Form 8883 2008-2026

What is the Form 8883

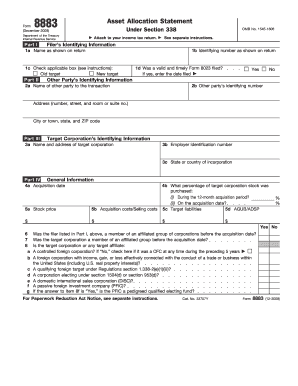

The Form 8883 is a crucial document used by taxpayers to report the allocation of assets in accordance with IRS regulations. This form is particularly relevant for individuals and businesses that need to disclose their asset distributions and valuations for tax purposes. It plays a significant role in ensuring compliance with federal tax laws, especially for those involved in transactions that affect their asset allocation in the tax year 2008.

How to use the Form 8883

Using the Form 8883 involves several steps to ensure accurate reporting of asset allocations. Taxpayers must first gather relevant financial information, including details about the assets being allocated. Once the necessary data is compiled, the form can be filled out, specifying the type of assets and their respective values. It is essential to follow the IRS guidelines closely to avoid errors that could lead to penalties or delays in processing.

Steps to complete the Form 8883

Completing the Form 8883 requires a systematic approach:

- Gather all necessary financial documents related to your assets.

- Identify the assets that need to be reported on the form.

- Fill out the form accurately, ensuring all values are correct and reflect the current market conditions.

- Review the completed form for any errors or omissions.

- Submit the form as part of your tax return or as a standalone document, depending on your specific situation.

Legal use of the Form 8883

The legal use of the Form 8883 is governed by IRS regulations, which stipulate that it must be filled out accurately and submitted in a timely manner. This form serves as a legal declaration of asset allocation, and any discrepancies can lead to audits or penalties. It is crucial for taxpayers to understand their obligations under the law when using this form, ensuring all information provided is truthful and complete.

Key elements of the Form 8883

Key elements of the Form 8883 include:

- Identification of the taxpayer and the tax year.

- Detailed descriptions of the assets being allocated.

- Valuation of each asset at the time of allocation.

- Signature of the taxpayer or authorized representative.

These components are vital for ensuring that the form meets IRS requirements and accurately reflects the taxpayer's financial situation.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8883 coincide with the general tax filing deadlines set by the IRS. Typically, taxpayers must submit their forms by April fifteenth of the year following the tax year in question. However, if additional time is needed, taxpayers can file for an extension, which may provide an additional six months to complete their tax returns, including the Form 8883.

Quick guide on how to complete irs form 8883 2008

Arrange Form 8883 effortlessly on any device

Web-based document management has gained traction among companies and individuals alike. It offers a superb eco-friendly replacement for traditional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Form 8883 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest method to modify and eSign Form 8883 with ease

- Obtain Form 8883 and then click Get Form to begin.

- Employ the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 8883 and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 8883 2008

Create this form in 5 minutes!

How to create an eSignature for the irs form 8883 2008

How to generate an electronic signature for your Irs Form 8883 2008 online

How to generate an eSignature for your Irs Form 8883 2008 in Chrome

How to generate an electronic signature for signing the Irs Form 8883 2008 in Gmail

How to make an eSignature for the Irs Form 8883 2008 right from your smartphone

How to make an eSignature for the Irs Form 8883 2008 on iOS devices

How to make an electronic signature for the Irs Form 8883 2008 on Android devices

People also ask

-

What is the 2008 8883 allocation and why is it important?

The 2008 8883 allocation refers to a specific document related to tax allocation that is crucial for accurately reporting financial information. Understanding this allocation ensures compliance with IRS regulations, minimizing potential penalties.

-

How does airSlate SignNow simplify the 2008 8883 allocation process?

airSlate SignNow streamlines the 2008 8883 allocation process by allowing users to create, send, and eSign documents quickly and securely. With its user-friendly interface, you can manage your documents efficiently, keeping your tax reporting seamless.

-

Are there any pricing plans associated with managing the 2008 8883 allocation using airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan can help you manage your 2008 8883 allocation process effectively, providing access to features that enhance document workflow.

-

What features does airSlate SignNow offer for the 2008 8883 allocation?

Key features of airSlate SignNow for the 2008 8883 allocation include customizable templates, automated workflows, and advanced security measures. These features empower users to handle their documents securely and efficiently.

-

Can I integrate airSlate SignNow with other software for managing the 2008 8883 allocation?

Absolutely! airSlate SignNow integrates seamlessly with numerous software applications, enhancing your ability to manage the 2008 8883 allocation alongside other business processes. This saves time and increases productivity.

-

What are the benefits of using airSlate SignNow for the 2008 8883 allocation?

Using airSlate SignNow for the 2008 8883 allocation provides numerous benefits, including reduced turnaround time for document approvals and enhanced compliance tracking. These advantages contribute to a more efficient tax reporting process.

-

Is airSlate SignNow secure for handling sensitive documents like the 2008 8883 allocation?

Yes, airSlate SignNow employs industry-leading security protocols to ensure that documents like the 2008 8883 allocation are protected. Your data is encrypted and stored securely, giving you peace of mind.

Get more for Form 8883

Find out other Form 8883

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile