Form 4852 2014

What is the Form 4852

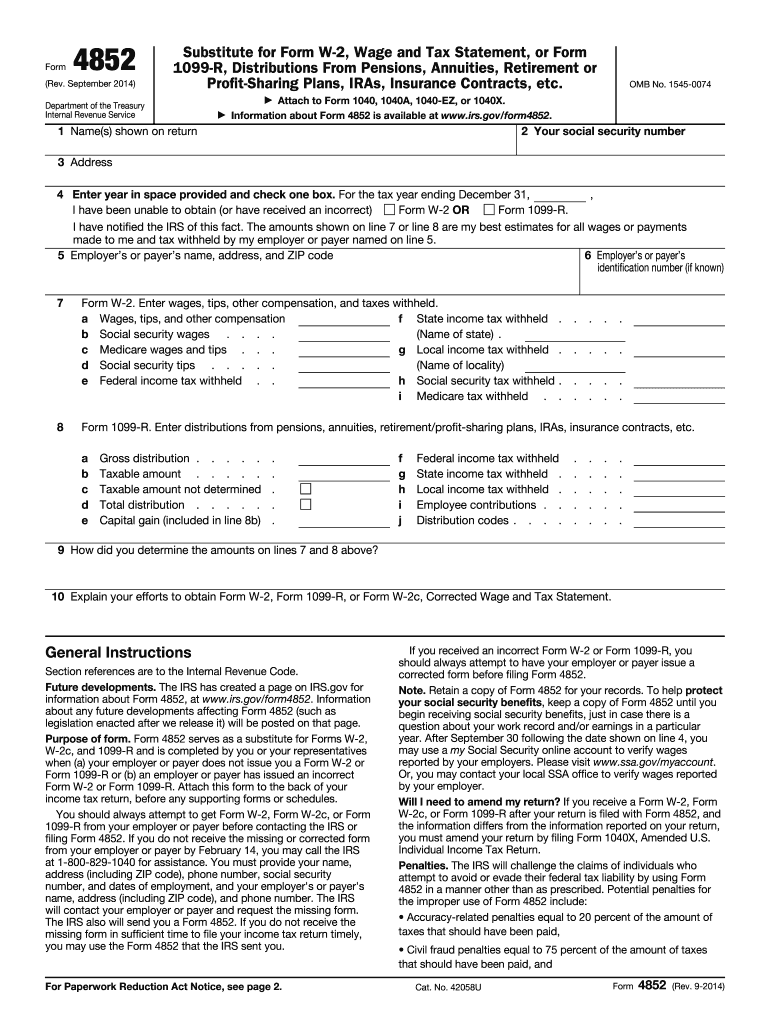

The Form 4852 is a tax document used by individuals in the United States when they have not received a Form W-2 or a Form 1099-R from their employer or financial institution. This form serves as a substitute for these documents, allowing taxpayers to report their income and withholding for the year. It is particularly useful for those who have lost their original forms or did not receive them due to employment changes or other circumstances. By using Form 4852, taxpayers can ensure they fulfill their tax obligations accurately.

How to use the Form 4852

To effectively use the Form 4852, taxpayers should first gather all relevant income information, including wages, tips, and other compensation. Once the necessary data is collected, the individual should fill out the form with details such as the employer's name, address, and the estimated amounts of income and withholding. It is crucial to provide accurate estimates to avoid discrepancies with the IRS. After completing the form, it should be submitted along with the individual’s tax return.

Steps to complete the Form 4852

Completing the Form 4852 involves several key steps:

- Gather all necessary income information, including pay stubs and previous tax documents.

- Fill out the personal information section, including your name, address, and Social Security number.

- Provide details about the employer or financial institution, including their name and address.

- Estimate your total income and withholding amounts based on your records.

- Sign and date the form to certify that the information provided is accurate.

Once completed, attach the Form 4852 to your tax return and submit it to the IRS.

Legal use of the Form 4852

The Form 4852 is legally recognized by the IRS as a valid substitute for Form W-2 and Form 1099-R when the original documents are unavailable. To ensure legal compliance, it is important to use the form correctly and provide accurate estimates of income and withholding. Falsifying information on the form can lead to penalties and legal consequences. Therefore, taxpayers should take care to maintain accurate records and only submit the form when necessary.

