Irs Form 656 L 2016

What is the Irs Form 656 L

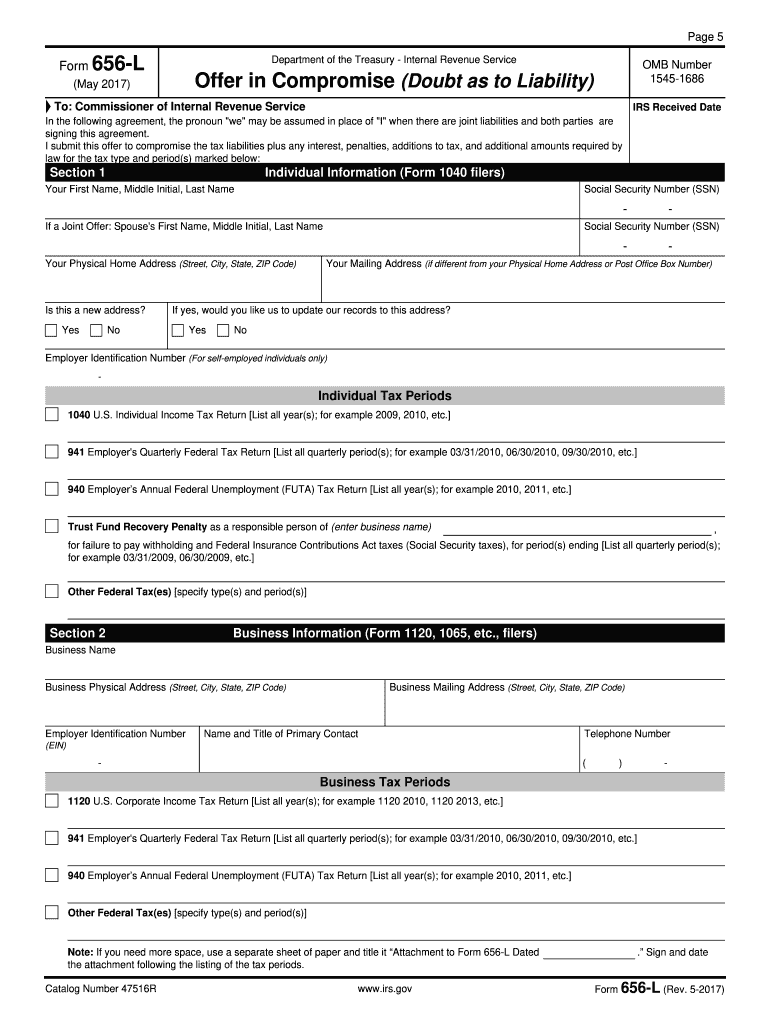

The IRS Form 656 L is a specific form used by taxpayers to request a reduction in the amount of tax liabilities owed to the Internal Revenue Service. This form is particularly relevant for individuals who believe they qualify for an offer in compromise due to their inability to pay the full amount of their tax debt. By submitting this form, taxpayers can initiate a process that may lead to a settlement of their tax obligations for less than the total amount owed.

How to use the Irs Form 656 L

Using the IRS Form 656 L involves several key steps. First, taxpayers must gather all necessary financial information to support their claim for a reduced tax liability. This includes income statements, asset documentation, and any other relevant financial records. After completing the form with accurate information, it should be submitted to the IRS along with any required fees. It's essential to ensure that the form is filled out correctly to avoid delays in processing.

Steps to complete the Irs Form 656 L

Completing the IRS Form 656 L involves the following steps:

- Obtain the form from the IRS website or other authorized sources.

- Fill out personal information, including name, address, and Social Security number.

- Provide detailed financial information, including income, expenses, and assets.

- Indicate the amount of tax liability you wish to compromise.

- Review the form for accuracy and completeness.

- Submit the form along with any required fees to the appropriate IRS address.

Legal use of the Irs Form 656 L

The IRS Form 656 L is legally recognized as a formal request for a compromise on tax liabilities. To ensure its legal validity, it must be completed accurately and submitted according to IRS guidelines. The form must include all necessary documentation to support the taxpayer's claim, and it must be signed by the taxpayer or their authorized representative. Compliance with all IRS regulations is essential to avoid any potential legal issues.

Eligibility Criteria

To be eligible to use the IRS Form 656 L, taxpayers must meet specific criteria set by the IRS. Generally, this includes demonstrating an inability to pay the full tax amount owed. Taxpayers must also provide evidence of their financial situation, including income, expenses, and assets. Additionally, individuals must not be in an open bankruptcy proceeding and must have filed all required tax returns for the previous years.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 656 L can vary based on individual circumstances and IRS guidelines. It is crucial for taxpayers to be aware of any specific deadlines related to their tax situation. Generally, forms should be submitted as soon as the taxpayer determines they are eligible for an offer in compromise. Keeping track of important dates, such as the end of the tax year and any IRS notifications, can help ensure timely submission.

Quick guide on how to complete irs form 656 l 2016

Set Up Irs Form 656 L Effortlessly on Any Device

Digital document management has gained traction among companies and individuals. It offers a superb environmentally friendly replacement for traditional printed and signed papers, allowing you to access the right template and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without unnecessary delays. Manage Irs Form 656 L on any device with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The most effective way to alter and eSign Irs Form 656 L with ease

- Find Irs Form 656 L and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Mark important sections of the documents or redact sensitive details with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced papers, tedious form searching, or mistakes that require reprinting document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Irs Form 656 L and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 656 l 2016

Create this form in 5 minutes!

How to create an eSignature for the irs form 656 l 2016

How to make an eSignature for your Irs Form 656 L 2016 in the online mode

How to create an electronic signature for the Irs Form 656 L 2016 in Chrome

How to create an electronic signature for putting it on the Irs Form 656 L 2016 in Gmail

How to generate an electronic signature for the Irs Form 656 L 2016 straight from your mobile device

How to generate an eSignature for the Irs Form 656 L 2016 on iOS

How to make an eSignature for the Irs Form 656 L 2016 on Android

People also ask

-

What is IRS Form 656 L and why do I need it?

IRS Form 656 L is a form used by taxpayers to request a reduction of their tax liabilities under certain circumstances. This form is essential if you believe you qualify for an Offer in Compromise with the IRS. By utilizing airSlate SignNow, you can easily eSign and submit your IRS Form 656 L, ensuring a smooth process for managing your tax-related documents.

-

How can airSlate SignNow assist with IRS Form 656 L?

airSlate SignNow simplifies the process of filling out and submitting IRS Form 656 L. Our platform allows you to eSign the form electronically, saving time and ensuring compliance with IRS standards. With our user-friendly interface, you can manage your tax documents efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for IRS Form 656 L?

Yes, airSlate SignNow offers a cost-effective solution for eSigning IRS Form 656 L. We provide various pricing plans that cater to different business needs, ensuring you get the best value for your document management. Check our website for detailed pricing information and find the plan that suits your requirements.

-

Can I store my IRS Form 656 L documents on airSlate SignNow?

Absolutely! airSlate SignNow allows you to securely store your IRS Form 656 L and other important documents in the cloud. This feature ensures that you have easy access to your files whenever you need them, while also keeping them safe and organized.

-

Does airSlate SignNow integrate with other software for IRS Form 656 L management?

Yes, airSlate SignNow offers seamless integrations with popular software tools, enhancing your workflow for managing IRS Form 656 L. By connecting with applications like Google Drive, Dropbox, and more, you can streamline your document process and save valuable time.

-

What are the benefits of using airSlate SignNow for IRS Form 656 L?

Using airSlate SignNow for IRS Form 656 L offers several benefits, including ease of use, security, and compliance. Our platform ensures that your documents are eSigned and submitted according to IRS regulations, while also providing you with the convenience of managing everything online.

-

How do I get started with airSlate SignNow for IRS Form 656 L?

Getting started with airSlate SignNow for IRS Form 656 L is simple! Sign up for an account on our website, and you can begin creating, eSigning, and managing your tax documents right away. Our easy-to-follow setup process will help you navigate through your document needs effortlessly.

Get more for Irs Form 656 L

- Aoc cvm 303 form

- North carolina department of transportation citizen incident statement form

- Nc 120 form

- Residency questionnaire form

- Form fill nc3

- Mh lic change app packet rev 08 2009 form

- Withdrawal request form 2a fairview road mt eden po

- Form st 100 att new york state and local quarterly sales and use tax credit worksheet revised 923

Find out other Irs Form 656 L

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free