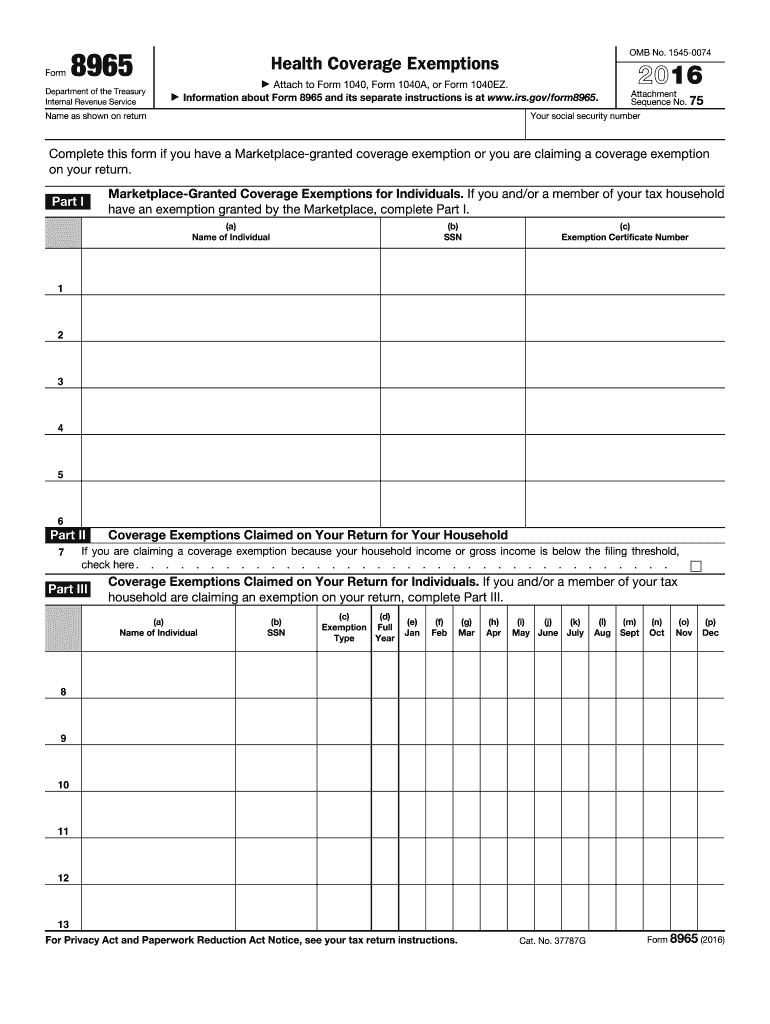

Irs Form 8965 2016

What is the IRS Form 8965

The IRS Form 8965 is a tax form used by individuals to report a health coverage exemption on their federal tax return. This form is particularly relevant for taxpayers who did not have health insurance coverage for part or all of the tax year and are seeking to avoid the shared responsibility payment mandated by the Affordable Care Act. The form allows individuals to claim exemptions based on specific criteria, such as financial hardship, religious beliefs, or certain life events.

How to use the IRS Form 8965

To use the IRS Form 8965, taxpayers must first determine their eligibility for an exemption. This involves reviewing the exemption categories outlined by the IRS. Once eligibility is established, the taxpayer should complete the form by providing necessary information, including personal details and the specific exemption being claimed. After filling out the form, it should be attached to the taxpayer's federal income tax return, ensuring that all information is accurate and complete to avoid any issues with the IRS.

Steps to complete the IRS Form 8965

Completing the IRS Form 8965 involves several key steps:

- Identify your eligibility for an exemption by reviewing the IRS guidelines.

- Obtain a copy of the form, which can be downloaded from the IRS website or accessed through tax software.

- Fill out the form, providing your personal information and selecting the applicable exemption category.

- Double-check all entries for accuracy to prevent errors that could delay processing.

- Attach the completed form to your federal tax return before submission.