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines when using Form 4852. Typically, the deadline for filing individual tax returns is April 15 of each year. If a taxpayer is using Form 4852, they should ensure that it is submitted alongside their tax return by this date. Additionally, if an extension is filed, the extended deadline is usually October 15. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

IRS Guidelines

The IRS provides specific guidelines for using Form 4852. Taxpayers should refer to the IRS instructions for Form 4852 to ensure compliance with all requirements. These guidelines outline how to estimate income and withholding accurately, as well as the circumstances under which the form can be used. Following these guidelines is essential to avoid errors that could lead to delays in processing the tax return or potential audits.

Quick guide on how to complete form 4852 2014

Effortlessly Prepare Form 4852 on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal eco-conscious substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, adjust, and eSign your documents swiftly and without interruptions. Manage Form 4852 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Adjust and eSign Form 4852 with Ease

- Locate Form 4852 and click Get Form to commence.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or redact confidential information with tools specifically provided by airSlate SignNow for that function.

- Generate your eSignature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Verify all the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or errors requiring the printing of new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your preferred device. Modify and eSign Form 4852 while ensuring excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4852 2014

Create this form in 5 minutes!

How to create an eSignature for the form 4852 2014

How to make an electronic signature for the Form 4852 2014 online

How to make an eSignature for the Form 4852 2014 in Google Chrome

How to make an electronic signature for putting it on the Form 4852 2014 in Gmail

How to create an electronic signature for the Form 4852 2014 straight from your smartphone

How to make an eSignature for the Form 4852 2014 on iOS

How to make an electronic signature for the Form 4852 2014 on Android OS

People also ask

-

What is Form 4852 and why is it important?

Form 4852 is a substitute form used for reporting income when a taxpayer has not received their W-2 or 1099-R. Understanding how to accurately complete Form 4852 is essential for ensuring that your tax return is filed correctly and that you receive the appropriate tax credit. Using airSlate SignNow, you can easily manage and eSign your Form 4852 to streamline your filing process.

-

How does airSlate SignNow simplify the eSigning of Form 4852?

airSlate SignNow provides a user-friendly platform that allows you to eSign Form 4852 quickly and securely. With our straightforward interface, you can upload your form, add necessary signatures, and send it to recipients in just a few clicks. This saves time and reduces the hassle of printing and scanning.

-

Are there any costs associated with using airSlate SignNow for Form 4852?

airSlate SignNow offers competitive pricing plans designed to fit various business needs. Our subscription models provide access to a range of features for eSigning forms, including Form 4852, at an affordable rate. You can choose a plan that aligns with your usage and budget.

-

Can I integrate airSlate SignNow with other software for processing Form 4852?

Yes, airSlate SignNow supports integrations with various applications, enabling you to streamline your entire workflow when handling Form 4852. Whether you use CRM systems, cloud storage, or document management tools, our integrations help facilitate a seamless process. This integration allows for efficient document handling and improved collaboration.

-

What security features does airSlate SignNow offer for Form 4852?

Security is a top priority at airSlate SignNow. Our platform provides features such as end-to-end encryption and secure cloud storage to protect your Form 4852 and other sensitive documents. Additionally, we comply with industry standards to ensure your data remains secure throughout the signing process.

-

How can airSlate SignNow help businesses manage multiple Form 4852 submissions?

With airSlate SignNow, businesses can easily manage multiple Form 4852 submissions through our centralized dashboard. This allows for efficient tracking and organization of all documents, ensuring that each submission is processed on time. Our batch send feature also simplifies sending multiple forms at once.

-

What benefits do businesses gain by using airSlate SignNow for Form 4852?

Using airSlate SignNow for Form 4852 offers numerous benefits including increased efficiency, cost savings, and enhanced accuracy. Our platform streamlines the eSigning process, reducing turnaround times and helping you stay compliant with tax regulations. Additionally, businesses can minimize manual errors when filling out and submitting Form 4852.

Get more for Form 4852

Find out other Form 4852

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors