W2R Annual Reconciliation Earned Income Tax PA Department 2019-2026

Understanding the W-2R Annual Reconciliation for Earned Income Tax

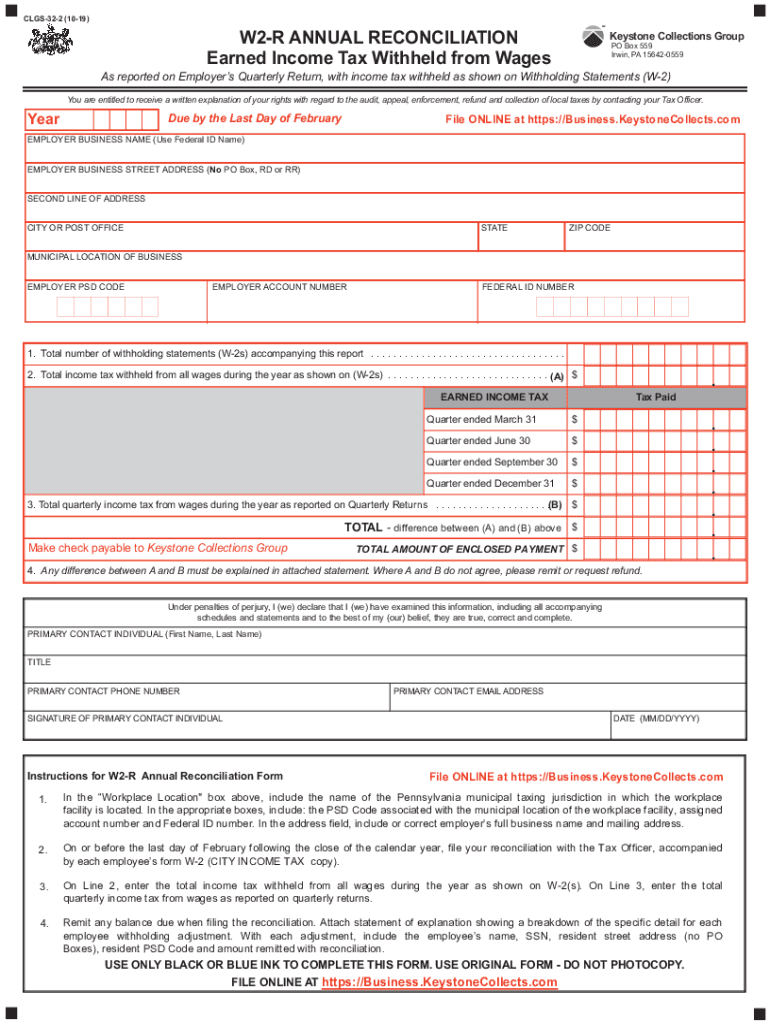

The W-2R Annual Reconciliation is a critical document for individuals who earn income in Pennsylvania. It serves to reconcile the earned income tax withheld by employers throughout the year. This form is essential for ensuring that the correct amount of tax has been collected and reported to the Pennsylvania Department of Revenue. The W-2R form is specifically designed for residents and non-residents who have earned income in the state, allowing them to accurately report their earnings and any tax withheld.

Steps to Complete the W-2R Annual Reconciliation Form

Completing the W-2R Annual Reconciliation requires careful attention to detail. Here are the steps to follow:

- Gather all W-2 forms from employers, which report your total earnings and taxes withheld.

- Ensure you have your Social Security number and any other identification numbers required by the state.

- Fill in your personal information, including your name, address, and contact details on the W-2R form.

- Input the total earnings and taxes withheld as reported on your W-2 forms.

- Double-check all entries for accuracy to avoid errors that could lead to penalties.

- Submit the completed form to the Pennsylvania Department of Revenue by the designated deadline.

Legal Use of the W-2R Annual Reconciliation Form

The W-2R form must be filled out and submitted in compliance with Pennsylvania tax laws. It is legally binding and serves as an official record of your earnings and tax obligations. Failure to submit this form accurately can result in penalties, including fines or additional taxes owed. It is crucial to understand the legal implications of this form and ensure that it is completed correctly to avoid any legal issues.

Required Documents for the W-2R Annual Reconciliation

To complete the W-2R Annual Reconciliation, you will need the following documents:

- All W-2 forms from employers for the tax year.

