941 Schedule B Form 2014

What is the 941 Schedule B Form

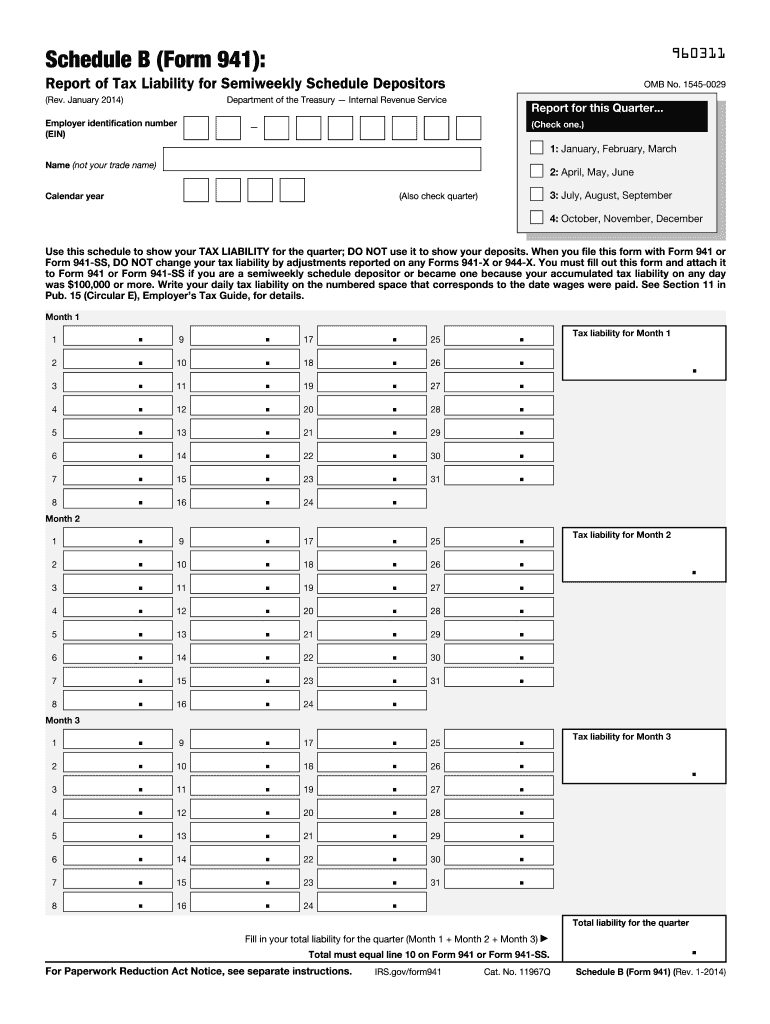

The 941 Schedule B Form is a crucial document used by employers in the United States to report their payroll tax liabilities. This form is specifically designed to provide the IRS with detailed information about the employer's tax deposits for federal income tax withheld and Social Security and Medicare taxes. It is typically filed alongside Form 941, the Employer's Quarterly Federal Tax Return, and is essential for ensuring compliance with federal tax regulations.

How to use the 941 Schedule B Form

Using the 941 Schedule B Form involves several steps. First, employers need to gather their payroll records for the reporting period. This includes information on wages paid, taxes withheld, and any adjustments made. Once the necessary data is collected, employers can fill out the form, detailing their tax deposits for each month of the quarter. After completing the form, it should be submitted along with Form 941 to the IRS by the designated deadline.

Steps to complete the 941 Schedule B Form

Completing the 941 Schedule B Form requires careful attention to detail. Follow these steps:

- Gather payroll records for the quarter.

- Determine the total taxes withheld for each month.

- Fill out the form, ensuring accuracy in reporting tax deposits.

- Review the completed form for any errors or omissions.

- Submit the form with your Form 941 by the deadline.

Legal use of the 941 Schedule B Form

The legal use of the 941 Schedule B Form is essential for maintaining compliance with IRS regulations. Employers are required to accurately report their payroll tax liabilities to avoid penalties. The information provided on this form is used by the IRS to verify that employers are making the correct tax deposits. Failure to properly complete and submit the form can result in fines or other legal consequences.

Filing Deadlines / Important Dates

Filing deadlines for the 941 Schedule B Form coincide with the quarterly deadlines for Form 941. Employers must submit their completed forms by the last day of the month following the end of each quarter. For example, the deadlines for 2023 are:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31 of the following year

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the 941 Schedule B Form. The form can be filed online through the IRS e-file system, which is often the fastest method. Alternatively, employers can mail the completed form to the appropriate IRS address based on their location. In-person submissions are generally not available for this form, as the IRS encourages electronic filing for efficiency and security.

Quick guide on how to complete 941 schedule b 2014 form

Complete 941 Schedule B Form effortlessly on any gadget

Managing documents online has gained traction among businesses and individuals alike. It offers a superb environmentally friendly substitute for traditional paper documents, since you can access the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle 941 Schedule B Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The simplest way to modify and eSign 941 Schedule B Form effortlessly

- Find 941 Schedule B Form and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize essential sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 941 Schedule B Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 941 schedule b 2014 form

Create this form in 5 minutes!

How to create an eSignature for the 941 schedule b 2014 form

How to create an electronic signature for the 941 Schedule B 2014 Form in the online mode

How to generate an eSignature for the 941 Schedule B 2014 Form in Chrome

How to generate an eSignature for putting it on the 941 Schedule B 2014 Form in Gmail

How to make an eSignature for the 941 Schedule B 2014 Form right from your mobile device

How to make an eSignature for the 941 Schedule B 2014 Form on iOS devices

How to create an eSignature for the 941 Schedule B 2014 Form on Android devices

People also ask

-

What is the 941 Schedule B Form?

The 941 Schedule B Form is a supplemental form required by the IRS that businesses use to report their payroll tax liabilities. This form is essential for employers who make semi-weekly tax deposits and allows them to report their tax liabilities accurately. Using tools like airSlate SignNow can simplify the completion and submission of the 941 Schedule B Form.

-

How can airSlate SignNow assist with the 941 Schedule B Form?

airSlate SignNow provides an easy-to-use platform for businesses to create, modify, and electronically sign the 941 Schedule B Form. With features like document templates and eSignature capabilities, airSlate SignNow streamlines the filing process, ensuring compliance and reducing the risk of errors in tax reporting.

-

Is airSlate SignNow cost-effective for managing the 941 Schedule B Form?

Yes, airSlate SignNow is a cost-effective solution for managing the 941 Schedule B Form and other related documents. With various pricing plans, businesses can choose the option that best fits their budget while benefiting from a simple and efficient eSigning process. The savings from avoiding penalties due to errors can also make it a valuable investment.

-

What features does airSlate SignNow offer for the 941 Schedule B Form?

airSlate SignNow offers multiple features that are beneficial for the 941 Schedule B Form, including customizable templates, bulk sending options, and secure document storage. Additionally, the platform provides real-time notifications and tracking, allowing users to stay informed about the status of their submitted forms.

-

Can I integrate airSlate SignNow with other software to manage the 941 Schedule B Form?

Absolutely! airSlate SignNow offers integrations with popular accounting and payroll software, making it easier to manage the 941 Schedule B Form in conjunction with your financial records. This integration ensures that your tax filings are accurate and up-to-date, enhancing overall efficiency.

-

What are the benefits of using airSlate SignNow for the 941 Schedule B Form?

Using airSlate SignNow for the 941 Schedule B Form simplifies the process from creation to submission, saving time and reducing errors. The platform’s secure eSignature feature accelerates approvals, and the easy access to documents ensures compliance with IRS requirements. Overall, it empowers businesses to handle their tax reporting more effectively.

-

How do I get started with airSlate SignNow for the 941 Schedule B Form?

Getting started with airSlate SignNow for the 941 Schedule B Form is simple. You can sign up for an account on their website, choose a pricing plan, and start creating your forms immediately. The user-friendly interface allows you to navigate through the process effortlessly.

Get more for 941 Schedule B Form

- Globe life insurance application form

- Uasa sr 0507 indd united american insurance company form

- Legal pleading template online fillable form

- Direct deposit form usaa

- Usaa beneficiary form

- Nj play sports soccer flag football softball co ed sports form

- Sc 1120s amp039samp039 the south carolina department of revenue form

- Maryland form 510 511d pass through entity declaration of estimated income tax

Find out other 941 Schedule B Form

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF