Irs Form 941 2011

What is the Irs Form 941

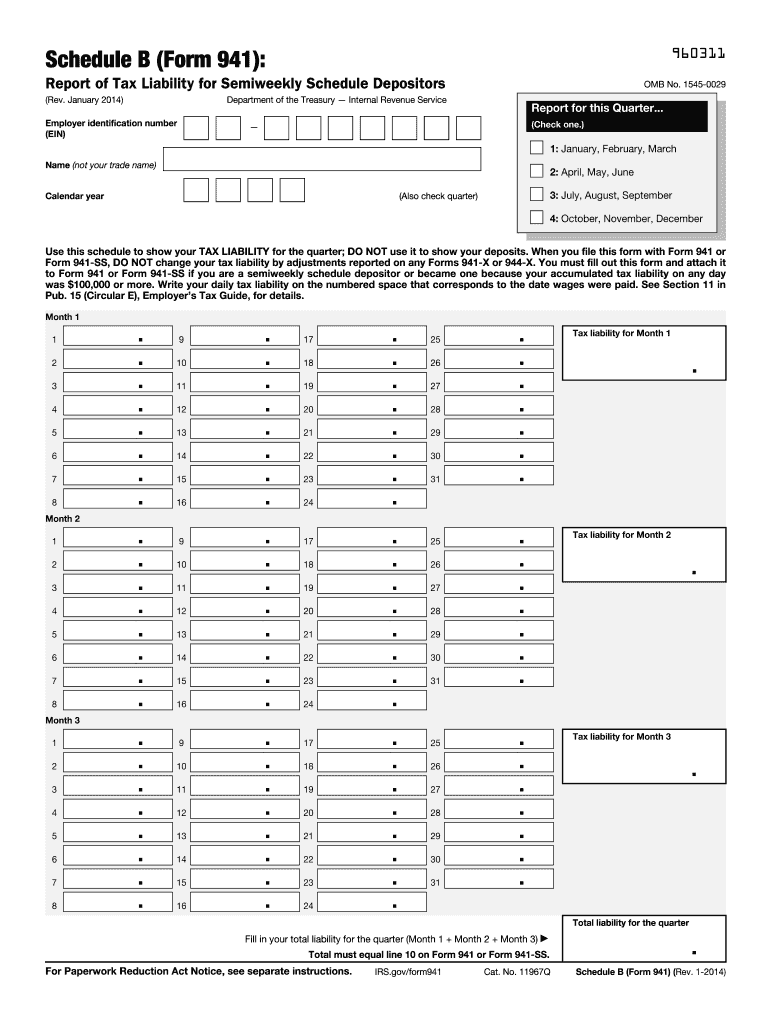

The Irs Form 941 is a quarterly tax form used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is crucial for businesses as it helps the Internal Revenue Service (IRS) track payroll tax obligations. Employers must file this form to ensure compliance with federal tax laws and to accurately report their payroll tax liabilities.

How to use the Irs Form 941

To use the Irs Form 941, employers must gather relevant payroll information for the quarter, including total wages paid, tips, and other compensation. The form requires specific details about the number of employees, the amount of federal income tax withheld, and the employer's share of Social Security and Medicare taxes. Once completed, the form must be submitted to the IRS by the designated deadline to avoid penalties.

Steps to complete the Irs Form 941

Completing the Irs Form 941 involves several key steps:

- Gather payroll records for the quarter, including total wages and tips.

- Calculate the total federal income tax withheld from employee wages.

- Determine the employer's share of Social Security and Medicare taxes.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review the form for any errors before submission.

- File the form electronically or by mail by the deadline.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the Irs Form 941. Generally, the form is due on the last day of the month following the end of each quarter. The deadlines are as follows:

- First quarter (January to March): April 30

- Second quarter (April to June): July 31

- Third quarter (July to September): October 31

- Fourth quarter (October to December): January 31

Legal use of the Irs Form 941

The Irs Form 941 must be filed accurately and on time to comply with federal regulations. Failure to file or inaccuracies can result in penalties and interest on unpaid taxes. The form serves as a legal document that verifies an employer's tax obligations and contributions to Social Security and Medicare, making it essential for maintaining compliance with IRS requirements.

Form Submission Methods (Online / Mail / In-Person)

Employers can submit the Irs Form 941 through various methods. The most common submission methods include:

- Online: Employers can file electronically using the IRS e-file system or through authorized e-file providers.

- Mail: The form can be printed and mailed to the appropriate IRS address based on the employer's location.

- In-Person: Employers may also deliver the form in person to their local IRS office, although this method is less common.

Quick guide on how to complete irs form 941 2011

Complete Irs Form 941 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can easily find the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage Irs Form 941 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Irs Form 941 without hassle

- Obtain Irs Form 941 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Select your preferred method to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require reprinting document copies. airSlate SignNow addresses all your document management needs in just a few clicks from the device of your choice. Edit and eSign Irs Form 941 and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 941 2011

Create this form in 5 minutes!

How to create an eSignature for the irs form 941 2011

How to generate an electronic signature for your PDF online

How to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

How to generate an electronic signature for a PDF file on Android

People also ask

-

What is IRS Form 941 and who needs to file it?

IRS Form 941 is a quarterly federal tax form that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee's paychecks. Businesses with employees must file this form to ensure compliance with federal tax obligations. Understanding how to accurately complete IRS Form 941 is crucial for maintaining good standing with the IRS.

-

How does airSlate SignNow facilitate the signing of IRS Form 941?

AirSlate SignNow allows users to easily upload and eSign IRS Form 941 digitally, ensuring a smooth signing process. With its user-friendly interface, you can quickly collect signatures from multiple parties without the hassle of printing or scanning. This streamlines your filing process, making it efficient and straightforward.

-

What features does airSlate SignNow offer for handling IRS Form 941?

AirSlate SignNow provides features such as template creation, automated reminders, and secure storage to help manage IRS Form 941 efficiently. Users can create reusable templates for IRS Form 941, ensuring consistent compliance and optimized workflows. Additionally, the platform offers audit trails for added security and transparency.

-

Is airSlate SignNow a cost-effective solution for managing IRS Form 941?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, offering pricing plans that cater to various needs. By eliminating the costs associated with paper-based processes, eSignatures on IRS Form 941 can save time and resources for your company. You'll find that investing in airSlate SignNow pays dividends through increased productivity.

-

Can airSlate SignNow integrate with other software for IRS Form 941 management?

Absolutely! AirSlate SignNow seamlessly integrates with various accounting and payroll software that can help manage IRS Form 941 and other tax forms. This integration enhances your workflow by allowing data from these systems to pre-fill relevant information on your IRS Form 941, reducing errors and saving valuable time.

-

What are the benefits of using airSlate SignNow for IRS Form 941?

Using airSlate SignNow for IRS Form 941 offers numerous benefits, including expedited signing processes and enhanced document security. It provides a digital trail of all actions taken on the form, making tracking and compliance easier. Additionally, eSigning allows for faster turnaround times, which can help ensure prompt submission to avoid penalties.

-

Is airSlate SignNow suitable for small businesses filing IRS Form 941?

Yes, airSlate SignNow is particularly well-suited for small businesses looking to streamline their IRS Form 941 filing process. Its intuitive platform requires no advanced tech skills, making it accessible for all users. With affordable pricing and essential features tailored for smaller teams, it becomes an ideal choice for efficient document management.

Get more for Irs Form 941

Find out other Irs Form 941

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer