Form 8883 Rev October Fill in Capable Asset Allocation Statement under Section 338 2002

What is the Form 8883 Rev October Fill In Capable Asset Allocation Statement Under Section 338

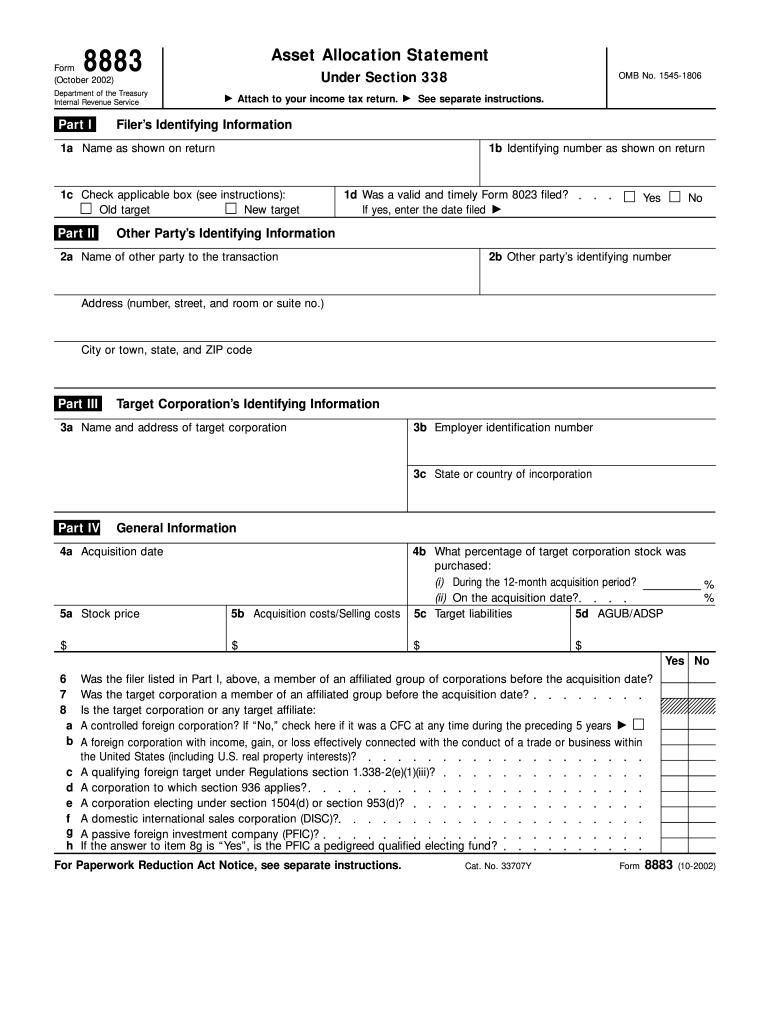

The Form 8883 Rev October is a specialized document used in the context of asset allocation under Section 338 of the Internal Revenue Code. This form is primarily utilized by corporations to report the allocation of the adjusted basis of assets acquired in a stock purchase treated as an asset acquisition. The form ensures that the proper tax treatment is applied to the assets involved in the transaction, allowing for accurate tax reporting and compliance with IRS regulations.

How to use the Form 8883 Rev October Fill In Capable Asset Allocation Statement Under Section 338

To effectively use the Form 8883 Rev October, businesses must first determine if the transaction qualifies under Section 338. Once eligibility is confirmed, the form should be filled out with detailed information regarding the assets acquired and their respective values. This includes identifying the type of assets, their fair market value, and any liabilities assumed. After completing the form, it should be submitted alongside the relevant tax returns to ensure compliance with IRS requirements.

Steps to complete the Form 8883 Rev October Fill In Capable Asset Allocation Statement Under Section 338

Completing the Form 8883 Rev October involves several key steps:

- Gather necessary documentation, including details of the asset acquisition and any related agreements.

- Identify the assets involved in the transaction, categorizing them into tangible and intangible assets.

- Determine the fair market value of each asset, ensuring accurate reporting.

- Fill in the form with the required information, including asset descriptions and values.

- Review the completed form for accuracy before submission.

Legal use of the Form 8883 Rev October Fill In Capable Asset Allocation Statement Under Section 338

The legal validity of the Form 8883 Rev October hinges on compliance with IRS guidelines and regulations. To ensure that the form is legally binding, it must be accurately completed and submitted within the specified deadlines. Additionally, the use of electronic signatures can enhance the legal standing of the document, provided that the signatures meet the requirements set forth by the ESIGN Act and UETA.

Key elements of the Form 8883 Rev October Fill In Capable Asset Allocation Statement Under Section 338

Key elements of the Form 8883 Rev October include:

- Identification of the acquiring corporation and the target corporation.

- A detailed list of the assets acquired, including their classifications.

- Fair market values assigned to each asset.

- Liabilities assumed as part of the acquisition.

- Signature of an authorized representative of the acquiring corporation.

IRS Guidelines

The Internal Revenue Service provides specific guidelines for completing and submitting the Form 8883 Rev October. These guidelines emphasize the importance of accurate asset valuation and the proper categorization of assets. Additionally, the IRS outlines the consequences of non-compliance, which can include penalties or audits. It is crucial for businesses to familiarize themselves with these guidelines to ensure adherence and avoid potential issues.

Quick guide on how to complete form 8883 rev october 2002 fill in capable asset allocation statement under section 338

Effortlessly prepare Form 8883 Rev October Fill In Capable Asset Allocation Statement Under Section 338 on any device

Digital document management has gained traction with both businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle Form 8883 Rev October Fill In Capable Asset Allocation Statement Under Section 338 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to adjust and eSign Form 8883 Rev October Fill In Capable Asset Allocation Statement Under Section 338 with ease

- Find Form 8883 Rev October Fill In Capable Asset Allocation Statement Under Section 338 and click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your chosen device. Edit and eSign Form 8883 Rev October Fill In Capable Asset Allocation Statement Under Section 338 and guarantee excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8883 rev october 2002 fill in capable asset allocation statement under section 338

Create this form in 5 minutes!

How to create an eSignature for the form 8883 rev october 2002 fill in capable asset allocation statement under section 338

How to create an eSignature for a PDF document in the online mode

How to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the purpose of the Form 8883 Rev October Fill In Capable Asset Allocation Statement Under Section 338?

The Form 8883 Rev October Fill In Capable Asset Allocation Statement Under Section 338 is used to report asset allocation in transactions involving the acquisition of a corporation's assets. It helps businesses determine the fair market value of assets and allocate tax basis accordingly. Proper use of this form is crucial for compliance with IRS regulations.

-

How can airSlate SignNow assist with completing the Form 8883 Rev October Fill In Capable Asset Allocation Statement Under Section 338?

airSlate SignNow streamlines the process of completing the Form 8883 Rev October Fill In Capable Asset Allocation Statement Under Section 338 by providing easy-to-use templates and eSign capabilities. You can easily fill in necessary fields, upload supporting documents, and securely share the form with required parties. This ensures accuracy and compliance while saving time.

-

Is there a cost associated with using airSlate SignNow for the Form 8883 Rev October Fill In Capable Asset Allocation Statement Under Section 338?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. The pricing includes access to features that simplify the completion of the Form 8883 Rev October Fill In Capable Asset Allocation Statement Under Section 338, including document storage, templates, and eSignature services. You can choose a plan that best fits your volume of document management.

-

What features does airSlate SignNow offer to enhance the completion of the Form 8883 Rev October Fill In Capable Asset Allocation Statement Under Section 338?

airSlate SignNow provides features like customizable templates, multi-user collaboration, and secure cloud storage specifically designed to enhance the handling of the Form 8883 Rev October Fill In Capable Asset Allocation Statement Under Section 338. Automated workflows and reminders help ensure that documents are completed and signed promptly, improving overall efficiency.

-

Are there any integrations available with airSlate SignNow to assist with the Form 8883 Rev October Fill In Capable Asset Allocation Statement Under Section 338?

Yes, airSlate SignNow offers integrations with numerous applications, including cloud storage solutions, CRM systems, and accounting software. These integrations help users manage the Form 8883 Rev October Fill In Capable Asset Allocation Statement Under Section 338 more effectively by consolidating data and enabling easy document sharing across platforms.

-

What are the benefits of using airSlate SignNow for tax-related documents like Form 8883 Rev October Fill In Capable Asset Allocation Statement Under Section 338?

Using airSlate SignNow for tax-related documents such as the Form 8883 Rev October Fill In Capable Asset Allocation Statement Under Section 338 offers signNow benefits, including increased accuracy, compliance assurance, and enhanced security. You can quickly access and manage all your tax documents online, reducing the risk of errors and ensuring that sensitive information is well-protected.

-

Is it difficult to learn how to use airSlate SignNow for the Form 8883 Rev October Fill In Capable Asset Allocation Statement Under Section 338?

No, airSlate SignNow is designed with user-friendliness in mind, allowing even those without extensive technical knowledge to easily navigate the platform. Tutorials, webinars, and customer support are available to assist users in efficiently completing the Form 8883 Rev October Fill In Capable Asset Allocation Statement Under Section 338 and maximizing the software's potential.

Get more for Form 8883 Rev October Fill In Capable Asset Allocation Statement Under Section 338

- Idaho unsecured installment payment promissory note for fixed rate idaho form

- Installments fixed rate promissory note secured by residential real estate for idaho idaho form

- Installments fixed rate promissory note secured by personal property for idaho idaho form

- Installments fixed rate promissory note secured by commercial real estate for idaho idaho form

- Notice of option for recording idaho form

- Life documents planning package including will power of attorney and living will idaho form

- General durable power of attorney for property and finances or financial effective upon disability idaho form

- Essential legal life documents for baby boomers idaho form

Find out other Form 8883 Rev October Fill In Capable Asset Allocation Statement Under Section 338

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT