Form 656 L Offer in Compromise Internal Revenue Service 2020

What is the Form 656 L Offer In Compromise

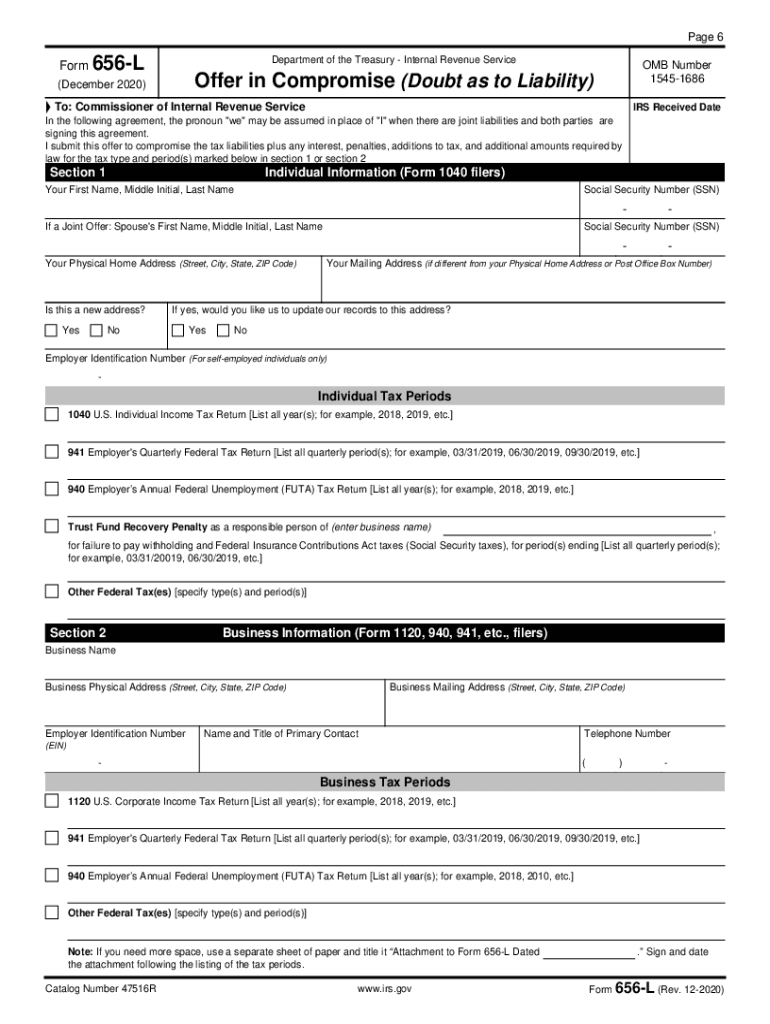

The Form 656 L, also known as the Offer in Compromise (OIC), is a tax form used by taxpayers to negotiate a settlement with the Internal Revenue Service (IRS) regarding their tax liabilities. This form allows individuals to propose a reduced amount to settle their tax debts based on their financial situation. The IRS considers various factors, including income, expenses, and asset equity, to determine whether to accept the offer. The goal is to provide a manageable resolution for taxpayers facing financial hardship.

Steps to Complete the Form 656 L Offer In Compromise

Completing the Form 656 L involves several important steps:

- Gather Financial Information: Collect detailed information about your income, expenses, and assets. This includes pay stubs, bank statements, and documentation of any debts.

- Fill Out the Form: Accurately complete all sections of the Form 656 L, ensuring that you provide truthful and complete information.

- Include Required Documentation: Attach necessary documents that support your financial situation, such as proof of income and expense records.

- Submit the Form: Send the completed form and all supporting documents to the appropriate IRS address, ensuring you keep copies for your records.

Eligibility Criteria for the Form 656 L Offer In Compromise

To qualify for the Offer in Compromise using Form 656 L, taxpayers must meet specific eligibility criteria set by the IRS. These criteria include:

- Demonstrating an inability to pay the full tax liability due to financial hardship.

- Being current on all required tax filings and payments.

- Not being in an open bankruptcy proceeding.

Meeting these criteria is essential for the IRS to consider your offer for compromise.

Required Documents for Form 656 L Submission

When submitting the Form 656 L, it is crucial to include various documents that substantiate your financial situation. Required documents may include:

- Proof of income, such as recent pay stubs or tax returns.

- Documentation of monthly expenses, including bills and receipts.

- Records of assets, such as bank statements and property valuations.

Providing comprehensive documentation increases the likelihood of your offer being accepted by the IRS.

IRS Guidelines for Form 656 L Processing

The IRS has established guidelines that govern the processing of Form 656 L. These guidelines outline the evaluation process for offers in compromise, including:

- Reviewing the taxpayer's financial information to assess their ability to pay.

- Determining whether accepting the offer is in the best interest of both the taxpayer and the IRS.

- Communicating the decision to the taxpayer, which may include acceptance, rejection, or a counteroffer.

Understanding these guidelines can help taxpayers navigate the OIC process more effectively.

Form Submission Methods for Form 656 L

Taxpayers can submit the Form 656 L through various methods, including:

- Online Submission: Some taxpayers may be eligible to submit their offer electronically through the IRS portal.

- Mail: The completed form can be mailed to the designated IRS address based on the taxpayer's location.

- In-Person Submission: Taxpayers may also schedule an appointment to submit the form in person at a local IRS office.

Choosing the appropriate submission method can impact the processing time of the offer.

Quick guide on how to complete form 656 l offer in compromise internal revenue service

Prepare Form 656 L Offer In Compromise Internal Revenue Service effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Form 656 L Offer In Compromise Internal Revenue Service on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Form 656 L Offer In Compromise Internal Revenue Service with ease

- Obtain Form 656 L Offer In Compromise Internal Revenue Service and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent paragraphs of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and eSign Form 656 L Offer In Compromise Internal Revenue Service and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 656 l offer in compromise internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the form 656 l offer in compromise internal revenue service

The best way to make an electronic signature for your PDF in the online mode

The best way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What is a form 656 offer in compromise and how does it work?

A form 656 offer in compromise is a proposal submitted to the IRS that allows taxpayers to settle their tax debts for less than the full amount owed. This process works by providing the IRS with financial details to justify a lower payment based on your financial situation. airSlate SignNow can help streamline the submission process by easily eSigning and sending the necessary documents.

-

How can airSlate SignNow help with the form 656 offer in compromise?

airSlate SignNow simplifies the preparation and submission of your form 656 offer in compromise. With its user-friendly interface, you can securely eSign and send your documents, ensuring that your application is processed efficiently. This makes managing your offer in compromise and other tax-related documents much more straightforward.

-

What features does airSlate SignNow offer for managing the form 656 offer in compromise?

airSlate SignNow offers robust features such as document templates, real-time collaboration, and secure storage for your form 656 offer in compromise. You can easily customize your documents, track their status, and ensure that all parties are on the same page throughout the application process. These features enhance your overall efficiency and reduce the potential for errors.

-

Is there a cost associated with using airSlate SignNow for the form 656 offer in compromise?

Yes, airSlate SignNow offers various pricing plans, making it a cost-effective solution for handling your form 656 offer in compromise. Plans are designed to suit different needs, whether you're an individual taxpayer or a business. You can choose a plan that best fits your budget and document management needs.

-

What benefits does airSlate SignNow provide when submitting a form 656 offer in compromise?

Using airSlate SignNow for your form 656 offer in compromise can provide numerous benefits, including time savings and enhanced document security. The platform allows for quick eSigning and submission, ensuring you meet deadlines without hassle. Additionally, you can rest assured that your sensitive documents are handled securely throughout the process.

-

Can I integrate airSlate SignNow with other platforms for a form 656 offer in compromise?

Yes, airSlate SignNow can easily integrate with various platforms, simplifying the process of submitting your form 656 offer in compromise. Whether you use cloud storage services or CRM platforms, the seamless integration capabilities help you manage your tax documents more effectively. This enhances your workflow and ensures all relevant information is accessible in one location.

-

What resources does airSlate SignNow provide for completing the form 656 offer in compromise?

airSlate SignNow offers a range of resources, including templates, guides, and customer support to assist you with your form 656 offer in compromise. These resources help you navigate the complexities of the application process, ensuring that you provide accurate and complete information. Such support can signNowly increase the chances of your offer being accepted.

Get more for Form 656 L Offer In Compromise Internal Revenue Service

- Wwwnjsbaorgwp contentuploadssample jointbracket nominating petition for annual school form

- Permission form for float riders

- Fundraiser permission slip form

- Group training agreement pt transformations

- Kick ass karaoke contest rules form

- Guest contract for prom form

- Statement of educational purpose kheaa form

- Change of address kuukpik form

Find out other Form 656 L Offer In Compromise Internal Revenue Service

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple