Wv Alternative 2017

What is the WV Alternative?

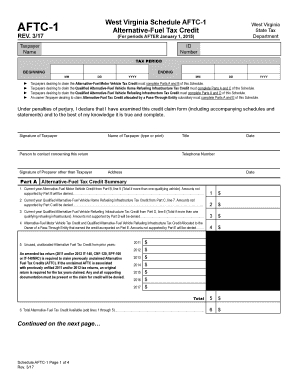

The WV Alternative refers to the West Virginia Alternative Fuel Tax Credit, which is designed to incentivize the use of alternative fuels in the state. This credit allows taxpayers to claim a refund on the tax paid for alternative fuels used in motor vehicles. The program aims to promote cleaner energy sources and reduce reliance on traditional fossil fuels, contributing to environmental sustainability while providing financial relief to users of alternative fuels.

Eligibility Criteria

To qualify for the WV Alternative, applicants must meet specific criteria set by the state. Eligible taxpayers include individuals and businesses that use alternative fuels for transportation purposes. The fuels must be recognized under the program, and the vehicles must be registered in West Virginia. Additionally, applicants should maintain accurate records of fuel purchases and usage to substantiate their claims for the tax credit.

Steps to Complete the WV Alternative

Completing the WV Alternative involves several key steps to ensure compliance and accuracy. First, gather all necessary documentation, including receipts for fuel purchases and vehicle registration details. Next, fill out the WV AFTC 1 form, providing accurate information regarding the alternative fuel used and the amount claimed. Once completed, review the form for any errors before submitting it to the appropriate state agency. It is essential to keep copies of all submitted documents for future reference.

Required Documents

When applying for the WV Alternative, certain documents are essential to support your claim. These include:

- Receipts for alternative fuel purchases

- Vehicle registration information

- The completed WV AFTC 1 form

- Any additional documentation requested by the state

Having these documents organized and ready can facilitate a smoother application process and help avoid delays.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the WV Alternative to ensure timely submissions. Typically, the application must be submitted by a specific date each year, often aligned with the state’s tax filing schedule. Taxpayers should check the West Virginia State Tax Department’s announcements for the exact dates and any updates regarding extensions or changes to the filing process.

Legal Use of the WV Alternative

The WV Alternative is governed by state laws that outline its legal use. Taxpayers must adhere to these regulations to ensure their claims are valid. This includes using alternative fuels in compliance with state definitions and maintaining accurate records. Misuse of the program, such as claiming credits for ineligible fuels or failing to provide proper documentation, can lead to penalties or disqualification from future claims.

Form Submission Methods

Taxpayers have several options for submitting the WV AFTC 1 form. The form can be filed online through the West Virginia State Tax Department’s website, allowing for a quick and efficient submission process. Alternatively, taxpayers may choose to submit the form by mail or in person at designated state offices. Each method has its own timeline for processing, so it is advisable to choose the one that best fits individual needs.

Quick guide on how to complete aftc 1 2017 2019 form

Your assistance manual on how to prepare your Wv Alternative

If you’re curious about how to finish and submit your Wv Alternative, here are some concise guidelines to simplify tax filing.

To begin, you simply need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a user-friendly and powerful document tool that allows you to edit, generate, and complete your tax forms effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and return to modify responses as necessary. Streamline your tax management with advanced PDF editing, eSigning, and convenient sharing.

Follow the instructions below to complete your Wv Alternative in just a few minutes:

- Establish your account and start working on PDFs in no time.

- Utilize our directory to locate any IRS tax form; browse through versions and schedules.

- Click Get form to access your Wv Alternative in our editor.

- Input the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if needed).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please remember that filing by hand can lead to increased return errors and slower refunds. Before e-filing your taxes, be sure to check the IRS website for filing regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct aftc 1 2017 2019 form

FAQs

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the aftc 1 2017 2019 form

How to create an electronic signature for your Aftc 1 2017 2019 Form in the online mode

How to create an electronic signature for your Aftc 1 2017 2019 Form in Google Chrome

How to make an electronic signature for putting it on the Aftc 1 2017 2019 Form in Gmail

How to create an electronic signature for the Aftc 1 2017 2019 Form right from your mobile device

How to create an electronic signature for the Aftc 1 2017 2019 Form on iOS

How to make an eSignature for the Aftc 1 2017 2019 Form on Android

People also ask

-

What is airSlate SignNow and how is it a Wv Alternative?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and electronically sign documents effortlessly. As a Wv Alternative, it provides an intuitive platform with cost-effective pricing and a host of features designed to enhance efficiency and streamline document workflows.

-

How much does airSlate SignNow cost compared to other Wv Alternatives?

airSlate SignNow offers competitive pricing plans that are often more affordable than other Wv Alternatives. By choosing airSlate SignNow, you can access a range of features without breaking the bank, making it an ideal choice for businesses of all sizes.

-

What features make airSlate SignNow a top Wv Alternative?

airSlate SignNow includes features like customizable templates, in-person signing, and robust integrations with popular applications. These functionalities set it apart from other Wv Alternatives, ensuring that users can manage their documents efficiently and effectively.

-

Can I integrate airSlate SignNow with other tools as a Wv Alternative?

Yes, airSlate SignNow integrates seamlessly with various third-party applications such as Google Drive, Salesforce, and Zapier. This makes it a flexible Wv Alternative that can fit into your existing workflow, enhancing productivity across your organization.

-

Is airSlate SignNow secure enough to be a trusted Wv Alternative?

Absolutely! airSlate SignNow prioritizes security by employing encryption and compliance with industry standards, including GDPR and HIPAA. This makes it a reliable Wv Alternative for businesses that handle sensitive information.

-

How does airSlate SignNow improve document workflows compared to other Wv Alternatives?

airSlate SignNow simplifies document workflows by allowing users to create, send, and track documents in one place. This streamlined process saves time and reduces errors, making it a superior Wv Alternative for businesses looking to enhance their efficiency.

-

What types of businesses benefit from using airSlate SignNow as a Wv Alternative?

Businesses of all sizes, from startups to large enterprises, can benefit from airSlate SignNow as a Wv Alternative. Its scalability and user-friendly interface make it suitable for various industries, helping teams manage their document signing needs effectively.

Get more for Wv Alternative

- Account application finland digi key digikey form

- Encroachment permit form home page city of palo alto cityofpaloalto

- Piian odor control odor neutralizerdoc form

- Bmedical recordb release bformb pdf uf health

- Vr 470 form

- Idaho conditional waiver and release upon payment ica 45 501 et seq idaho lien release form

- In the iowa district court in and for johnson county form

- Transcript request form rudolf steiner college

Find out other Wv Alternative

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word