Legal use of the IRS Form 8965

The legal use of the IRS Form 8965 is governed by the Affordable Care Act and related IRS regulations. Taxpayers must ensure that they meet the criteria for the exemption they are claiming. Misuse of the form, such as falsely claiming an exemption, can lead to penalties or additional taxes owed. It is essential to understand the legal implications of the form and to maintain accurate records that support the exemption claim.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 8965 align with the general tax return deadlines. Typically, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of these dates to ensure timely submission of their forms and avoid penalties. Extensions may be available, but it is crucial to check the IRS guidelines for specific details.

Required Documents

When completing the IRS Form 8965, certain documents may be required to support your exemption claim. These can include:

- Proof of income to establish financial hardship.

- Documentation of any qualifying life events, such as marriage or divorce.

- Religious exemption documentation, if applicable.

Having these documents ready can facilitate the completion of the form and ensure compliance with IRS requirements.

Eligibility Criteria

Eligibility criteria for claiming an exemption on the IRS Form 8965 include various factors, such as:

- Income level below the federal poverty line.

- Short coverage gap of less than three consecutive months.

- Specific life events, including marriage, divorce, or birth of a child.

- Membership in certain religious sects that oppose health insurance.

Understanding these criteria is vital for taxpayers who wish to avoid the shared responsibility payment for not having health coverage.

Quick guide on how to complete 2016 irs form 8965

Effortlessly Prepare Irs Form 8965 on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, as you can acquire the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without any hindrances. Handle Irs Form 8965 on any device with the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The Easiest Way to Edit and eSign Irs Form 8965 with Ease

- Locate Irs Form 8965 and click on Get Form to begin.

- Take advantage of the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign feature, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Irs Form 8965 and guarantee effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 irs form 8965

Create this form in 5 minutes!

How to create an eSignature for the 2016 irs form 8965

How to create an electronic signature for your 2016 Irs Form 8965 in the online mode

How to make an electronic signature for your 2016 Irs Form 8965 in Google Chrome

How to make an eSignature for signing the 2016 Irs Form 8965 in Gmail

How to generate an eSignature for the 2016 Irs Form 8965 from your smart phone

How to make an eSignature for the 2016 Irs Form 8965 on iOS

How to create an eSignature for the 2016 Irs Form 8965 on Android OS

People also ask

-

What is IRS Form 8965 and who needs it?

IRS Form 8965 is a tax form used to claim a health coverage exemption when filing your federal income tax return. This form is essential for individuals who do not have qualifying health coverage for part or all of the year. If you are seeking to understand how to fill out IRS Form 8965, our platform can help you streamline the process.

-

How can airSlate SignNow assist with IRS Form 8965?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending IRS Form 8965. Our solution simplifies the document management process, ensuring that you can securely share and eSign your exemption forms without hassle. Plus, our user-friendly interface makes it easy for anyone to navigate.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8965?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs, including those needing to manage IRS Form 8965. We provide a cost-effective solution that ensures you get the best value for an efficient eSigning experience. Check our pricing page for more details.

-

Can I integrate airSlate SignNow with other software for IRS Form 8965?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage IRS Form 8965 alongside your existing workflow. Whether you use CRM systems, cloud storage, or document management tools, our integrations make it easy to keep everything connected.

-

What are the benefits of using airSlate SignNow for IRS Form 8965?

Using airSlate SignNow for IRS Form 8965 offers numerous benefits, including enhanced security, speed, and convenience. Our platform allows you to complete and submit your forms quickly, ensuring compliance while minimizing the chances of errors. Plus, you can track the status of your documents in real-time.

-

Is airSlate SignNow secure for handling IRS Form 8965?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your IRS Form 8965 and other sensitive documents are protected. Our platform uses advanced encryption and security protocols to safeguard your data against unauthorized access. You can trust us to handle your documents securely.

-

How can I get support for IRS Form 8965 on airSlate SignNow?

If you have questions about IRS Form 8965 or need assistance, our customer support team is here to help. You can signNow out via live chat, email, or phone for prompt assistance. We also offer an extensive resource center with guides and FAQs to help you navigate the process.

Get more for Irs Form 8965

- Mbti form g scoring template

- First report of an in ju ry occupational disease or death uakron form

- Pbso alarm registration form

- Indiana university health 2011 application reference form

- Credit report dispute forms

- Variation application packet village of morton grove mortongroveil form

- Treasury authorization form

Find out other Irs Form 8965

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal