Irs Form 8965 2014

What is the IRS Form 8965

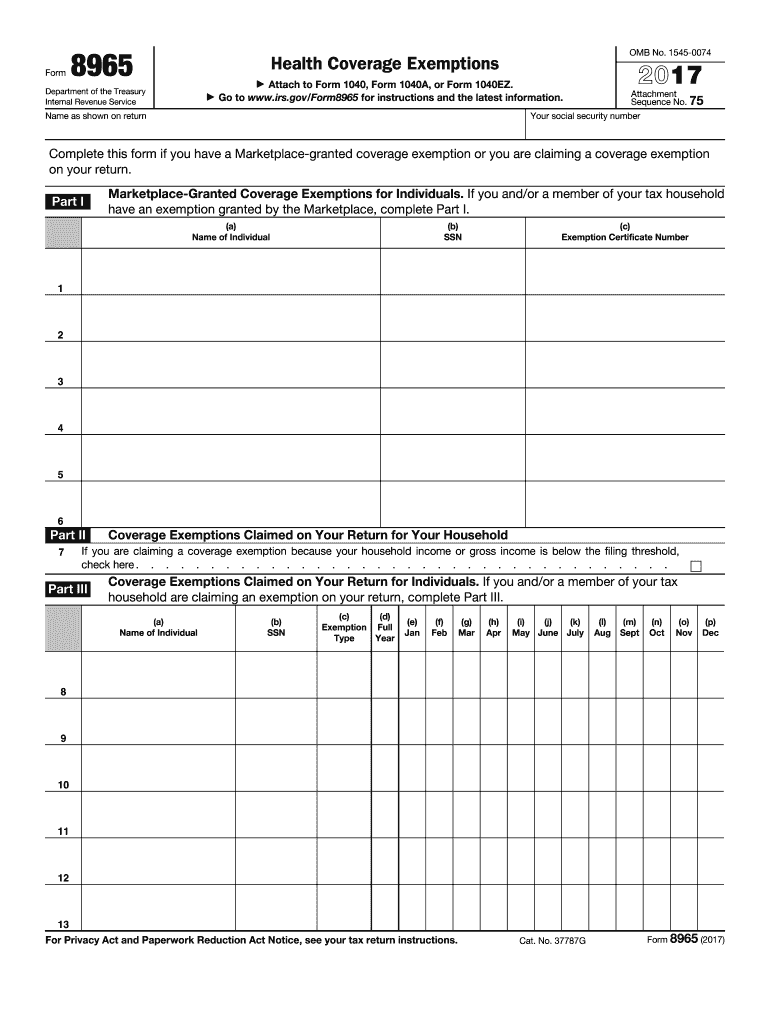

The IRS Form 8965 is a tax form used by individuals to claim a health coverage exemption under the Affordable Care Act (ACA). This form is essential for taxpayers who did not have minimum essential coverage for part of the tax year and are seeking to avoid a penalty for not meeting the ACA's health insurance mandate. By completing this form, individuals can indicate their eligibility for an exemption based on specific criteria, such as financial hardship or other qualifying circumstances.

How to use the IRS Form 8965

To use the IRS Form 8965 effectively, individuals must first determine if they qualify for a health coverage exemption. This involves reviewing the exemption categories outlined by the IRS. Once eligibility is established, taxpayers should accurately fill out the form, providing necessary details about their situation. The completed form should then be submitted with the annual tax return, ensuring that all information aligns with other tax documents to avoid discrepancies.

Steps to complete the IRS Form 8965

Completing the IRS Form 8965 involves several key steps:

- Gather necessary documentation, including information about your health coverage and any qualifying exemptions.

- Review the exemption categories to confirm eligibility.

- Fill out the form by providing personal information and selecting the applicable exemption type.

- Double-check the form for accuracy and completeness.

- Attach the completed form to your tax return when filing.

Legal use of the IRS Form 8965

The legal use of the IRS Form 8965 is governed by the regulations set forth by the IRS under the Affordable Care Act. To be legally valid, the form must be completed accurately and submitted within the required timeframe. Taxpayers should ensure that they meet the criteria for the selected exemption and retain copies of the form and supporting documents for their records. Failure to comply with these requirements may result in penalties or disallowance of the exemption.

Eligibility Criteria

Eligibility for claiming an exemption on the IRS Form 8965 is based on specific criteria established by the IRS. Common categories include:

- Income below the filing threshold.

- Short coverage gaps of less than three consecutive months.

- Hardship exemptions due to circumstances such as homelessness or eviction.

- Eligibility for certain government programs, such as Medicaid.

Taxpayers should carefully review these criteria to ensure they qualify before completing the form.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 8965 align with the annual tax return deadlines. Typically, individual tax returns are due on April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of any changes to deadlines and ensure that the completed form is submitted on time to avoid penalties.

Quick guide on how to complete 2014 irs form 8965

Manage Irs Form 8965 seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to generate, modify, and electronically sign your documents swiftly without delays. Handle Irs Form 8965 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to modify and electronically sign Irs Form 8965 effortlessly

- Obtain Irs Form 8965 and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as an ink signature.

- Review the details and then click the Done button to finalize your changes.

- Select your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require creating new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Irs Form 8965 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 irs form 8965

Create this form in 5 minutes!

How to create an eSignature for the 2014 irs form 8965

How to make an electronic signature for a PDF document in the online mode

How to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is IRS Form 8965 and why do I need it?

IRS Form 8965 is used to report a health coverage exemption for the Affordable Care Act. If you qualify for an exemption from the health insurance mandate, submitting IRS Form 8965 is necessary to avoid penalties. Using airSlate SignNow can streamline the process of completing and submitting this form electronically.

-

How can airSlate SignNow help me with IRS Form 8965?

With airSlate SignNow, you can easily fill out and eSign IRS Form 8965, ensuring that your submission is accurate and timely. Our platform simplifies document management, allowing you to collaborate with others and track changes seamlessly. This means you can handle your tax-related documents with confidence and efficiency.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8965?

Yes, airSlate SignNow offers flexible pricing plans that cater to various business needs, including those who need to manage IRS Form 8965 efficiently. Our plans are cost-effective and designed to provide value through features like unlimited eSigning and document storage. You can choose a plan that suits your budget while ensuring compliance with IRS requirements.

-

Can I integrate airSlate SignNow with other software to manage IRS Form 8965?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enabling you to manage IRS Form 8965 along with your other business documents. Whether you use CRM systems, cloud storage solutions, or accounting software, our integration capabilities enhance your workflow and document management.

-

What features make airSlate SignNow ideal for handling IRS Form 8965?

airSlate SignNow provides a user-friendly interface, robust security features, and customizable templates that make handling IRS Form 8965 straightforward. You can easily fill, sign, and send your form with just a few clicks, ensuring compliance and saving you valuable time. Additionally, our tracking features help you stay informed about the status of your submissions.

-

How secure is my information when using airSlate SignNow for IRS Form 8965?

When using airSlate SignNow for IRS Form 8965, your information is protected with industry-leading security measures. We employ encryption and secure access controls to ensure that your data remains confidential and safe from unauthorized access. You can submit your forms with peace of mind knowing your information is secure.

-

Do I need technical skills to use airSlate SignNow for IRS Form 8965?

No, you don't need technical skills to use airSlate SignNow for IRS Form 8965. Our platform is designed to be intuitive and user-friendly, allowing anyone to quickly learn how to create, fill, and eSign documents. With easy-to-follow instructions and customer support available, you can manage your forms effortlessly.

Get more for Irs Form 8965

Find out other Irs Form 8965

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document