- Any 1099 forms if applicable, reporting additional income.

- Identification documents, such as your Social Security card.

- Any previous year’s tax returns for reference.

Filing Deadlines for the W-2R Annual Reconciliation

It is important to be aware of the filing deadlines for the W-2R Annual Reconciliation. Typically, the form must be submitted by April 15 of the year following the tax year in question. If this date falls on a weekend or holiday, the deadline may be extended. Timely submission helps avoid penalties and ensures compliance with state tax regulations.

Examples of Scenarios for Using the W-2R Annual Reconciliation

Various scenarios may require the use of the W-2R Annual Reconciliation form:

- If you have multiple employers during the year, you will need to reconcile the total income and taxes withheld from each.

- Self-employed individuals who receive a W-2 from an employer and additional income from freelance work must report both sources.

- Individuals who have moved in or out of Pennsylvania during the year need to ensure they report their earnings accurately for the time spent in the state.

Quick guide on how to complete w2r annual reconciliation earned income tax pa department

Prepare W2R Annual Reconciliation Earned Income Tax PA Department seamlessly on any device

Virtual document administration has become increasingly favored by businesses and individuals. It offers an ideal sustainable alternative to traditional printed and signed paperwork, allowing you to locate the correct form and safely store it online. airSlate SignNow provides you with all the resources you need to create, edit, and eSign your documents swiftly and without interruptions. Manage W2R Annual Reconciliation Earned Income Tax PA Department on any device using airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to edit and eSign W2R Annual Reconciliation Earned Income Tax PA Department effortlessly

- Obtain W2R Annual Reconciliation Earned Income Tax PA Department and then click Get Form to begin.

- Use the tools we supply to fill out your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate the stress of lost or misplaced documents, the hassle of tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device of your preference. Edit and eSign W2R Annual Reconciliation Earned Income Tax PA Department and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w2r annual reconciliation earned income tax pa department

Create this form in 5 minutes!

How to create an eSignature for the w2r annual reconciliation earned income tax pa department

How to make an electronic signature for your PDF document online

How to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The best way to create an eSignature for a PDF file on Android OS

People also ask

-

What are keystone collections group forms?

Keystone collections group forms are specialized document templates designed for businesses to streamline their collection processes. These forms facilitate efficient communication and collection of payments, ensuring that your operations run smoothly.

-

How can I use keystone collections group forms with airSlate SignNow?

You can easily create and customize keystone collections group forms within the airSlate SignNow platform. Our user-friendly interface allows you to generate forms quickly and send them out for eSignature, making the process hassle-free.

-

Are keystone collections group forms secure?

Yes, all keystone collections group forms created with airSlate SignNow are secured with top-tier encryption. We prioritize data security, ensuring that your sensitive information remains protected throughout the signing and collection process.

-

What features are included with keystone collections group forms on airSlate SignNow?

airSlate SignNow provides robust features for keystone collections group forms, including eSignature capabilities, document tracking, and automated reminders. These functionalities enhance your workflow and improve your collection rate.

-

Is there a cost associated with using keystone collections group forms?

airSlate SignNow offers flexible pricing plans that include access to keystone collections group forms. Depending on your business needs, you can choose a plan that suits your budget while enjoying the full spectrum of our services.

-

Can I integrate keystone collections group forms with other software?

Absolutely! airSlate SignNow allows for seamless integration with various third-party applications, enhancing the usability of keystone collections group forms. Whether you're using CRM systems or accounting software, our integrations simplify your workflow.

-

What benefits do keystone collections group forms provide for my business?

By utilizing keystone collections group forms, your business can signNowly improve the efficiency of your collections process. These forms reduce time spent on paperwork and increase response rates, leading to faster payments and better cash flow.

Get more for W2R Annual Reconciliation Earned Income Tax PA Department

- Jack daniels label generator form

- Acp application form

- Texas family law practice manual form 4 2

- Patient prescription form veterans administration va only

- Kenton county quarterly withholding form

- Golf course budget spreadsheet form

- 534 e for your protection and privacy please press form

- Planned absence form community christian school

Find out other W2R Annual Reconciliation Earned Income Tax PA Department

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template