in Google Chrome

How to generate an eSignature for putting it on the Pa Dced Clgs 32 2 2017 in Gmail

How to create an eSignature for the Pa Dced Clgs 32 2 2017 straight from your mobile device

How to make an electronic signature for the Pa Dced Clgs 32 2 2017 on iOS

How to make an electronic signature for the Pa Dced Clgs 32 2 2017 on Android

People also ask

-

What is PA annual reconciliation and how does it benefit my business?

PA annual reconciliation is the process of ensuring that all financial transactions are accurate and complete at the end of the fiscal year. By utilizing airSlate SignNow, businesses can streamline this process through efficient document management and electronic signatures, which enhances productivity and reduces errors.

-

How does airSlate SignNow assist with PA annual reconciliation?

airSlate SignNow provides an intuitive platform for sending, signing, and managing documents electronically, making it easier to collect necessary signatures and maintain accurate records for PA annual reconciliation. The ability to track document status in real-time ensures all essential agreements are finalized before financial reporting.

-

What features should I look for in software for PA annual reconciliation?

For an effective PA annual reconciliation process, look for features like document templates, eSignatures, audit trails, and integration capabilities with accounting software. airSlate SignNow includes these features to ensure a seamless and efficient experience during year-end financial close.

-

What are the pricing options for airSlate SignNow to help with PA annual reconciliation?

airSlate SignNow offers various pricing plans to cater to different business needs, ensuring you can choose an option that fits your budget and requirements for PA annual reconciliation. Each plan includes a set of powerful features to simplify document handling and eSigning.

-

Can airSlate SignNow integrate with my existing accounting software for PA annual reconciliation?

Yes, airSlate SignNow integrates seamlessly with many popular accounting software platforms, facilitating easier PA annual reconciliation. This integration allows for direct data flow, reducing manual input errors and streamlining your financial processes.

-

Is airSlate SignNow secure for managing documents related to PA annual reconciliation?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure access controls, to safeguard your documents during the PA annual reconciliation process. You can trust that your sensitive financial information is protected.

-

How can airSlate SignNow improve the efficiency of PA annual reconciliation?

By utilizing airSlate SignNow for document management and electronic signatures, businesses can signNowly reduce the time spent on PA annual reconciliation. Our platform allows for faster document processing and quick access to signed agreements, enhancing overall efficiency.

Get more for Keystone Collections Group Forms

- Form of letter of appointment commonwealth bank commbank com

- Registration form facilitating anger management psychology org

- Duties form 61

- Land title identity verification form 2015 2019

- Db2 ot medicare form

- Rugby union injury report form sports medicine australia

- Nat 3346 2012 2019 form

- Ablls social interactions tracking sheets trackingsheets form

Find out other Keystone Collections Group Forms

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer